Silver Coin Premiums Soar: Signal "Alt-Money" Demand As Re-Opening Recovery Hype Fades

Silver is the matrix of precious metals:

-

on the one hand, it is an industrial metal, critical to the production process in many of the world's most in-demand products;

-

and on the other hand, it has been 'money' for millennia, playing second-fiddle as a spending 'asset' relative to gold's 'wealth'.

The question is always, which of these demand/supply attributes is more prevalent at any one time.

Right now, is it the "blue pill" of blissful ignorance that an economic recovery is imminent and v-shaped; or is it the unpleasant truth of the "red pill" that this is the beginning of the end of the current system and a post-COVID world will look very different (and require protection).

Well, we may have the answer.

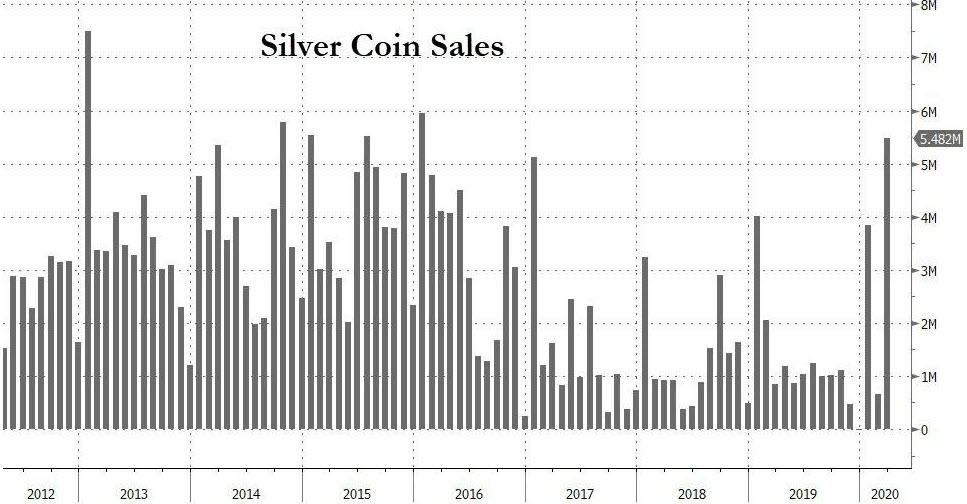

The price of silver coins is surging ('Monetary' demand) as futures prices sink ('industrial' demand), somewhat shunning the hope-filled hyping of stocks' recovery off the lows in March...

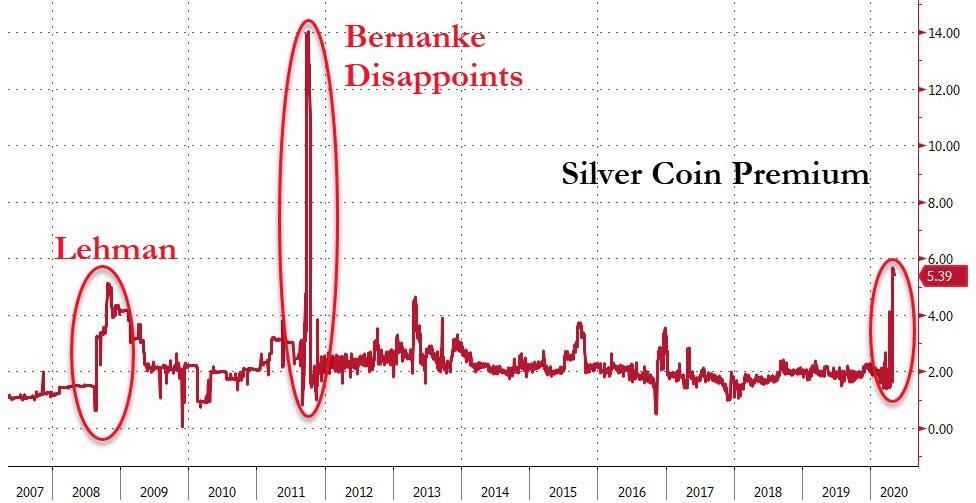

And in fact, this is the largest (physical) silver coin premium since Bernanke disappointed the markets in 2011 and since Lehman sent investors scrambling...

Additionally, the demand for "monetary" silver may be driven by the fact that it has never been cheaper relative to gold...

In ancient Greece during the age of Pericles, gold was valued at 14x silver. In ancient Rome, Julius Caesar valued gold at 12x silver.

It remained this way for centuries.

Even in the earliest days of the United States, eighteen centuries after Caesar, The Coinage Act of 1792 established a ratio of 15:1.

(According to the law, one US dollar is supposed to be 24.1 grams of silver, or 1.6 grams of gold. So those pieces of paper in your wallet are not dollars– they are technically “Federal Reserve Notes”.)

