Houston: The Banks Have A Huge Problem

For many years after the financial crisis, US commercial banks were mocked when instead of generating earnings the old-fashioned way, by collecting the interest arb on loans they had made, or even by front running the Fed with their prop (and flow) trading desks, they would "earn" their way to just above consensus estimates by releasing some of their accumulated loan loss reserves, which thanks to creative accounting, would end up boosting the bottom line. The thinking here went that having suffered massive losses during the financial crisis "kitchen sink" when all banks suffered crushing losses to they would get bailed out, banks would then "recoup" billions in losses over time that would be run through the income statement as a reversal of accrued loss provisions.

Well, after the longest expansion in history, it's time for this process to go into reverse, and instead of releasing loan loss reserves the banks are now starting to build them up again in preparation for a wave of consumer defaults due to the US economic shutdown.

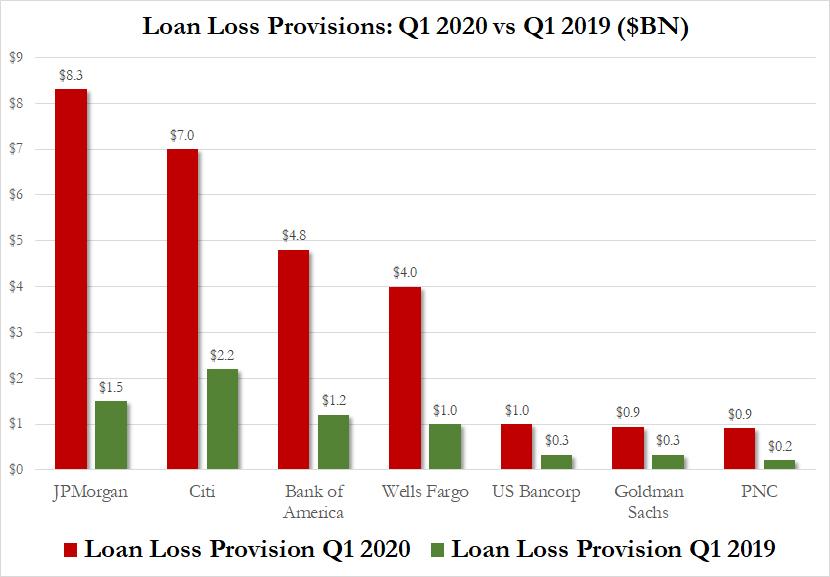

As we reported earlier, this big story from earnings season so far - now that all major US money center banks have reported earnings - has been how much in loan loss provisions and reserves have the big US banks taken as precaution for the economic upheaval due to the coronacrisis. As shown below, on average most banks - this time including the hedge fund known as Goldman Sachs which has since pivoted to becoming a subprime lender to the masses with "Marcus" - saw their loan loss provisions surge by roughly 4x from year ago levels, with JPMorgan's jumping the most, or just over 5x, hinting the other banks are likely underprovisioned for the storm that is coming.

Alas, these provisions amounts are nowhere near enough if history is any indication.

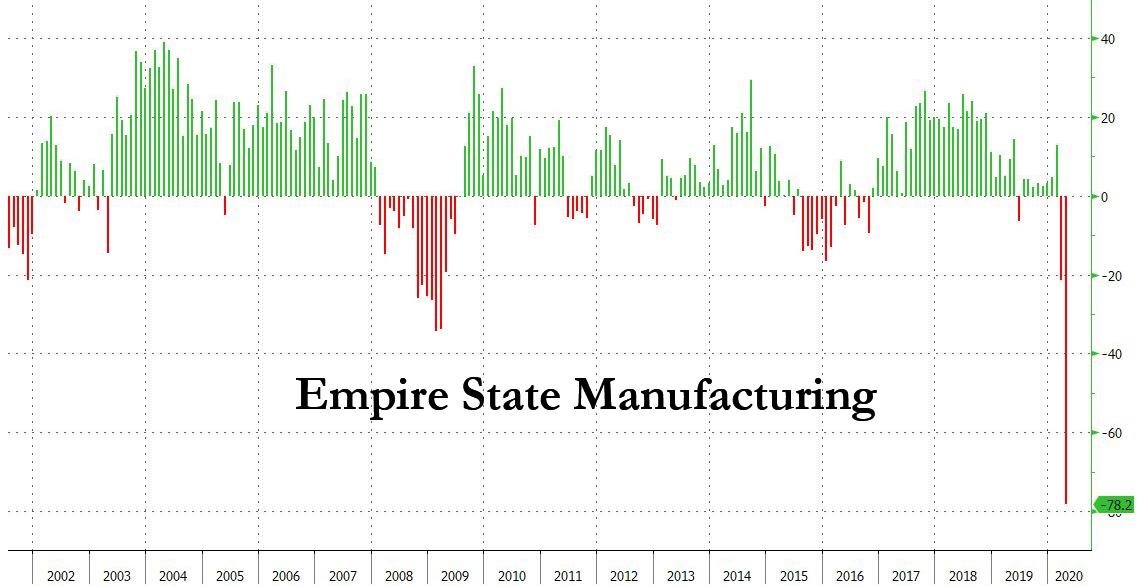

What if instead of using JPMorgan as a benchmark, one takes the financial crisis as a reference: after all, we already know that both GDP and unemployment will be far, far worse in Q2 compared to even the worst levels of the financial crisis, something today's Empire Fed number vividly demonstrated...

