Investor Warning From JPMorgan: Brace For Surging Federal Debt

EDITOR NOTE: The “major damage” to public finances as a result of our ballooning federal debt will be just as bad as it was during WWII, according to JPMorgan Chase & Co. The investment bank’s message to investors: brace for it, for it is coming. Our take: if you are overweight US equities, bonds, or other dollar-denominated assets, hedge them. Of course, we’ve been saying this for years at GSI Exchange. And those who heeded our warnings as early as 2016 are now riding a very strong bull market. Well, we’re saying it again.

Ballooning coronavirus debt at the federal level poses “very serious” issues for investors, according to JPMorgan Chase & Co.’s asset management unit.

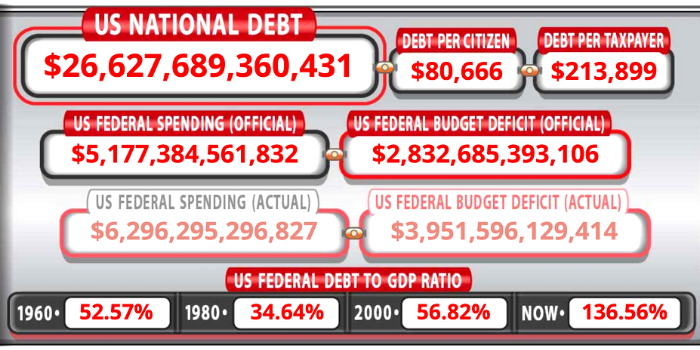

“We now expect deficits of roughly $3.5 trillion in fiscal 2020 and $3.0 trillion in fiscal 2021, bringing the debt to $23.3 trillion or 106.5 percent of GDP by September 30th,” David Kelly, J.P. Morgan Asset Management’s chief global strategist, said Monday in his weekly note. That’s just below the record 108 percent of gross domestic product in 1946, he wrote, “as the U.S. government faced the colossal debt racked up in fighting World War II.”

The coronavirus-induced recession — and the government relief measures battling it — are inflicting “major damage” to public finances, according to Kelly. Amid the uncertainty, he sees a “logical investment strategy” favoring real assets and stocks trading at low-earnings multiples globally.

The “probable path, in the aftermath of the pandemic, is one of somewhat higher inflation, somewhat tighter monetary policy and somewhat higher taxes,” Kelly said in his note. “Higher inflation could come first and, on its own, would tend to be a negative for cash and bonds, neutral for equities, and positive for real assets.”

[II Deep Dive: GMO, Long Bearish, Finds a Sector It Loves]

Congress is again hammering out new legislation to help Americans through the pandemic after negotiations between political parties broke down last week. While President Donald Trump over the weekend announced executive orders providing assistance for lost wages, a deferral on tax obligations, and a potential moratorium on residential evictions and foreclosures, challenges remain for U.S. lawmakers.

Originally posted on Institutional Investor