Repo Market BREAKS As Dealers Run Out Of Securities To Use For Fed Funds

Two weeks ago, just after the Fed first announced its massive overnight and term repo operation expansion which now amounts to some $1 trillion in daily repo capacity (and before Powell expanded this bazooka to included ZIRP and unlimited QE), we said that this is a big mistake as the Fed was targeting the wrong liquidity conduit.

Then, after the Fed launched QE across the entire curve and expanded it to include MBS, the Fed's monetary police became outright bizarre: on one hand the Fed was offering to buy Treasurys and MBS held by Dealers (at a hefty, unknown premium to market), on the other it was offering Dealers to park those securities at the Fed either overnight or on a term basis in exchange for cash while incurring modest capital charges.

After all, why would anyone pick repo over QE in the current market was a total mystery.

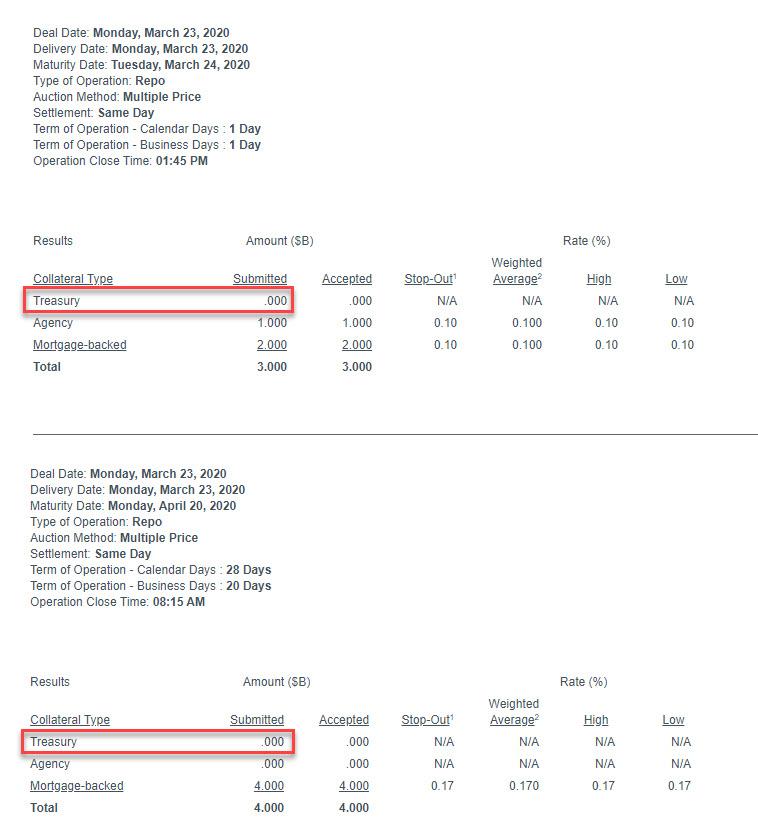

Why indeed, and as we expected, after several repo operations that saw zero Treasury submissions in the Fed's overnight and term repo operations at the start of this week...