... and even though the duration of the coming recession remains unclear and is a function of how quickly the coronavirus vaccine is developed, it is more than likely that total loan losses will match, if not surpass what happened in 2008, especially since this time the crisis is global and not just US based.

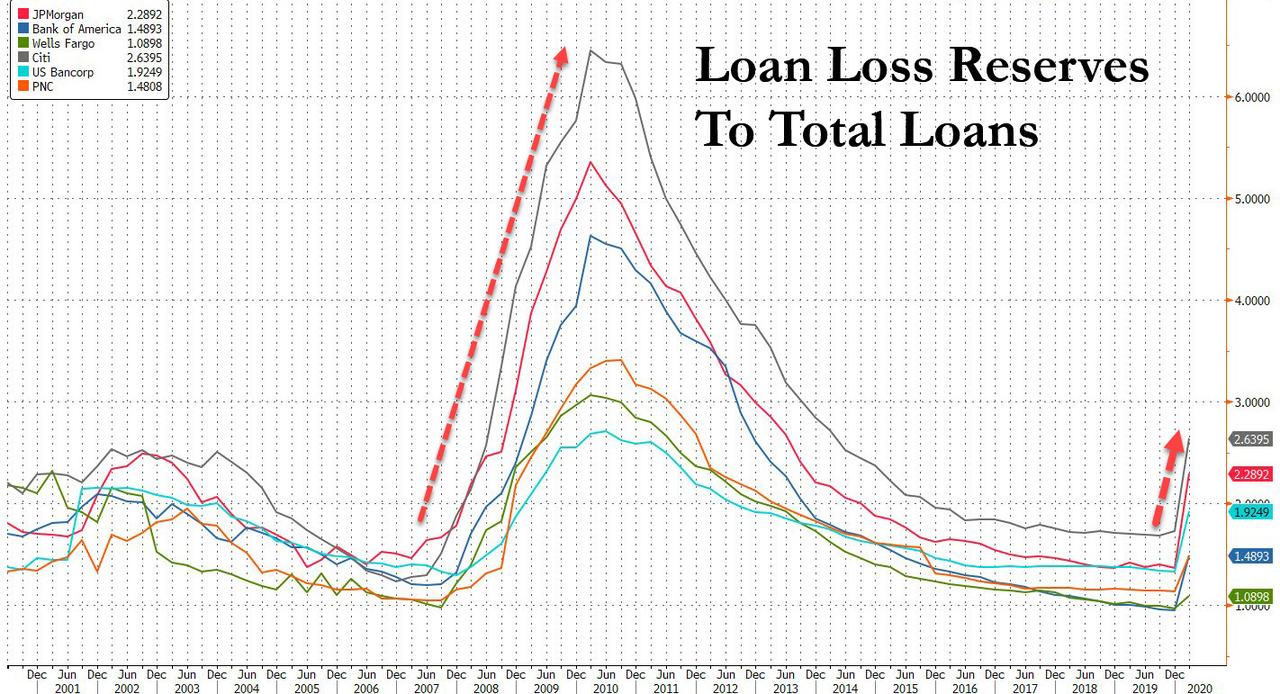

So as banks are set to be hit with tens of billions in charge offs - for which they are trying their best to reserve even if they have no idea just how bad the hit will be - we decided to look at what the banks did in the aftermath of the financial crisis. What we found is that most banks reserved total losses anywhere between 4 and 6% of total loans. This time around? So far it is less than 2%, as shown in the chart below.

This means that there is a reason why banks did not want to discuss what their future provisions would and could be - because they know very well that if the financial crisis is a template, there is a long way to go before banks are properly provisioned. As an aside, BofA CFO Donofrio was almost angry on a few occasions when responding to questions how much more reserves in Q2 the bank would need, saying the bank reserves based on what we know at the moment, and that if he knew how much higher reserves would be he’d "add them now."

Well, if he won't add them now, he will add them in Q2, when loan loss provisions will explode, and we expect bank loss expectations will soar by double digits across most banks as the ghost of 2009 loan losses fully materializes.

So to put it all in context, so far the Big 4 banks have reserved an additional $24BN in Q1 for future loses. But if the GFC is any indication of the defaults that are about to be unleashed, the real amount of losses, discharges and delinquencies will increase 3x-4x compared to the current baseline, meaning that over the next several quarters, banks will have to take another $75-$100BN in reserves on loans that go bad, wiping out years of profits, which were used not for a rainy day fund but to pay for - drumroll - buybacks.

This, to put it mildly, is a major problem for banks which until now were seen as generously overcapitalized, because if the US banking sector is facing $100BN (or more) in loan losses, then the Fed will have no choice but to once again step in and bail out the US financial sector.

How will we know if banks are indeed facing an Everest of loan losses instead of a mole hill? Keep an eye on those charge-off updates. While they have yet to pick up, once they do it will be an avalanche of consumers refusing or unable to pay down their loans, sticking banks with the loss. The only question then is whether the banks will stick taxpayers with what is shaping up as yet another taxpayer bailout of the US financial system.

Read Original Article at zerohedge.com