Homeless Tent City Continues to Haunt Powell

EDITOR NOTE: What you’re about to read is a well-written piece, but one that leans with perhaps too much reverence toward the Federal Reserve. The author asks, perhaps imagining herself in Jerome Powell’s shoes, “How can the Fed have done so much — slashed interest rates, propped up the stock market, bought up $3.3 trillion in Treasurys and mortgage-backed securities — yet parts of the economy remain so broken?” Well, it’s probably broken and littered with a nearby tent city, for those very reasons--the Fed slashed interest rates, propped up the stock market, bought up $3.3 trillion in Treasurys and mortgage-backed securities, creating a financial economy that rewarded those at the top who had massive exposure to the equity markets, neglecting most Americans who do not, while claiming the value of their future income in the process of maintaining America’s paper wealth.

Jerome Powell says the recovery is far from over. The bleak reality is made clear outside his window on the Fed chair’s drive to work.

As he drove past the intersection of 21st and E streets in Northwest Washington, a 68-year-old man peered through the window, struck by an encampment of homeless people here that grew from 10 tents to 20 in the past year. Then 30. Now 40.

The people living in those tents had no idea that their burgeoning village kept this man, Federal Reserve Chair Jerome H. Powell, up at night, or that he kept thinking about them as he drove two blocks south to his office. Powell doesn’t know their names or backstories, either. But what he saw was clear. A visceral reminder of the uneven economic recovery. Right there in the Fed’s shadow.

It’s in these brief interludes — when the most powerful person in the economy passes some of the most powerless — that Powell grapples with one of the most vexing economic conundrums facing the central bank and the country 14 months into the coronavirus crisis. How can the Fed have done so much — slashed interest rates, propped up the stock market, bought up $3.3 trillion in Treasurys and mortgage-backed securities — yet parts of the economy remain so broken?

How Biden stimulus bill will target homelessness

Powell referred to the tent city three times in the span of seven days, including in a ″60 Minutes” interview and on a panel hosted by the International Monetary Fund. During a talk with the Economic Club of Washington on Wednesday, Powell mentioned the encampment again, saying the homeless should be part of any assessment of the economy’s strength.

“They need to be in the room with us as we make our decisions,” Powell said.

But there are no rooms at what advocates call “21st and E.” In fact, many of the people seeking shelter here have more elemental concerns. At the same moment Powell was speaking to the Economic Club, rain was falling on the encampment and residents were scrambling to stay dry.

Malo and Isaiah, a young couple who go by the same last name “Lotus” and share a space no wider than a kiddie pool, draped a navy blue tarp over their neon green tent and reinforced the stakes into the mud. Monetary policy couldn’t have been further from their minds.

The Fed’s actions, and its limits

As the pandemic triggered the worst economic crisis since the Great Depression in March 2020, the Dow Jones industrial average fell more than 10,000 points in less than two months. Some days, it fell more than 2,000 points.

Millions of workers lost their jobs in a matter of weeks. The economy practically shut down overnight as health officials desperately tried to understand a disease that would kill at least 565,000 Americans.

$19 million in stimulus going to fight D.C. homelessness

Powell moved fast. On March 3, 2020, the Fed announced an emergency interest rate cut, then slashed rates to zero 12 days later. By the end of the month, the Fed outlined a sprawling set of programs to rescue the financial system.

The actions triggered a huge stock market rally that began toward the end of March, when the Dow closed below 19,000. In recent days, it has closed above 34,000, and analysts are bullish that the hot streak will continue.

Powell has won bipartisan praise for his stewardship of the Fed, even while so much has changed in Washington during his three years as chair. He was put in the top job by President Donald Trump when Republicans controlled Congress. Now, Democrats hold power.

Powell’s four-year term expires in early 2022, and President Biden hasn’t signaled whether he will renominate the chairman to another term. Powell declines to talk about his future in public remarks, but he has spoken bluntly about the state of the recovery. As one of the wealthiest Fed leaders, he’s now drawing attention to a homelessness crisis near where he grew up.

Although the economy is expected to rebound strongly this year, Powell has urged people to pay attention to often overlooked corners of the economy. And he has warned lawmakers and others that something is not quite right about this recovery. Many people are getting left behind, and that’s why he has mentioned the people at 21st and E.

The bleak reality comes with complicated questions: What more could the Fed have done to reach the most vulnerable during this recovery? And does this encampment’s growth, even indirectly, have anything to do with the Fed’s actions?

