Ray Dalio On Coronavirus, Effects On The Economy, and Society

EDITOR NOTES: Hedge fund billionaire Ray Dalio thinks we are heading towards another Great Depression. He sounded the alarm of an impending recession long before the coronavirus. The red flags (large federal debts, huge wealth gaps, conflict with China, etc) where already there and the pandemic has tipped the scale the wrong way. It's accelerate things. JP Morgan is predicting a 40% decline in GDP. He points out that the numerous government safety net programs of today like unemployment insurance, food stamps and Social Security will help to keep a new recession/depression from lasting as long as the Great Depression.

President Donald Trump and his administration are confident that the U.S. economy will quickly rebound after the coronavirus pandemic is contained — but some experts are not so sure.

Count hedge fund billionaire Ray Dalio among the skeptics. “We’re not going to go back to normal,” Dalio tells CNBC Make It.

But he also has hope. “Soon we are going to reconsider how we are going to divide the pie and there are reasons that it won’t be good for capitalists,” Dalio says.

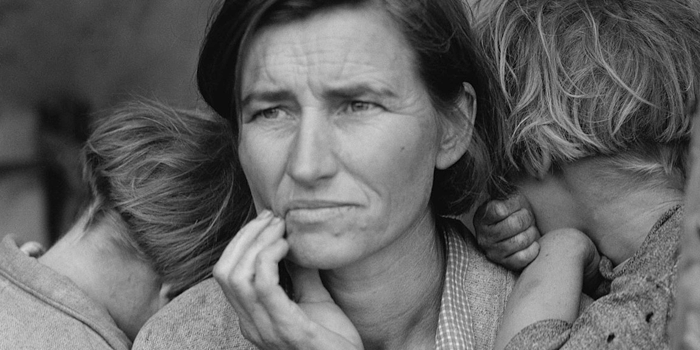

The closest parallel is the Great Depression

Dalio sees the closest parallel to the world’s current economic situation as the Great Depression, which lasted from 1929 well into the 1930s, and is regarded as the worst economic crisis in American history.

Much like with the Great Depression, Dalio predicts that the impending downturn will require a recovery period that could last several years, even as long as five years, he says.

“Think of the virus as like a tsunami that comes in,” Dalio says. “And if it goes away completely and we never see it again, it still will produce damage, the financial damage ... incomes that are lost, balance sheets that are hurt, restructurings that need to take place. So that will impede the recovery.”

Dalio was actually sounding the alarm on the economy’s trajectory long before the current pandemic shook global markets and put tens of millions of people out of work. Dalio warned of an impending recession in 2020 as early as January 2019 and, at the time, he pointed to various economic red flags that he still believes are reminiscent of the period that included the Great Depression and the 1930s.

There are “circumstances that existed before this downturn that existed [then],” Dalio says, which made the economy particularly vulnerable. Those circumstances include the country’s large debts, large wealth and political gaps, and the U.S. conflict with China as a rising power, to name a few.

“If there was not this [pandemic] there would have been a downturn at some point,” he says.

First, Dalio points to the fact that the United States already had very low interest rates. With the Federal Reserve being unable to lower interest rates much more, the central bank’s effectiveness has been limited in terms of boosting the economy the way it had in past recessions, including 2008, Dalio says.

That relative ineffectiveness of the Fed is reminiscent of the Great Depression, Dalio says, when the central bank is seen by many economists to have failed to counteract the widespread bank collapses that followed the 1929 stock market crash. Instead, the resulting credit crunch made it nearly impossible for companies and entrepreneurs to borrow money, and the downturn went on to become a full-blown depression.

Dalio also sees similarities between the growing U.S. debt load and the 1930s as well, when the passage of President Franklin D. Roosevelt’s New Deal helped balloon the country’s debt to record levels throughout the decade leading up to World War II.

He also likened Roosevelt’s actions in 1933 to the U.S. government’s decision this past April to send stimulus checks to citizens, as well as the Fed’s plan to inject up to $2.3 trillion into the economy through business lending programs and plans to buy corporate bonds.

“The government announced that it was going to give those checks to all of those people. And the central bank announced that it would print money and buy financial assets. And it’s the same kind of move [as 1933],” Dalio says.

(For what it’s worth, a group of economists at the Harvard Business Review contend that injecting capital into the economy in the form of the Fed’s moves and the CARES Act, as opposed to what the central bank did in the ’30s, will avoid sinking the country into a depression.)

