Sound Money Fundamentals - What's in Your Wallet?

Not All Forms of Money Are Created Equal

Long gone are the days when we carried gold and silver coins to purchase goods and services. Although gold and silver no longer have their day-to-day functional values, can we genuinely dismiss them as a mere symbol of real wealth?

What constitutes real monetary wealth other than “sound money”? But then, what is sound money?

The notion of “sound money” brings up a sense of authenticity. There are many things (e.g., products and services) that claim to be authentic.

But when we try to evaluate something as authentic or not, we look beyond its current function and performance. We look for things that are proven and time-tested.

In other words, something that can be considered authentic has to have a history in which it has proven itself time and time, again.

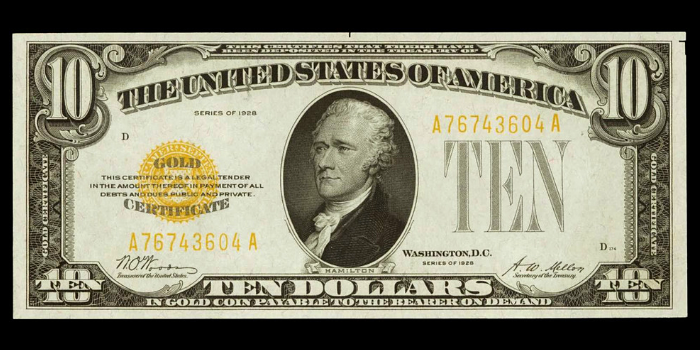

Classic 1887-s Rainbow-Toned Silver US Morgan. A great example of sound money. (Photo By A. A. Anderson)

When we imagine “sound money” throughout history, we hear the sound of coins hitting a hard surface; we can easily imagine those sounds to be gold, silver, even copper coins.

We imagine the origin of the term which dates at least as far back as Ancient Rome (it surely goes far beyond that). But Rome provides a good example, as we’ll see.

Having adopted a system of sound money, Rome debased it by cutting the silver content in their coins by 5% using other metals.

This didn’t fare well with the population once they found out, particularly for Roman soldiers who risked life and limb only to receive coins that weren’t worth their full amount of silver.

This debasement--this distortion of authentic value--is just one historically verifiable instance of a practice that many governments have been practicing ever since. It’s still happening everywhere right now.

Interestingly, when governments debase money today, not only do citizens’ hardly notice it, most seem to approve it. That’s because a large majority of people don’t have a solid understanding of what “real money” is...or was.

And this list of people who are not in the know also extends to most politicians and “financial experts.”

First, What Is Money?

Societies have agreed on a common medium of exchange--i.e., “money”--simply because bartering doesn’t work.

Let’s suppose you grow corn. You can offer your corn to a local doctor in exchange for medical services, but that doctor may not need corn. Instead, she may need other goods which you don’t or can’t produce. Hence, the need for a more common and homogeneous medium of exchange; in short, money.

Historically, gold and silver rose to prominence as the most valued form of money and for a good reason. Both were portable, divisible, durable, homogenous, and more importantly...they were scarce.

Scarcity is an important factor, as not just anyone can “create” money which would potentially ruin the entire balance of exchange. These characteristics made money the “most marketable commodity.”

What Is Inauthentic Money?

A perfect example of money degraded is to be found in our history. Let’s go back to the American Civil War when the federal government ran out of funds to finance the war.

As you might know, paper money was backed by gold and silver. The problem was that the cost of the war began depleting the federal government’s gold and silver reserves.

To continue funding the war, President Lincoln signed the Legal Tender Act in 1862. This allowed the government to print $150 million worth of paper notes--none of which were backed by gold or silver.

This act debased the dollar, for the paper had no real “intrinsic value” backing it. It was “inauthentic,” it value produced not by mining precious metals by running a printing press.

75 years before this act, such unbacked notes were vehemently rejected by America’s citizens.

George Washington called it “wicked.” James Madison considered it “unjust” and “unconstitutional.” Thomas Jefferson wrote that “its abuses also are inevitable and, by breaking up the measure of value, makes a lottery of all private property…”

Nevertheless, “greenbacks” were issued, and the Civil War had been funded.

The negative effect of this act is that it qualitatively transformed how people “perceived” money.

Money was no longer a valuable commodity with tangible properties. Instead, money became whatever government gave its stamp of approval; whatever was considered “legal tender.”

Money, once “real,” underwent a “magical” transformation--its only issuer (its monopolizer) being the government.

Not too quickly afterward, the Greenback lost its purchasing power. Lincoln’s Secretary of Treasury, Chief Justice Chase, after initially imposed legal tender, reversed it for two reasons: first, legal tender does not exist in the Constitution; and second, it was solely intended as a war-time measure, and the war was finally over.

But the status of authentic money was not to last much longer. The next 60 years saw the formation of the Federal Reserve.

The Federal Reserve has devalued the dollar by 97% since its founding, counter to its mandate to maintain “price stability.”

In addition to this, we saw the enforcement of an unconstitutional income tax, gold confiscation, and the abolishment of the gold standard.

The consequences: an explosive acceleration of government spending, leading us to the $21 Trillion debt that we now hold.

So, What Is “Sound Money”?

Sound money is any “currency” whose purchasing power is not subject to manipulation by the government or central bank; its transactional value supported by the self-correcting mechanisms of a free-market system.

Sound money is a scarce commodity that cannot be created out of thin air, nor should its designation be monopolized by the government or central bank power.

Sound money is authentic, meaning that it should have a history of proving itself over time.

Looking back over millennia, gold and silver are the only forms of sound money that have withstood the test of time.

So, to answer the question posed at the top of this article, gold and silver are not mere symbols of wealth. They constitute real wealth; sound money.

It’s just that we’ve grown accustomed to valuing the symbols of sound money (Greenbacks) rather than the sound money (gold and silver) that once backed the symbols.