Italian Debt Contagion Puts US Banks at Risk

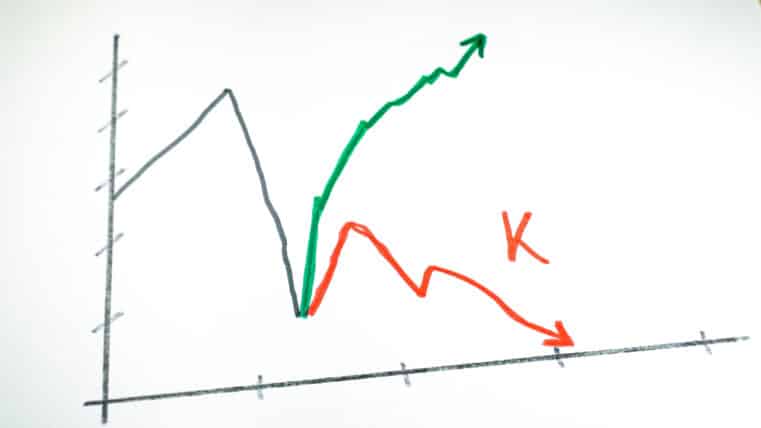

Just two weeks ago on May 29, the Dow crashed by nearly 400 points...the S&P declined by 31...and the Nasdaq fell 37.

Among all of the sectors in the US equities markets, the banking sector led the crash. Why US banks? Because many held direct or indirect exposure to Italian bonds whose sell-off resulted in a devastating yield jump.

These banks included Wells Fargo, Bank of America, JP Morgan Chase, Morgan Stanley, Citi and Goldman Sachs. Goldman Sachs led the pack, declining almost 20%!

Some financial pundits claim that US bank exposure to Italian bonds is small and therefore manageable.

They’re missing the point: the threat is much wider than most investors realize. In other words, the threat is systemic.

How so? Let’s take a step back and consider the big-picture view of instability in Italian politics and economics.

On the surface, the current crisis is centered on a conflict between populist and globalist forces.

Italian President Sergio Mattarella vetoed the nomination of an anti-EU economic minister strongly supported by Italy’s largest party, the populist Five Star Movement, and Italy’s right-wing League party.

Instead, Mattarella sought to establish his own minister; a pro-EU economist whose nomination was blocked by the two opposing parties.

These countermoves resulted in an impasse, and an agreement to hold new elections in July.

As you can probably see, Italy’s political instability may also threaten solidarity of the EU, as Italy is the EU’s fourth-largest economy.

Should Italy’s anti-EU parties win, they may hold a referendum on exiting the EU. And if that happens, then Spain and Portugal and others may follow.

So now you get the big picture. But let’s back up and consider the logic (or lack thereof) behind the investments that make up Italy’s debt exposure.

Contrary to populist notions, if you look well below the substratum, you’ll find that practically all of Italy’s economic problems are self-inflicted.

The current crisis is nothing other than the production of “anti-production”: the consequences of a state-serving system designed to repetitively impede its own progress through excessive government intervention and taxation.

Here are the facts:

- Political instability: no other European nation has seen more government changes since WWII than Italy.

- Crony capitalism: Italian governments have a history of championing businesses and state-owned corporations at the expense of smaller, more competitive companies.

- Labor market inefficiencies: high unemployment differences between regions have remained consistently wide.

- Corrupt financial incentive system: banks are incentivized to provide loans to indebted and inefficient state-owned companies, municipalities, in addition to financing government spending sprees; all of which led Italy having the largest non-performing loan figure in all of the EU.

- Inept or corrupt legal system: unable to repossess assets due to loan defaults, corporations are “incentivized” to carelessly malinvest their funds into projects and infrastructure, many of which end up proving anti-productive.

Given these factors, why would any nation consider Italy to be investment-worthy?

More importantly, why should we Americans be worried? Simple: the global financial system is interconnected.

European banks are invested in Italy, holding Italian bonds as capital reserves.

American banks to have some Italian bond exposure, but they are holding plenty of European assets, many of which are directly or indirectly exposed to Italian bond risk.

Many banks have borrowed against Italy’s debt...or are indirectly exposed to it.

Remember that the Italian economy is the EU’s fourth largest; much bigger than that of Greece.

Its reach in terms of risk is systemic, not just on a European scale, but a global one.

This is why the Italian crisis is being called “the mother of all systemic threats.”

If these banks fail, its destructive impact on the world’s financial system will be significant, and US Banks will get caught in the crossfire.

If your retirement portfolio holds any of these six banks--JPMorgan, Wells Fargo. Bank of America, Citigroup, Morgan Stanley, and Goldman Sachs--all of which may be severely impacted by Italy’s crisis, you might want to reconsider your holdings or hedge them with safe-haven assets.

Similar to the 2008 financial crisis, “ground zero” for this looming catastrophe stems from a seemingly inconspicuous point of origin.

But as we all know, negative contagion accelerates the force of indirect consequences, making their negative effects even more powerful as they are unexpected.

We do not know what will happen in July when Italy reconvenes for its election. But whatever may come of it, hedging your portfolio from market and dollar risk with physical gold may be your smartest move.