Ocasio-Cortez Secures a Seat On the House Service Financial Committee

An ugly transformation is taking place in America. Divisions in political sentiment and economic thought have become so deep, far-reaching, convoluted, and impassioned that most Americans are no longer able to see the issues with sobering clarity.

Before long, we may no longer be able to recognize ourselves as a nation--namely, our principles of democracy, our economic freedoms, and our right to privacy.

This is what happens when “practice” is derived from theory and ideology rather than through pragmatic experience; when those with no real “skin in the game” are allowed to dictate policy affecting those who are fully invested in matters directly affecting the real world.

“Capitalism hasn’t always existed in the world, and it will not always exist in the world.”

-Ocasio-Cortez, Interview on Firing Line, PBS

How is it possible that a Democratic Socialist like Freshman Rep. Alexandria Ocasio-Cortez ends up on the House Financial Services Committee?

How is it that an inexperienced politician with no real-world experience in business or finance but with a dangerously hostile sentiment toward the principles of free-market capitalism may end up influencing the very policies followed by the industrial players she personally abhors?

Obviously, a misguided segment of America put her in that position. Now that she occupies a seat, the banking sector now has a high-profile enemy.

To be clear, we also have our own problems with big banks. But our preference is toward the reduction of bank and government interventions; the end goal is to establish a more free market environment.

Ocasio-Cortez aims to hamper the operations of the sector through strict regulation and control.

Should the government take this turn, what’s to stop the government from extending and increasing its interventions toward Americans as a whole? Though we are far from that scenario now, her appointment indicates that such an extreme leftward swing can happen.

That’s socialism. The term Democratic Socialism is a misnomer (the nuanced differences between the two terms are negligible). And a Democratic Socialist in the House Financial Services Committee is, arguably, an aggressive contradiction.

Not only has this freshman New York politician vowed to work against the corporate industries comprising her constituency, but this seat also puts her in a position to exert substantial influence over a system that she barely understands let alone respects.

Not surprisingly, one of her staunchest Democratic allies is none other than Maxine Waters, D-Calif, the committee’s new Chairwoman.

As Democrats re-took the House during midterm elections last November, Waters announced during a meeting: "Make no mistake, come January, in this committee the days of this committee weakening regulations and putting our economy once again at risk of another financial crisis will come to an end,” a statement that roiled the markets, however, brief its effect.

Of course, Waters’ and Ocasio-Cortez’ solution toward mitigating this risk is to impose tight regulatory restrictions that ultimately will hamper market operations.

Bear in mind that democratic socialism is about establishing social “ownership” over the means of production. Democratic socialists view capitalism as inherently incompatible with the notions of equality, liberty, and solidarity.

The problem with this view is that capitalism naturally fuels a dynamic and fluid state of inequality through competition, which is a necessary factor for both innovation and progress.

But Ocasio-Cortez and Waters are willing to sacrifice innovation and progress in the name of equality--not equality of uniqueness, difference, or individual potential, but equality of flatness, sameness, and individual subjugation.

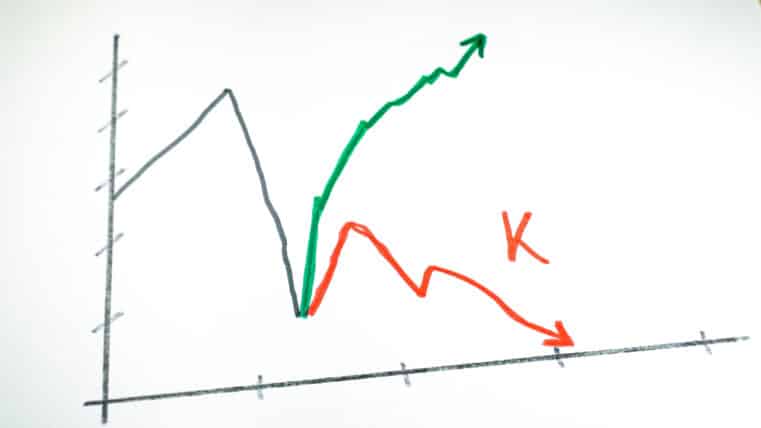

Chances are that the democratic socialist goal will not come to fruition in America. But it will add an extra dose of uncertainty to the markets, creating even more volatility atop of everything else that’s already going on.

If you’re invested in the markets, you may have a rough ride through this cycle, but it is a cycle that every investor must ride through no matter how rough.

Perhaps the most prudent strategy to take is to lessen your own portfolio volatility by hedging your funds across multiple asset classes--equities, bonds, cash, and precious metals--in order to avoid over-concentration in any one given asset.