Are We Ripe for a 1987-Style Crash?

With the stock market recovering from its recent correction and approaching, once again, its all-time-highs, it’s prudent to wonder how long this bull market will last.

And when it eventually comes crashing down, as all bull markets do, how bad might it be?

Given the magnitude of this run—currently, a gain of 185.44% on the Dow since 2009—might the “big one,” that is, a crash of historic proportions comparable to 1987, happen this year?

As the great philosopher Yogi Berra once said, “It’s tough to make predictions, especially about the future.”

But this doesn’t mean that we can’t see the two critical factors that may give us insight into the odds of a boom or bust happening, factors that drive the markets: sentiment and fundamentals.

Let’s see what a few experts are saying about both.

Peter Schiff, speaking at the Vancouver Resource Investment Conference 2018 last month:

- “Investors have not been this optimistic...since 1987. They are even more optimistic than they were at the height of the technology bubble, the dot-com bubble, the new era...1987 didn’t end well, right?”

This is his take on the current sentiment; overly-optimistic, he says.

- “The economy has not improved under Trump. We don’t have a booming economy. I mean, Trump keeps telling us we have a booming economy, but nothing is booming.”

This is Peter expressing his sentiment on the fundamentals of the economy under the Trump administration. But what exactly is he talking about?

- “Now, the tax cuts, are they going to grow the economy? No! Because they didn’t cut government spending. See, you don’t get government for nothing. Taxes pay for government. But if you cut taxes and you don’t cut government, how do you pay for that government?”

Here, Peter has a valid argument: how will government pay for itself if it continues to spend while reducing its own income via taxpayer money?

- “I believe the debt and inflation we have to create to finance the tax cuts will be a bigger drag on the economy than the tax cuts are a boost.”

And this line of arguments leads to his conclusion that we are well within a condition comparable to that of the mid 1980’s.

- “Where there will be growth is in the budget deficits and that kind of is where I see some of the similarity now in the 1980s – 1987...Here’s the problem. America’s broke. America has more debt than ever before … The debt has more than doubled since the financial crisis. Why did we have a financial crisis? We had too much debt!”

Some people might easily dismiss Peter Schiff for his (sometimes) bombastic style and far-reaching views; this, despite his strong Austro-Economic position and professional credentials.