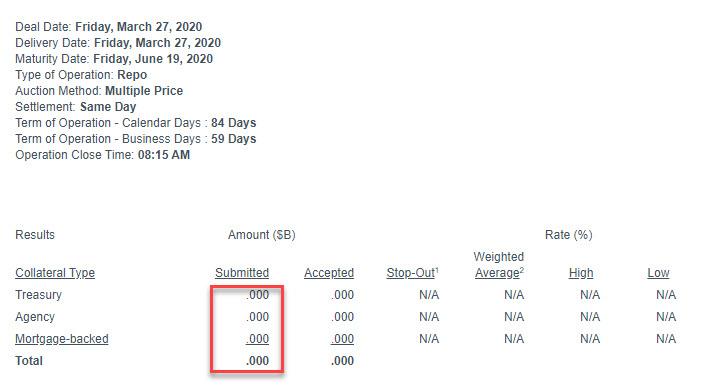

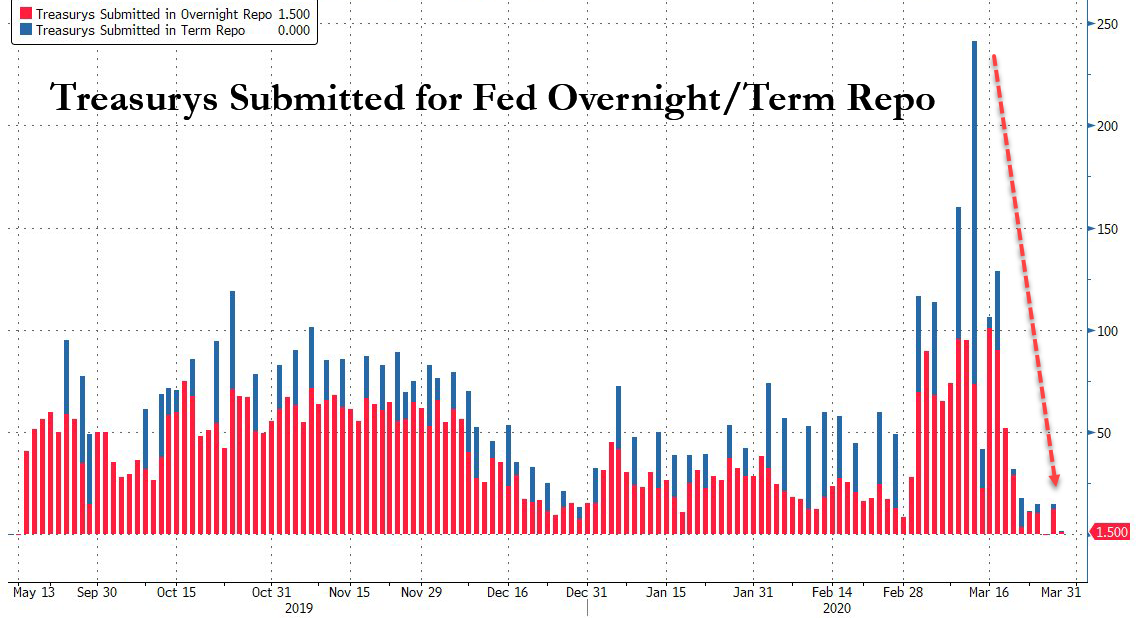

... we finally got a failing repo operation, when this morning the Fed saw no bids (i.e., submissions) in either Treasurys, MBS and Agency securities in its $500BN 3-month repo operation!

Today's other repo operation, the $500BN overnight repo saw just $1.5BN in TSYs submitted (the remaining $5.25BN were MBS) into the $500BN operation.

For those who haven't been following the Fed's repo operations, this was the first time since the bank restarted its repo operations that it received no bids on its term offerings. But it's not just term: as the charts below show, ever since the Fed announced unlimited QE concurrently with massive repos, the amount of securities submitted into repos has collapsed and for Treasurys has been $0 on most of this week's operations...

... with MBS catching up fast.

To be sure, having predicted this outcome, it is now obvious - if only in retrospect - to everyone: according to Bloomberg, "the lack of interest may stem from the fact that the central bank is buying $75b of Treasury securities a day."

Well, duh.

So what can the Fed do to unbreak the repo market? Why undo some of its massive QE!

According to Barclays' Joseph Abate, the scale of the Fed's asset purchases may be "inadvertently creating dislocations" in the repo market (inadvertently because it was perfectly obvious to everyone what would happen, except the Fed of course). "The increase in specials volumes, their spread widening to GC, and the pick-up in fails are all symptoms of a distribution problem", adds Abate who suggests that the Fed might consider increasing counterparty lending caps in its securities program.

"Why on Earth you would tie something up for three months in repo with the Fed buying," said Ian Burdette, managing director at Academy Securities, who followed up with a very apt observation:

"I think people are getting wise to the fact that an absolute tsunami of global sovereign debt issuance is on its way. Best to sell it all to the fed now probably."

That is indeed, spot on, however it also means that going forward the Fed's repo operations will be a "fail" virtually every time as Dealers chose not to park their securities with the Fed but instead sell them to the Fed, a contradictory outcome which was obvious to most people as far back as two weeks ago.

All... except the Fed of course which is just making things up as it goes along and no longer ever realizes what it is doing.

The financial market is crumbling and EVERYONE will be affected. Only those who know what's going on and PREPARE will survive... dare we say thrive. Our 7 Simple Action Items to Protect Your Bank Account will give you the tools you need to make informed decisions to protect yourself and the ones you love.