Is Gold Poised to Replace the Dollar as Store of Value Amid Rising Fiscal Dominance?

Let me level with you—what we’re seeing right now isn’t just another blip in the system. It’s not a soft landing or some technical correction on a chart. No, this is a regime shift in how the financial world works. And the fallout could be massive.

Paul Wong from Sprott just laid it all out, and I’ve got to tell you—he’s confirming everything I’ve been warning about for years: The dollar is toast, the Fed is neutered, and gold is stepping in as the real store of value. Let’s break this down.

Gold’s Explosive Run: Stress Is the Fuel

Gold’s up over 30% so far this year, its biggest year-to-date run since the late '70s—and we all know what followed that: inflation, recession, and gold going vertical. Wong calls this a "stress-driven" rally, and he’s spot on. Gold doesn’t spike like this unless the system’s flashing red.

This isn’t about demand from jewelry or a few hedge funds hedging risk. No, this is about deep structural distrust in the dollar and the institutions backing it. The Fed, once the supposed adult in the room, is being politically bullied and turned into a puppet. That’s not hyperbole—it’s happening right now.

Trump vs. the Fed: The Gloves Are Off

The White House is now openly strong-arming the Fed. One governor has resigned, another was fired—a move not seen since the Fed was founded in 1913. The official excuse? Mortgage fraud. The real reason? Political control. If this stands, the Fed’s independence is gone. Period.

Wong points out that President Trump is actively working to install a majority of loyalists at the Federal Reserve Board. With a 4-3 split, monetary policy will be run straight from the Oval Office. That means no more neutral rate setting—just rate cuts on demand and easy money until the wheels fall off.

And let me tell you something: markets are already pricing it in. The yield curve is steepening. The long end (30-year bonds) is rising while short-term rates fall. That's classic flight from confidence. Investors don’t want long-term exposure to a currency run by politicians.

Fiscal Dominance: The Treasury’s Taking Over

Wong describes what’s happening as a shift into fiscal dominance. Here’s what that means in plain English: The Treasury (the government) now runs the show, and the Fed is just the guy carrying their bags.

Monetary policy used to be about controlling inflation. Now it’s about keeping the government’s borrowing costs low. That's it. We’re entering an era where interest rates will be kept artificially below inflation to make sure Uncle Sam can keep spending like a drunken sailor without blowing up the debt.

That means one thing: negative real rates, possibly for years. And if you’re sitting in dollars or Treasuries, that’s death by a thousand cuts.

Tariffs + Trade Wars = Stagflation 2.0

Add to that the tariff bomb going off—15% or higher on a wide range of imports—and you’ve got the ingredients for another round of stagflation. Prices are up, wages are stuck, and growth is slowing. That's bad news for most assets... but not for gold.

Inflation from tariffs isn’t going away anytime soon, and the Fed, now under political pressure, can’t hike to fight it. They’re stuck. The only way out? Print more, spend more, and inflate away the debt.

Yield Curve Control: Financial Repression Incoming

Wong warns we might soon see yield curve control (YCC)—that’s where the Fed steps in and says, “Nope, we’re not letting long-term interest rates rise.” It sounds nice on the surface, but let me tell you what that really means:

- The bond market is no longer free.

- The government sets your returns.

- Inflation will eat your savings alive.

This is financial repression. It’s a quiet way to steal from savers, retirees, and anyone who believed in the “safety” of U.S. bonds.

And in that environment, gold soars. Why? Because it’s the one monetary asset they can’t control.

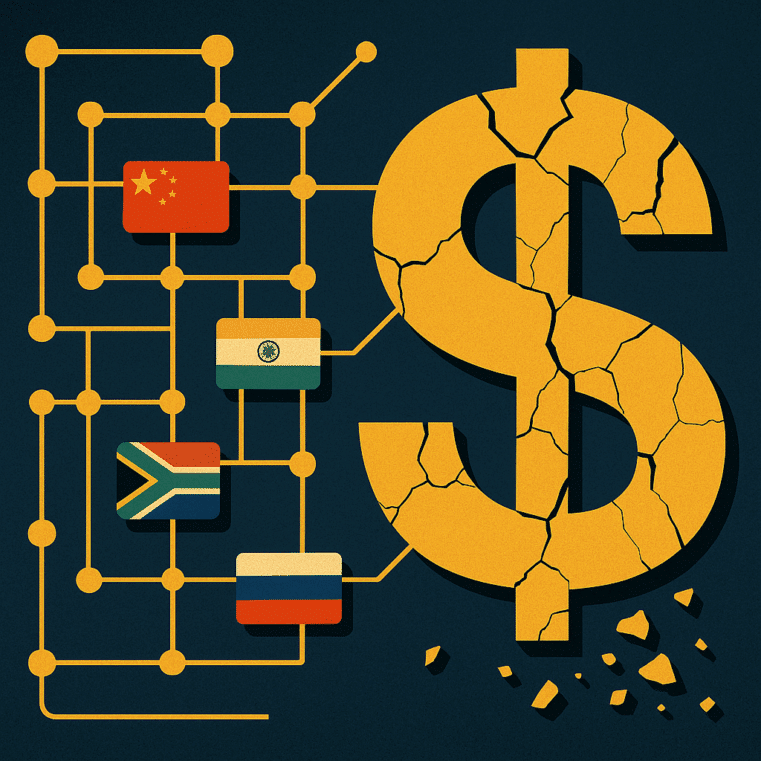

The End of Dollar Dominance?

All this is eroding trust in the dollar not just at home, but globally. Wong makes the case that gold is being re-monetized—quietly but steadily—as the world’s next neutral reserve asset.

The U.S. dollar was once king because it served three functions:

- Unit of account

- Medium of exchange

- Store of value

That last one? It’s already failing. The dollar is losing purchasing power fast, and other countries see it. That’s why central banks around the world are buying gold at a record pace—because they know what’s coming.

Gold: The Only Safe Store of Value Left

Gold is liquid, trusted, and free from the manipulations of Wall Street and Washington. It doesn’t get “voted out” of office. It doesn’t default. And it doesn’t care about Fed minutes or unemployment data.

If you think the old rules still apply, you’re in for a rude awakening. This isn’t just about protecting your wealth anymore—it’s about surviving the next phase of financial warfare.

And make no mistake: this is warfare. It’s the government vs. savers. It’s central banks vs. your independence. And gold is your last line of defense.

Final Thought: If You’re Waiting, You’re Losing

Look, I didn’t grow up rich. I didn’t inherit trust funds or sit on Wall Street in a corner office. I learned the value of a dollar the hard way. And I’ve watched that dollar get diluted, manipulated, and turned into a weapon against the very people who trusted it.

Don’t be the last person holding the bag when this house of cards comes down.

👉 Download Bill Brocius’ free eBook: Seven Steps to Protect Yourself from Bank Failure

👉 Subscribe to Dedollarize’s wealth protection newsletter and stay ahead of the collapse.

Stay smart. Stay free. Own gold.

—Frank Balm