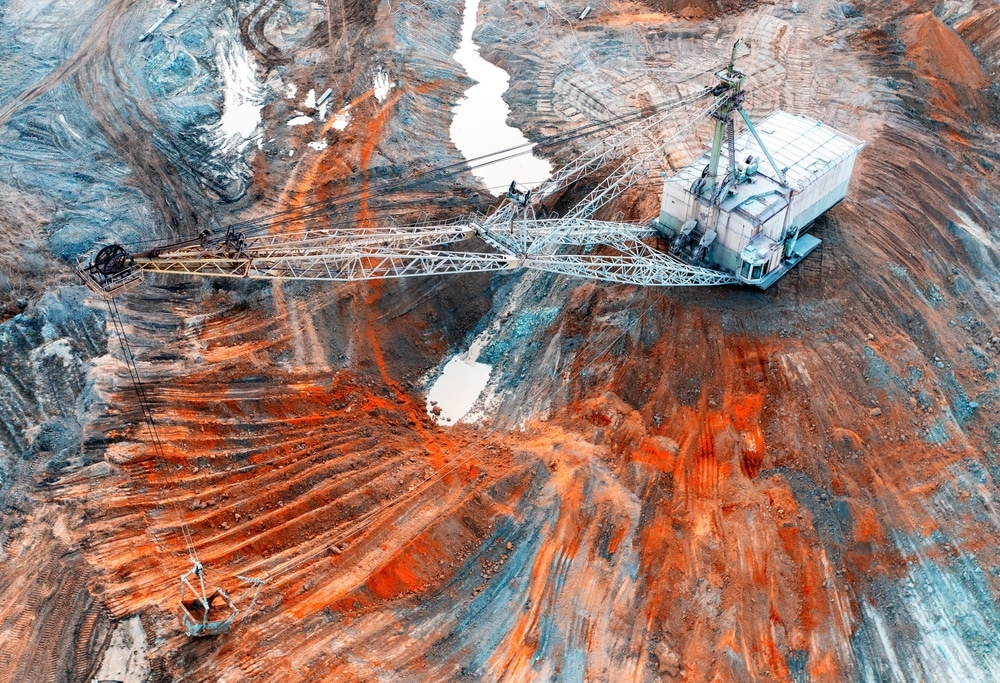

The illusion of financial security is cracking, and Sunday’s Mastercard outage was just another fracture in the brittle, centralized banking system. They call it a “glitch.” A minor inconvenience. Nothing to see here. But don’t be fooled—this was a warning shot, a taste of the financial stranglehold they are preparing to tighten around you.

Mastercard users across the U.S., U.K., Japan, Italy, and Australia woke up to find their digital wallets useless. No groceries. No gas. No way to function in the world they’ve engineered—a world where cash is demonized, and your survival depends on the approval of unseen corporate gatekeepers.

So, was it a simple mistake? A technical issue? Or was this a deliberate test run for a system designed to control every transaction you make? History tells us one thing: when powerful institutions claim “nothing to see here,” there is always something to see.