The Fed has several tools to protect the economy, and Powell deployed them with full force last year. But that kind of intervention aids some parts of the economy more than others.

Slashing interest rates and backstopping corporate debt, for example, helped direct money into the financial system. Some of the biggest beneficiaries were wealthier Americans who hold investments. As a stark sign of how the rich got richer in the past 12 months, the number of billionaires on Forbes’s 35th-annual ranking grew by nearly a third, swelling by 660.

Claudia Sahm, a former Fed economist and now a senior fellow at the Jain Family Institute, said the inequality stems from the limitations of the Fed’s monetary policy tool kit. Low interest rates or asset purchases influence the macroeconomy as a whole. In the Fed’s efforts to quicken the recovery, Sahm said that “some of the problems they’re trying to solve, they make a little bit worse.”

“It’s not intentional,” she added. “They don’t like [Tesla’s] Elon [Musk] more than the worker at Walmart. But the reality is that their tools make him better off more quickly than the worker.”

The Fed, for its part, plans to keep interest rates low to allow the labor market to build strength, and the central bank isn’t ready to pull back on its other economic supports. Powell often points to the 8.5 million people — probably millions more — whose jobs haven’t returned since February 2020.

Plus, Powell routinely warns Congress about declaring victory too quickly. Elected lawmakers can target aid to specific industries or pockets of the economy, while the Fed cannot.

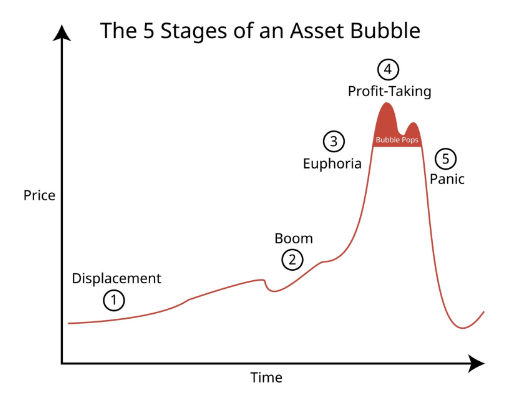

The unequal recovery is playing out in a turbocharged housing market as some buyers, flush with cash, compete for increasingly expensive homes. Some analysts worry that the housing boom could spiral into a bubble, which could trigger an even bigger mess.

When home prices rise dramatically, that can squeeze out people who can barely make rent or mortgage payments. Sometimes, those people have nowhere to go but places like 21st and E.

“As long as you’re okay with bugs, as long as you have a tent and a tarp, it’s a lot cheaper than the cost of living,” said Malo Lotus, 19, who has lived at the encampment for about four months. “All the money you could put to rent, you could just save.”

The encampment is a patchwork of multicolored tents — the kind intended for temporary use, not permanent shelter. In some corners, there are snapshots of lives left behind: A stained mattress folded into a metal shopping cart. A bicycle with a mangled back tire. A discarded pair of pink underwear with white polka dots.

At the same time, many residents take pride in the community they’ve created. One woman nicknamed the organized row of tents facing E Street “Park Avenue.” There’s a trash pickup and a portable toilet. Residents routinely check on one another, distribute donated food and make trades, such as a portable charger in exchange for a flashlight.

People come here for a few reasons, advocates say. The encampment is close to Miriam’s Kitchen, a nonprofit organization focused on ending homelessness, where residents can access services and get a meal. Some are drawn to the relative safety of the area, which is surrounded by gleaming government buildings and a heavy security presence.

But advocates say the coronavirus crisis is most responsible for the encampment’s surge. The virus keeps many people away from shelters. People who held stable jobs so recently had the floor fall out from beneath them.

Malo Lotus used to clock in at least 40 hours a week working at a Popeyes. She and her partner, Isaiah Lotus, 21, relied on the money, especially when it came to buying diapers for their now-10-month-old daughter.

Malo Lotus said she was furloughed last year, since only a handful of workers could be in the kitchen at once. When they arrived at the encampment, they nestled their tent alongside a wall that separates them from the busy street below.

They are both trying to finish high school. One recent morning, Malo Lotus was working on calculus homework. Isaiah Lotus hopes to become a dance teacher or choreographer. Miriam’s Kitchen is helping them fill out paperwork to receive a stimulus check.