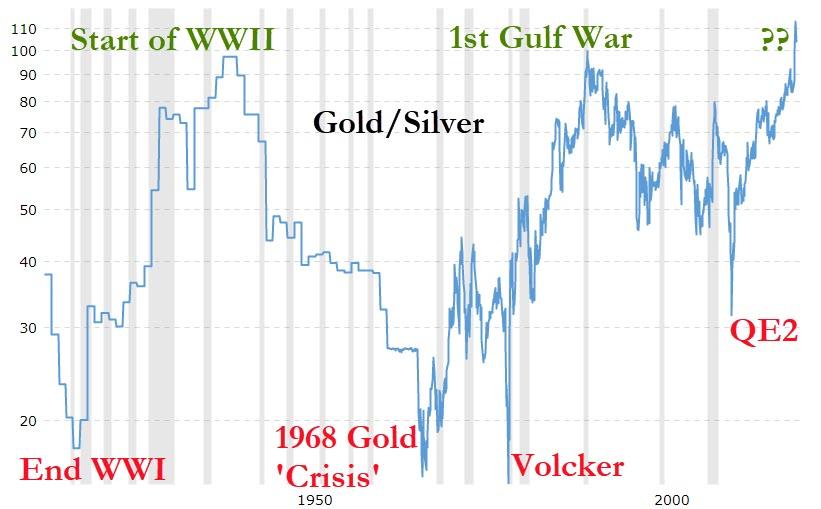

In modern times there is no longer a fixed ratio between gold and silver, though its long-term average over the last several decades has been between 50:1 and 80:1.

This is a lot higher than in ancient times… but the circumstances are obviously different.

Today, gold is still widely used as a reserve by central banks and governments around the world. And investors still buy gold as a hedge against inflation and uncertainty.

Silver, on the other hand, as we detailed above, has countless industrial applications; it’s a critical component in everything from mobile phones to automobiles to solar panels.

Like gold, silver is also a hedge against inflation and uncertainty.

But silver’s demand fundamentals are more heavily influenced by overall economic health. If the economy is in recession, silver prices can fall because there’s less demand from industry.

Gold, on the other hand, doesn’t follow that pattern. In 5 out of the last 6 recessions, in fact, gold has increased in price.

That’s why recessions, and extreme turmoil, can lead to a massive spike in the gold/silver ratio. Gold goes up, and silver stays flat (or falls).

-

Just prior to World War II as Hitler launched his invasion of Poland, the ratio spiked to 98:1.

-

In 1991 as the first Gulf War began, the ratio again reached 100:1.

-

Today we’re back again in that territory; as of this morning, the ratio is 110:1, and it’s been as high as 120 or more in recent weeks.

This ratio may stay elevated for a while, or even go higher.

But in the past, the ratio has always returned to more traditional levels. Always. Even when the world was facing Adolf Hitler or the Great Depression.

So it stands to reason that, if they keep printing money (which they already are), and the ratio eventually returns to its historical range, the price of silver could really skyrocket.

...and it won't be due to the economy.

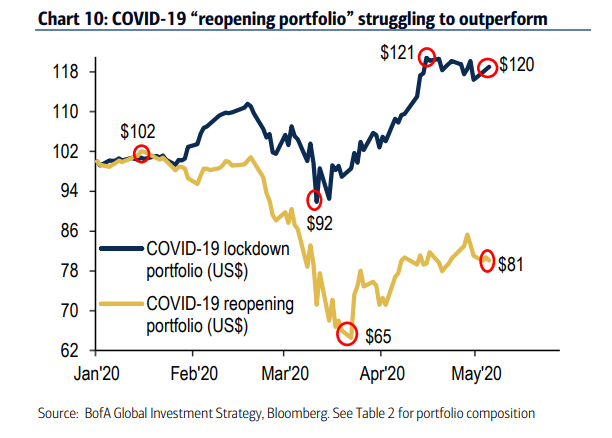

And in case you need more reassurance that the "recovery" is not coming anytime soon, Goldman's "re-opening" basket is significantly struggling to outperform.

Global silver demand nudged higher in 2019 thanks to a 12% increase in investment demand as retail and institutional investors focused their attention on the long-term investment appeal of the white metal according to a report highlighted in the latest edition of the Silver Institute’s Silver News.

According to the World Silver Survey 2020, total demand inched higher by 0.4% despite the trade war. Investment demand grew to 186 million ounces, the largest annual growth since 2015. Exchange-traded product holdings stood at 728.9 million ounces at year-end, up by 13%, achieving the largest annual rise since 2010. Meanwhile, silver mine supply fell for the fourth straight with output declining by 1%.

At its core, silver is a monetary metal. It tends to track with gold over time. And it has historically outperformed gold in a gold bull market.