Is the Gold Rush Just Catching Its Breath or Crashing?

Folks, let’s get one thing straight: just because gold prices cooled off a bit this week doesn’t mean the rally’s over. If anything, it’s proof that we’re in the early stages of something much bigger — and smarter investors are treating this like the calm before the next surge. In fact, according to the World Gold Council, central banks bought more than 1,000 metric tons of gold in 2023, one of the largest annual purchases on record, signaling that the world’s biggest players are positioning for long-term instability, not short-term headlines. That kind of institutional accumulation doesn’t happen at market tops, and it reinforces why the gold rally just beginning narrative remains firmly intact despite short-term pauses.

Now I don’t mean to sound like a broken record, but this is why I’ve been pounding the table for years: Gold and silver aren’t just investments — they’re lifelines.

Let me break this down the way I’d explain it to my brother who’s still working construction back in Pennsylvania: imagine your house is on fire (that’s the economy right now), and gold is the fireproof safe with your valuables inside. It doesn’t matter if it gets dusty or dented in the chaos — what matters is that it protects what’s yours.

And here we are, just two weeks into 2026, and gold’s already added $256 — the best January start in history. Silver? Up over 24%. That’s the kind of move you usually only see when the world is on the edge of something big.

Why the “Pause” Is Good News

You might’ve heard the term consolidation thrown around this week. That’s just a fancy way of saying gold’s taking a breather after sprinting ahead. Think of it like a boxer in between rounds — catching his breath, not getting knocked out.

Wall Street analysts are acting like the party’s over because prices aren’t breaking records every single day. But the fundamentals haven’t changed:

- Central banks are still hoarding gold like there’s no tomorrow.

- The Federal Reserve is cornered. Rate cuts are coming — maybe not this quarter, but the pressure is building.

- Geopolitical tensions are exploding. Iran, the Red Sea, Taiwan — pick your powder keg.

And don’t even get me started on FedNow and the push toward Central Bank Digital Currencies (CBDCs) — the ultimate control grid. When they can freeze your funds with a keystroke, you’re going to wish you had some assets outside the system.

Gold and silver don’t care who’s president. They don’t care what the Fed says in its press release. They store your time and labor without the middleman.

Beware the Euphoria — but Don’t Let It Scare You Off

Now, one analyst in the article mentioned how “everyone’s suddenly bullish on gold” — and yeah, that does make me a little cautious. Whenever the herd starts piling in, corrections happen. But let me tell you — there’s a big difference between a dip and a downturn.

Corrections in a bull market are buying opportunities. Period. Think of it like your favorite tool going on sale — if you know you’ll need it, you grab it at a discount.

If we see gold fall back to $4,500 or even $4,450, I’ll be backing up the truck. Same with silver. Because nothing about the global mess we’re in has been fixed. If anything, it’s getting worse.

And here’s something most mainstream outlets won’t tell you: when the financial elites talk about gold “consolidating,” they’re often just shaking out the weak hands so they can load up at a better price. Don’t be the sucker who sells them your lifeboat.

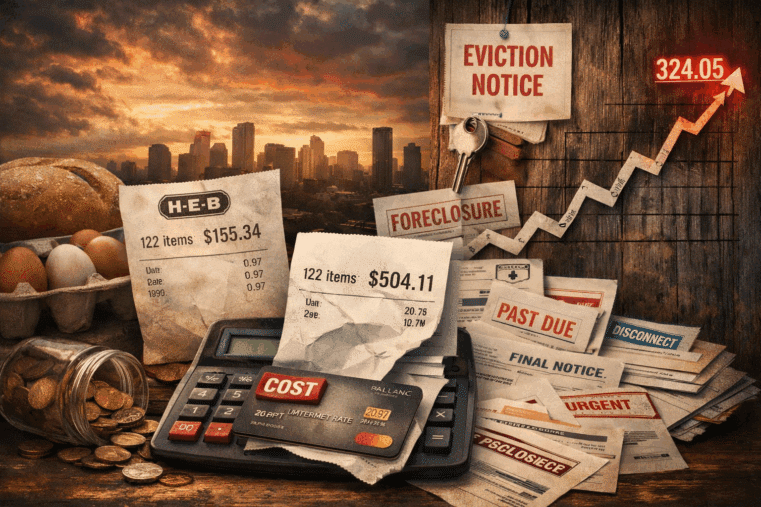

Arm Yourself Before the Collapse

Don’t wait for the next “bank holiday” or currency reset to realize you’ve been had. The signs are all around us — gold’s exploding, the Fed’s boxed in, and digital control systems are locking into place.

Get physical. Get secure. And above all — get educated.

Because no one’s going to send you a warning when it all goes down.

Download the FREE "Digital Dollar Reset Guide" right now

Your future self will thank you — or curse you.

That depends on what you do right now.

Stay ready,

Frank Balm