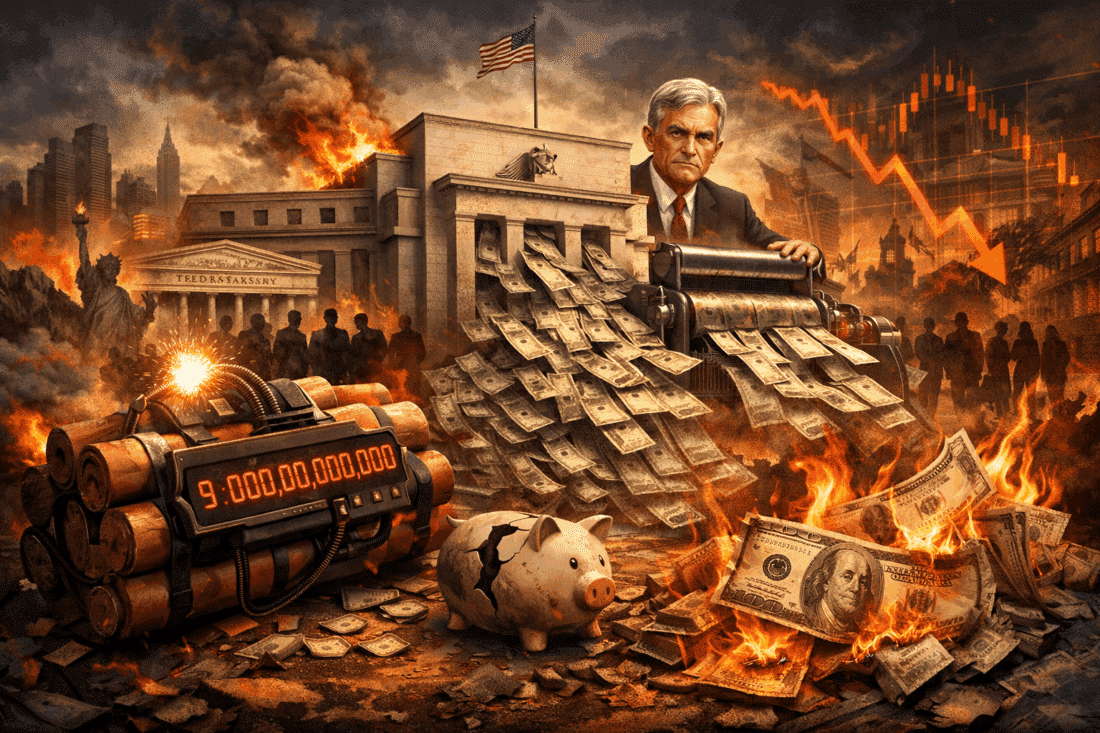

But what of his views and arguments? Here’s a simple image that encapsulates everything Peter is talking about:

Despite Peter’s common-sense, yet well-informed and rigorous, approach to economics, perhaps some investors might prefer to listen to economists holding a more official or academic title, such as those in the Federal Reserve.

Here’s former head of the Dallas Federal reserve, Richard Fisher, admitting the Fed’s role in manipulating the stock market:

- What the Fed did — and I was part of that group — is we front-loaded a tremendous market rally, starting in 2009...It’s sort of what I call the “reverse wimpy factor” — give me two hamburgers today for one tomorrow.

And here’s what Jerome Powell--current Federal Reserve Chairman--had to say about the US debt levels as early as 2012:

"I have concerns about more purchases. As others have pointed out, the dealer community is now assuming close to a $4 trillion balance sheet and purchases through the first quarter of 2014. I admit that is a much stronger reaction than I anticipated, and I am uncomfortable with it for a couple of reasons.

First, the question, why stop at $4 trillion? The market in most cases will cheer us for doing more. It will never be enough for the market. Our models will always tell us that we are helping the economy, and I will probably always feel that those benefits are overestimated. And we will be able to tell ourselves that market function is not impaired and that inflation expectations are under control. What is to stop us, other than much faster economic growth, which it is probably not in our power to produce?

When it is time for us to sell, or even to stop buying, the response could be quite strong; there is every reason to expect a strong response. So there are a couple of ways to look at it. It is about $1.2 trillion in sales; you take 60 months, you get about $20 billion a month. That is a very doable thing, it sounds like, in a market where the norm by the middle of next year is $80 billion a month. Another way to look at it, though, is that it’s not so much the sale, the duration; it’s also unloading our short volatility position."

My third concern — and others have touched on it as well — is the problems of exiting from a near $4 trillion balance sheet. We’ve got a set of principles from June 2011 and have done some work since then, but it just seems to me that we seem to be way too confident that exit can be managed smoothly. Markets can be much more dynamic than we appear to think.

When you turn and say to the market, “I’ve got $1.2 trillion of these things,” it’s not just $20 billion a month — it’s the sight of the whole thing coming. And I think there is a pretty good chance that you could have quite a dynamic response in the market.

I think we are actually at a point of encouraging risk-taking, and that should give us pause.

Investors really do understand now that we will be there to prevent serious losses. It is not that it is easy for them to make money but that they have every incentive to take more risk, and they are doing so. Meanwhile, we look like we are blowing a fixed-income duration bubble right across the credit spectrum that will result in big losses when rates come up down the road. You can almost say that that is our strategy."

Taking inventory of what’s happening now:

- Corporate debt levels are higher than before 2008

- Consumer debt is at the highest levels in history

- Treasury yields have spiked to 10-year highs

- The QE pump is no longer available for the stock buybacks that have been pumping up the stock market

What does this all mean? There’s nothing else that can float the markets, however artificial that device may be, other than the Fed.

With the whole country—nation, businesses, and consumers—in massive debt, what do you think will be the logical and fundamental consequence?

The big question being: will 2018 be the year when this will all come tumbling down?