“I could see myself in any position, or a job that would pay me very well,” Isaiah Lotus said. “I would take a job where I can at least always be able to get there on time, have something to do. I would love it, to be honest.”

Jesse Rabinowitz, senior manager of policy and advocacy at Miriam’s Kitchen, said that on any given night there are 6,500 people experiencing homelessness in the District, the majority of whom are Black.

“I agree with Chairman Powell that this keeps me up at night,” Rabinowitz said. “Homelessness is such a stark and visual reminder of the racialized income inequality in the city and in the country.”

A new dashboard

The Fed uses a wide dashboard of metrics to monitor the labor market. And recently, pressure has grown to drill down beyond the aggregate unemployment rate, which was 6 percent in March. Economists note that the overall figure doesn’t account for major disparities in the jobless rate between White, Black, Hispanic and Asian workers.

Last month, for example, Black workers’ unemployment rate was 9.6 percent; it was 7.9 percent for Hispanic workers. The unemployment rate for White workers was 5.4 percent.

Now, economists puzzle over a slew of unconventional indicators to understand how the economy is recovering. Foot traffic in stores helps explain consumer spending patterns. Mobile data shows how much time people spend at home and when they leave the house. Yelp data exposes how many businesses have shut their doors.

Now, the Fed chairman is studying the growth of a homeless camp outside his car window. He has raised concerns about continued problems with food insecurity as millions of Americans still report not having enough to eat.

These issues aren’t just captivating Fed officials in Washington.

Mary C. Daly, president of the Federal Reserve Bank of San Francisco, said the food bank lines near her home in Oakland are “an obvious sign the pandemic isn’t behind us, and the economic fallout from it isn’t behind us.” She said the pandemic rolled back progress that had been made to narrow housing and food insecurity.

“I think that it is really important, not just as an economist but as a policymaker, that the publicly collected data we can calculate doesn’t tell the whole story,” Daly said. “You need to talk to people. You need to walk around in communities.”

‘A place for me to be’

How the economic recovery is judged depends heavily on how the most vulnerable Americans fare. That includes people waiting in miles-long food bank lines, or the ones making a home at 21st and E.

Mario Key, 41, used to earn money through Uber Eats, riding his bike back and forth from the Maryland suburbs to make deliveries in the District. He had moved back into his childhood home to care for his dying mother, then learned her house was in foreclosure.

After losing the house, Key said he was shot in the chest outside a McDonald’s in Washington. He survived, but could no longer ride his bike. He became homeless in 2018.

Key said he’s waiting to be approved for housing. He has one portable heater to cover his large brown and beige tent along one edge of the camp.

“I don’t know that he has much control over the city,” Key said of Powell. “One of the things I wish was that there would be a place for me to be … so that people have somewhere to be when they hit that bottom rung. People are starving.”

Compounding the Fed’s challenge is that many jobs lost during the pandemic may not return. The longer people are stuck outside the workforce, the harder it often is to get back in.

“There’s a lot of suffering out there still,” Powell said in the “60 Minutes” interview. “The economy that we’re going back to is going to be different from the one that we had. And in some ways, those differences will make it challenging for those people to go back to work. And I think we owe them helping them get back to work.”

Eventually, the rush of stimulus money will fizzle out. The Centers for Disease Control and Prevention recently extended its federal eviction moratorium until June 30. But advocates fear another wave of homelessness once those protections fade away.

“They don’t say this, but this is part of why Jay Powell and every Fed official has been begging for Congress to do more,” said Sahm, the former Fed economist. “If Congress doesn’t do more, inequality will blow up, and we won’t reach full employment.”

At 21st and E, one woman sat facing her tent and sipped a soda. She said she had two jobs as an usher at some of Washington’s most acclaimed performing arts spaces before the pandemic.

She used to sleep outside on the campus of George Washington University but was displaced when the pandemic closed the school. She came to the encampment near the Fed and moved into a spare tent next to Key’s.

When asked, she said she was surprised to learn that Powell — someone with so much authority over the world’s economy — had noticed her community’s plight.

With a bit of hope, and a bit of disbelief, she said: “Maybe we could invite him to visit.”

Original post from TheWashingtonPost

The financial market is crumbling and EVERYONE will be affected. Only those who know what's going on and PREPARE will survive... dare we say thrive. Our 7 Simple Action Items to Protect Your Bank Account will give you the tools you need to make informed decisions to protect yourself and the ones you love.