Peter Schiff: Nobody Should Be Bailed Out!

Venture capitalist Chamath Palihapitiya made waves when he said during a CNBC interview that the government should not bail out companies impacted by the coronavirus shutdowns.

“On Main Street today, people are getting wiped out. Right now, rich CEOs are not, boards that have horrible governance are not,” he said.

“What we’ve done is disproportionately prop up poor-performing CEOs and boards, and you have to wash these people out.”

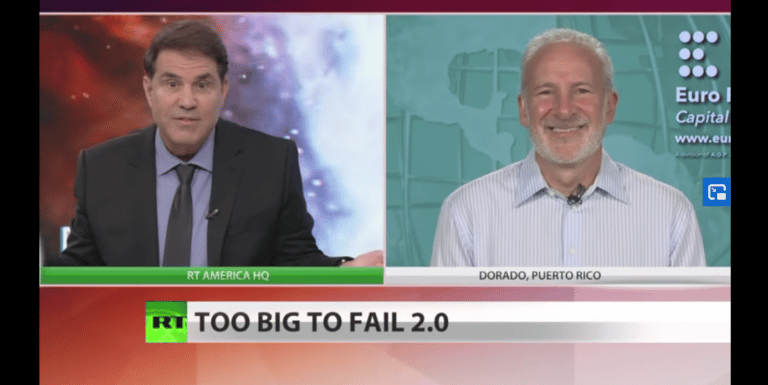

During an interview on RT, Peter Schiff said he’s been saying the same thing since day one.

You know, the real beneficiaries of the bankruptcies are not the employees of the company. I mean, they will benefit, although some of these companies in a restructured bankruptcy will end up shedding some of their workers, which is a good thing, because many of these companies have too many workers, and in order to survive, they need to be more competitive, especially if demand is down in their industries. But the big winners in bankruptcies are the customers.”

CNBC acts as if the government has to bail out the airlines or there won’t be any more airlines. Or if the government doesn’t save the hotels, there won’t be any more hotels. Peter called this “nonsense.”

They don’t blow up the hotels. They don’t blow up the planes. What happens is, in a bankruptcy, new owners come in, all the debt is wiped out, and now you have an efficient management team with an un-levered company that can actually lower prices. So, consumers end up with a better deal once the companies are restructured. But by keeping them afloat with more debt, the companies are never viable and they have to keep overcharging customers based on a government subsidy. And once the government steps in and prevents them from restructuring, they’re going to be in constant need for additional government money.”

Rick Sanchez summed it up: let things happen the way they normally do in the marketplace. If somebody doesn’t do a good job, somebody else comes along and does it better and in the end, everybody wins.

The problem is that during the 2008 crisis, everybody decided some businesses were too big to fail. And the CEOs must be the smartest people in the room. So, how dare we think about replacing them. So, they had to be bailed out.

Peter said if we had let more businesses fail in 2008, there would be fewer businesses failing now.

We wouldn’t have created the moral hazard. Businesses would have known that there’s no government to bail them out, so they would have acted more responsibly. And had the Federal Reserve not kept interest rates so low, companies wouldn’t have done all the buy-backs. They wouldn’t be all levered up. They would be able to withstand this temporary emergency.”

Peter said you can’t let the workers off the hook in the current situation either.

You’ve got all these people who have lost their jobs who have no savings. They can’t make it without a paycheck because they have a big mortgage. They have credit card debt. They have auto loans. They have student loans. Why is that? Why don’t Americans have any savings either? That’s part of the problem. And nobody should be bailed out. No company should be bailed out. No individuals should be bailed out. Everybody needs to deal with the consequences of their own actions.”

That’s not to say lenders and borrowers, or landlords and tenants, or banks and companies can’t get together and work out deals to help each other out on their own.

But nobody should be getting a check from the government because the government doesn’t have any money. All the government is doing is printing money and they’re destroying the value of everybody’s savings.”

Peter warned that we are going to have “massive inflation” in the United States.

The government is doing far more damage with the bailouts and the stimulus. None of this money is free. If you’re wondering who is going to pick up the tab – if you have money in the bank, if you have bonds, if you have a retirement account, if you have savings, if you have cash value in an insurance policy, if you have an annuity, if you have a pension, you’re going to get wiped out. Because you’re going to pick up the tab because your purchasing power is going to be destroyed by all the money the Fed is creating.”

Read Original Article at zerohedge.com