How Corporate ESG Has Become a Dirty Word

"ESG" has gone from the buzzword that every investment advisor, company and government official had to be familiar with and append to every single piece of business they were involved with - to becoming "the latest dirty word in corporate America".

Such was the topic of a new WSJ article that all but officially marks the formal funeral for one of the biggest grifts on Wall Street.

The report notes that many businesses are distancing themselves from the term due to growing investor disapproval, political pressures, and legal challenges surrounding their environmental, social, and governance initiatives.

Executives are shifting their language on earnings calls, the Journal noted, with companies like Coca-Cola renaming corporate reports and committees to exclude ESG. New phrases like "responsible business" are being adopted instead, and some Wall Street firms are shutting down ESG funds amid waning interest.

Although the concept of integrating accountability into business has a long history, recently, ESG has become contentious. Despite this shift, a Teneo survey reveals that most CEOs are maintaining their sustainability commitments, albeit with altered approaches and more caution in their public disclosures to avoid regulatory and political backlash.

Brad Karp, chair of law firm Paul Weiss told the Wall Street Journal: “We’ve seen a great deal of reframing and adjusting by CEOs in the ESG arena. Not only of what they say, but also where they say it and how they characterize it.”

He continued: “Most companies are moving forward operationally with their ESG programs, but not publicly touting them, or describing them in different ways.”

The political landscape around ESG intensified after a 2022 conflict between Disney and Florida Governor Ron DeSantis, the Journal wrote, leading to criticism from numerous state officials and a retreat by some asset managers.

The shift saw over $14 billion withdrawn from ESG funds in the first nine months of 2023. Reacting to this, BlackRock's Larry Fink didn't mention ESG in a 2023 investor letter, following fund withdrawals from states in 2022 due to the firm's focus on ESG. Similarly, State Street adjusted its voting policy for investors less inclined towards ESG, and Fidelity revised its proxy-review process to exclude ESG considerations.

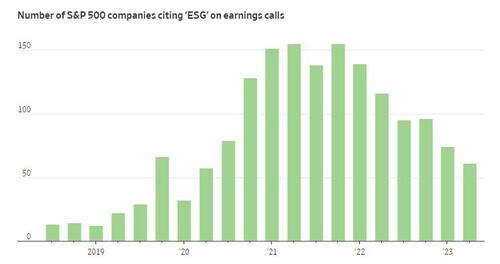

According to FactSet, mentions of ESG in earnings calls have dropped from 155 S&P 500 companies discussing it in the fourth quarter of 2021 to just 61 by the second quarter of 2023.

Texas Attorney General Ken Paxton concluded: “If this trend is decreasing, these CEOs must have realized that this puts them at greater legal risk and costs them customers.”

Recall, we have written about the dying off of ESG and "green" investment products over the last few months. Most recently, at the end of 2023, Goldman Sachs shuttered its ActiveBeta Paris-Aligned Climate U.S. Large Cap Equity ETF.

Bloomberg ETF analyst Eric Balchunas pointed out last month that "there was just way too much supply for the demand" with the ETF and that "it's going to get worse too". Balchunas says the ETF only took in $7 million over the course of 2 years.

We also wrote about Jeff Ubben late last year, who shuttered his sustainability fund - calling traditional climate summitry an “echo chamber” of diplomats.

Less than a week before that we noted that $30 billion had been shaved off the value of clean energy stocks over the preceding 6 months.

Finally, we pointed out last year how the ESG grift was reaching endgame after Markus Müller, chief investment officer ESG at Deutsche Bank's Private Bank stated that sustainability funds should include traditional energy stocks, arguing that not doing so deprives investors of a prime opportunity to invest in the transition to renewable energy.

We bet it won't be long before the next dirty word on Wall Street becomes "DEI"...

This article originally appeared on Zero Hedge

The financial market is crumbling and EVERYONE will be affected. Only those who know what's going on and PREPARE will survive... dare we say thrive. Our 7 Simple Action Items to Protect Your Bank Account will give you the tools you need to make informed decisions to protect yourself and the ones you love.