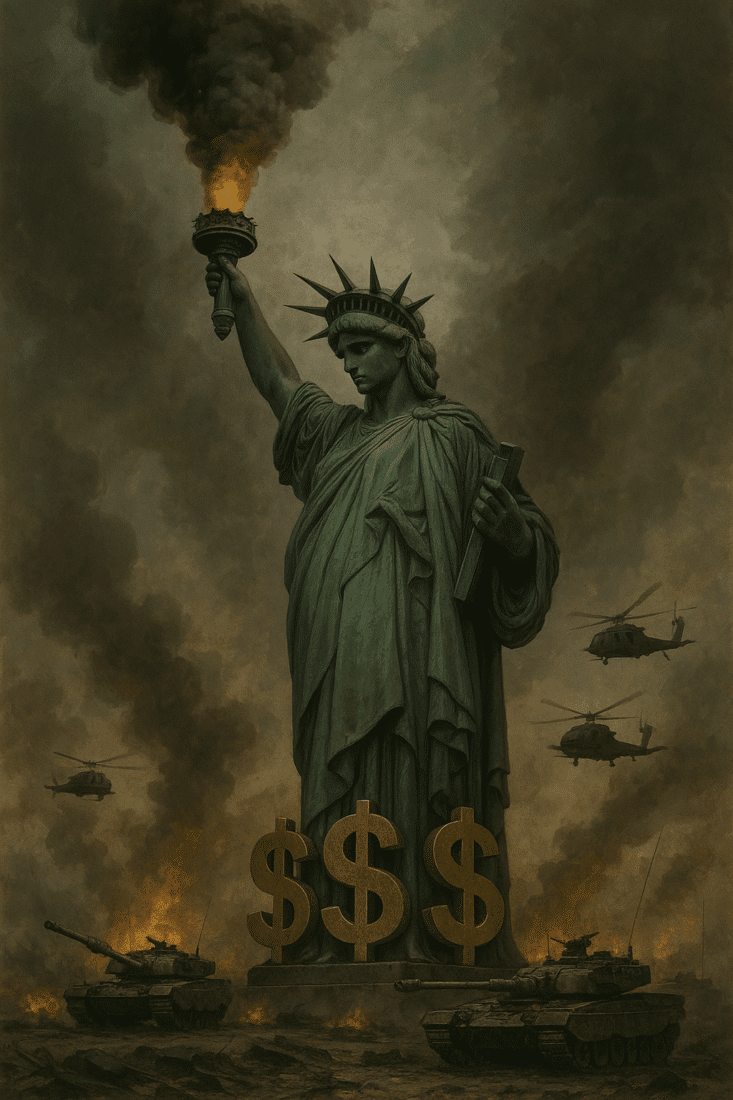

Is Donald Trump About to Do a Hard Reboot of the US Banking System?

Since before the COVID-19 pandemic began infecting the economy, President Trump had already been pressuring the Federal Reserve to lower interest rates to prop up the equities market. Now, post-lockdown, an astounding $6 Trillion has been pumped into the financial system to save an economy that appears to be only steps away from utter devastation.

Interest rates are once again close to zero, and we’re all wondering if the post-COVID-19 economy may warrant the necessity for interest rates to push below zero. Despite the dangers that may result from crossing that negative line, President Trump seems to be all for it.

What’s President Trump up to? The notion that negative rates may be dangerous for the economy is nothing short of rational. Yet, vision and rationality don’t always mix well. Sometimes, in order to accomplish a vision of something greater, you have to take risks that go well beyond the thresholds of common sense. As we’ve seen in Donald Trump’s career--four bankruptcies, each one leading to some form of business reinvention, resulting in greater wealth accumulation and, eventually, the US Presidency--it’s clear that Trump has always followed a different playbook.

Now, it appears as if he’s applying that playbook (or something similar) to the US economy.

Negative Interest Rates 101

As we’ve written before, many prominent financial institutions and investors began forecasting the potential for negative rates since before the coronavirus crises. On the investor side, perhaps the most prominent of them all is Warren Buffet who warned of the “extreme consequences” that may arise from such a decision.

If you’re not familiar with the idea of negative rates, it means that you’ll pay interest for depositing your money in a bank or any other account where the issuer is borrowing your money. When you put money into savings, your bank “borrows” your money in order to lend it out. Typically, for taking the risk of lending money to your bank, you’re compensated by interest payments. In a negative rate scenario, you would pay bankers to lend them your money. It’s quite strange for Americans, though it’s happening in many places across the world, as in a few European countries and Japan.

How does this happen? If the Federal Reserve sets the overnight deposit rate below zero, banks will have to pay the Fed to hold their reserves. To cover these rates, banks will likely pass them on to their customers (like you), charging customers for positive balances.

Why do central banks set interest rates to below zero? Some economists believe that negative rates can vitalize a flatlining economy. Of course, not all economists agree with this approach.

In sharp contrast to Buffett and those economists who warn against the dangers of negative rates, President Trump is in favor of going below zero. Why? Because he feels that negative rates may provide countries who’ve adopted them an unfair competitive advantage in the global arena.

Last January, Trump told attendees at the World Economic Forum: "We’re forced to compete with nations that are getting negative rates, something very new...meaning, they get paid to borrow money, something I could get used to very quickly."

While the Fed disagrees with this approach, Trump insisted, tweeting last September that "The Federal Reserve should get our interest rates down to zero, or less...It is only the naïveté of Jay Powell and the Federal Reserve that doesn’t allow us to do what other countries are already doing," going as far as to call the Fed “boneheads.”

Creative Destruction to Forge a New US Economy

One of the Fed’s main tasks is “to protect the banking system,” according to William Lee, a Milken Institute (think tank) economist. Negative rates may be “the last tool the Fed pulls out of its tool kit.”

All of this, of course, consists of monetary manipulation, obscuring both the “real” and “perceived” value of American currency. Trump knows this, and although it can serve his interests toward maintaining the market’s (and economy’s) momentum, it’s no secret that he doesn’t think very highly of the Federal Reserve or the economic models they use to justify their interventions.

Both President Trump and his economic advisor Judy Shelton both know of the damage that extended quantitative easing, let alone negative rates, can inflict on the US economy. Yet, Trump is all for it. So, the question once again: what’s he trying to do?

We know that Judy Shelton has been calling for the reintroduction of gold into the financial system via gold-backed US Treasuries. We also know that Trump supports this idea.

Drawing from Trump’s business playbook, one in which he used bankruptcy as a tool to reinvent and reinvigorate his massive portfolio of companies, it isn’t much of a leap to conjecture that perhaps he has a similar vision for the US economy--namely, straining the monetary and banking system to its limits in order to “reboot” it, building a new and much stronger monetary system backed by gold.