It’s no coincidence that Dalio sees similarities between rising debt levels in the U.S. and the country’s post-Depression-era debt, however. With the U.S. set to borrow a record $3 trillion this quarter to aid the economy, the national debt is up to roughly $25 trillion, which has pushed the federal deficit to levels not seen since World War II.

Economists have warned that such large debt levels will only make it more difficult for the country to pull itself out of a recession.

Meanwhile, the estimated impact of the coronavirus shutdown on the U.S. economy is becoming more clear as new economic data is revealed. In April, economists at JPMorgan issued a dire forecast that predicts a 40% decline in the U.S. gross domestic product for the current quarter, which would also be reminiscent of the Great Depression, when GDP fell by nearly 30%.

Other estimates predict that the U.S. economy could shed 47 million jobs, pushing the unemployment rate to 32% (the rate peaked at nearly 25% during the Great Depression, and around 10% during the last recession, in 2009). Already, the country’s unemployment rate surged to 14.7% in April, and weekly jobless claims show that more than 36 million Americans have already filed for unemployment insurance over the past eight weeks.

How bad could it get

While the Great Depression lasted for several years, Dalio has contended that the current downturn could be “relatively brief” in comparison, but the recovery period — how long it takes for the economy to return to its previous growth trajectory — could take “three, four, or five years,” he says.

And there are still reasons to be optimistic that the effects of this downturn on the average individual person will not be as dire as during the Great Depression, economists have noted, when the sight of bread lines full of hungry people was common and homeless encampments, aka “Hoovervilles,” popped up throughout the country.

For instance, even with unemployment numbers soaring, some companies and industries have pivoted to keep working and sectors like health and e-commerce are still hiring, and staffing agencies expect more companies will begin adding jobs again once manufacturing starts to reopen around the country.

Perhaps most importantly, though, there are numerous social safety net programs that exist today, however flawed, like unemployment insurance, food stamps and Social Security, that did not exist yet during the Great Depression, and which should help many Americans stay afloat even during a major downturn. (And, some policy experts have argued that the current crisis offers an opportunity to further bolster some of those existing programs.) Former Federal Reserve Chairman Ben Bernanke told The Wall Street Journal that, while the current downturn is likely to be painful, it should be shorter than the Great Depression.

“Many people are suffering now, and the economy won’t recover in only a quarter or two,” Bernanke said. “But if we’re able to get reasonable control of the virus, the economy will substantially recover, and this downturn should be much shorter than the Great Depression.”

A catalyst for change

Meanwhile, Dalio is optimistic about the future.

He’s said that this downturn will result in a major restructuring of the economy, similar to what happened after the Great Depression, when American as a superpower rose in the wake of World War II and Roosevelt’s New Deal helped distribute wealth more equitably.

In the wake of this current downturn, Dalio, who has written an upcoming book on this topic called “The Changing World Order,” expects a “reordering” that will see increased conversation and action around issues like addressing the wealth gap, corporate taxes, health care and even the U.S. relationships with rising powers like China.

As a result of this experience, soon “we’re going to say: ‘How do you divide the wealth? Who owes what part of the bill? What is it going to mean for health care? What is it going to mean for taxes?’” Dalio says.

“I would expect that many of the factors that supported prices won’t be around. Like, I’d expect to see corporate taxes rise and company buybacks and acquisitions fall.”

While what actually happens on those fronts will likely depend largely on the political climate in America, and which leaders are in power following the coronavirus crisis, Dalio at least feels the downturn will fuel a more robust conversation that could very well result in lower health care costs, higher wages and higher taxes on corporations.

Dalio has also said he believes people should be “very excited about the new future,” arguing that the restructuring and “reflection” forced by this downturn will also lead to innovation in areas like technology and the digital revolution, including in terms of how people work and interact.

“Every industry is being disrupted,” Dalio says.

He says that artificial intelligence and the data revolution, especially, will create many opportunities going forward, both for innovators who can come up with new ways to implement that technology, as well as industry leaders who are quick to embrace new technology.

“We’re in the early stages of a thinking revolution,” he tells CNBC Make It.

The coming restructuring process will be difficult, Dalio says, but that the world has made it through similar periods before.

In the long run, this downturn will end up as little more than a blip compared with overall economic growth over decades, he says. Still many people would have to suffer through a yearslong period where it could be difficult to find a job, and wages would potentially fall, before the economy fully recovers.

“When you look at per capita GDP over time, it almost looks like a straight line. And, all of these big [downturns] that we’re looking at up close actually hardly show up in that line, because the greatest force is human adaptability and inventiveness,” Dalio added.

“They’re miserable, [but] we get past them in a certain number of years.”

Originally posted on CNBC