Stablecoins, AI Agents, and the Coming Digital Cage

The Digital Playground or the Panopticon?

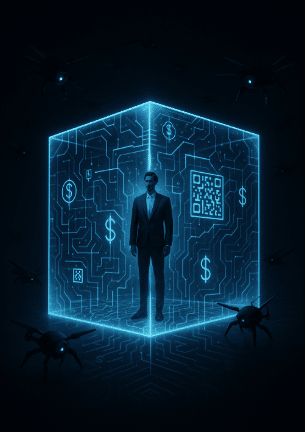

Let’s get something straight: when Peters cheers on "Autonomous AI Agents transacting at vast scale, without the need for banks," he’s not announcing freedom — he’s describing a prison being assembled in broad daylight.

He’s hyped that AI bots using Google’s AP2 and Coinbase’s x402 tech can now make payments using stablecoins “at the speed of code.” But speed isn’t freedom — it’s control, especially when those rails are traceable, programmable, and inherently surveilled.

Stablecoins, especially dollar-backed ones like USDC or USDT, are not decentralized freedom tokens. They are tightly regulated instruments tied to fiat banking systems and increasingly under the thumb of state and corporate interests. You think you're escaping banks? You're not. You’re swapping one master for another — and this one never sleeps.

AI agents acting on our behalf? Don’t kid yourself. Once you hand off your financial autonomy to bots — however “intelligent” — you’re out of the loop. Combine that with smart contracts and stablecoins, and you have fully automated financial compliance. No appeal, no gray areas, no forgiveness. The code is the law. And the law is written by people who do not have your liberty in mind.

What They Don't Tell You About Stablecoins

Peters gushes about regulatory clarity for dollar-backed stablecoins like it's a blessing. But that clarity means one thing: oversight. Every transaction can be frozen, censored, or flagged. Every user can be traced. What makes stablecoins “better” in the eyes of the system is exactly what makes them more dangerous to personal freedom.

Forget privacy. Programmable money is money that can vanish based on your social score, your carbon output, or your browser history. Don’t believe me? Look at what China’s doing with the digital yuan. That’s the blueprint. Stablecoins in the West are just the soft-launch version.

A Future Without Banks Isn’t a Future Without Tyranny

Peters praises a future “beyond banks.” I’m all for killing off the Too Big to Fail cartel — but not if we replace it with something worse: a technocratic payment regime that exists on-chain, always on, always watching, always judging.

In this shiny new world, you aren’t the customer. You are the product, the data point, the node. You’ll be granted access to the system as long as you behave. You’ll use the “open stack” they built. You’ll trust the AI Agent they coded. You’ll pay in stablecoins they can freeze.

Sound like freedom?

Derek’s Take: Fight Back or Be Farmed

If you don’t want your money controlled by bots, your access managed by algorithms, and your future dictated by unaccountable code, it’s time to act. Learn to live off the digital grid. Use real assets. Hold your own keys. Build parallel systems that don’t need their rails, their compliance, or their surveillance.

The tech bros are building the matrix. And most folks are lining up to plug in.

Don’t be one of them.

🔥 CALL TO ACTION

Download Seven Steps to Protect Yourself from Bank Failure by Bill Brocius. This isn’t theory — it’s a blueprint for surviving the next phase of financial control.

Get it now!

Stay free. Stay vigilant. Stay dangerous.