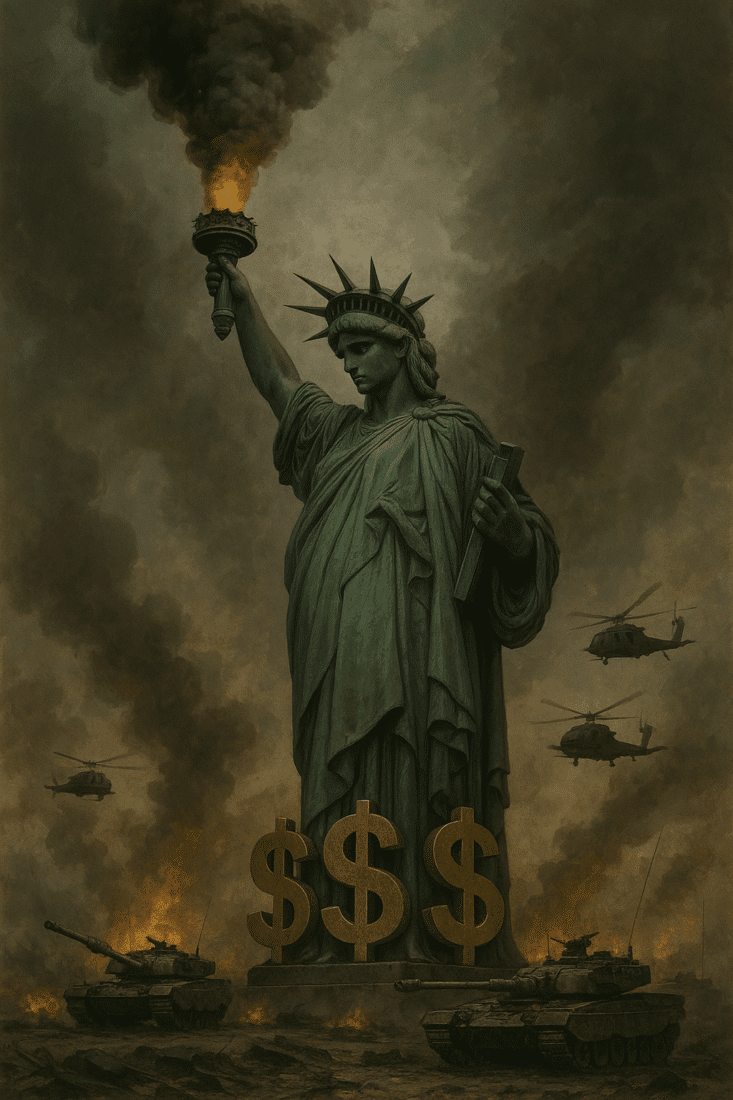

Inflation Isn’t Easing—It’s Hiding: How the Numbers Lie

Unease? No—It's the Quiet Before the Storm

Have you noticed it? That creeping sensation that the numbers no longer add up—that the official story isn’t matching your lived experience? They call it “unease.” I call it the precursor to something much more disruptive.

Let’s talk about what just happened: On April 2nd, President Donald Trump announced sweeping reciprocal tariffs against major trading partners. Wall Street flinched, consumer sentiment staggered, and behind the scenes, business leaders began tightening their belts.

And right on cue—days later—private sector job growth came in at just 62,000. That’s not a slowdown. That’s a stall-out. For context, the previous month’s hiring figures were more than double that.

But while the economists debate semantics, the data screams louder than any press conference: something is breaking.

The Illusion of Strength and the Reality of Stagnation

Let’s look at the numbers that matter. The Personal Consumption Expenditures (PCE) price index—a key inflation gauge preferred by the Fed—rose 3.6% in Q1 2025. That’s up from 2.4% just one quarter ago. The Fed’s target? 2%.

So while the official narrative may tout a resilient economy, the truth is more sinister. Inflation is surging. Hiring is slowing. And tariffs are throwing jet fuel on an already combustible trade environment.

You think the Fed’s going to ride in and cut rates to rescue the job market?

Not a chance.

The Fed’s trapped. Lower rates now would signal surrender to inflation. But tightening monetary policy when job growth is evaporating? That’s how you engineer a recession—or worse.

They’ve built a monetary house of mirrors, and every path forward leads to collapse.

Trump’s Tariffs: The Political Spark to an Economic Fire

There’s more to these tariffs than meets the eye. Trump isn’t just playing trade war poker. He’s playing chess—with the Federal Reserve caught as an unwilling pawn.

By raising trade barriers, he’s effectively daring the Fed to act. If consumer prices jump—as they will with more expensive imports—and the Fed holds firm or tightens, demand collapses. If the Fed cuts to protect jobs, inflation spins out of control.

Checkmate either way.

Is this economic sabotage or strategic acceleration toward monetary reform? If you’ve been following my work, you already know the answer.

What Comes Next—and What You Can Do Now

Here’s the forecast most won’t publish: Unemployment is going to rise through the remainder of the year, even as inflation lingers above target. This is the classic stagflation setup that defined the 1970s. But unlike the past, today’s debt levels and global interdependence make the outcome far more dangerous.

The smart move isn’t to wait for a bailout.

It’s to exit the system before it shuts the door behind you. That means moving wealth into real assets, learning how to protect liquidity in a capital-controlled environment, and decoupling from the fiat Ponzi structure one step at a time.

Your Next Move

The economic warning signs aren’t just blinking—they’re blaring. And yet, the mainstream continues to soothe the masses while preparing lifeboats for the elite. Don’t be the last one off the sinking ship.

If you want to insulate yourself from what’s coming, start now:

- 📘 Get your free digital copy of “Seven Steps to Protect Your Bank Accounts”

Learn the exact strategies to keep your money safe from seizure, inflation, and systemic collapse.

👉 Download here - 📕 Prefer a hardcover? Get Bill Brocius’ "The End of Banking as You Know It" at a special price

This book is the blueprint for exiting the banking matrix—for good.

👉 Order here

Remember, economic sovereignty isn't gifted—it’s earned, step by step.

—Mr. Anderson