Silver Makes a Comeback Amid Bitcoin's Blaze

While Bitcoin’s skyrocketing price has been getting all the attention as the top cryptocurrency sets new all-time highs on a near-daily basis, it’s also breached another level that should be significant to precious metals investors, as noted in a recent article by Dailycoinpost Editor Etan Hunt.

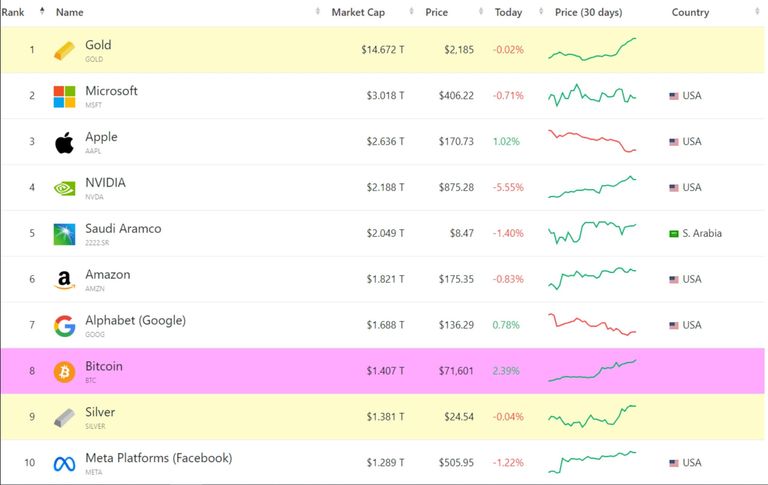

Hunt pointed out that when BTC surged to $72k, it also boosted the token’s total market capitalization, making it the eighth-largest financial asset in the world.

“As Bitcoin’s market capitalization eclipses $1.4 trillion, it now surpasses established giants such as Meta (formerly Facebook) and silver, the world’s second-largest commodity,” he said.

Image source: Dailycoinpost.com

Both Bitcoin and gold have been making new highs concurrently since last week, and while silver has made solid gains, it lagged the other two assets while never coming close to challenging its own ATHs, which enabled Bitcoin to usurp its spot.

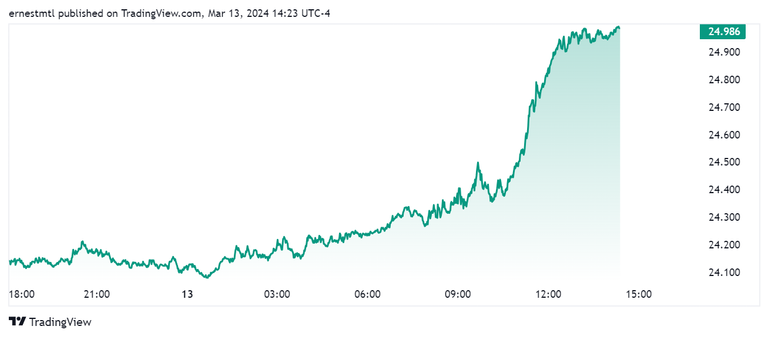

But the tide appears to be turning for the gray metal, as a strong move this week has seen bulls take spot silver right up to the edge of the $25 per ounce threshold on Wednesday afternoon.

If Bitcoin sees a decent pullback, silver may be in a position to retake the eighth spot. But even if it does, with the ETF-induced bull market now raging in the cryptosphere, holding that position will be a tall order.

“Yet, the ultimate prize remains gold, the quintessential store of value and a benchmark for financial stability,” Hunt wrote. “Surpassing gold would necessitate a monumental leap, with Bitcoin’s price soaring to an unprecedented $700,000.”

Hunt said that while this level may appear outlandish, “Bitcoin’s track record speaks volumes, having surged more than 60% since the start of 2024 and 40% in the past two weeks alone.”

“As Bitcoin continues to redefine the financial landscape, its ascent underscores the transformative potential of decentralized digital assets,” he said.

Gold and silver bugs, for their part, are banking on the precious metals’ track record of stability during tough times and outperformance once interest rates begin to fall.

With both metals and cryptos now on a steady climb higher, and with the next Fed meeting coming up next week, these alternative assets look poised to continue to turn heads as they compete for investment.

This article originally appeared on Kitco News