The Asset Bubble Illusion: Why Rate Cuts Signal the Real Crash

The Calm Before the Financial Storm

Disinflation. A term the markets hardly acknowledge but one that seasoned analysts like George Gammon know is far more dangerous than the inflationary fears dominating headlines. If history is any guide, the recession that looms ahead will reshape our financial landscape in ways most Americans are unprepared for.

What if the real danger isn’t inflation but disinflation, followed by a sharp reversal into economic chaos? This isn’t speculation—this is the pattern that has played out time and again, from the recessions of the 1970s to the tech bust of 2001. Are we blind to history, or simply ignoring it?

Why the Crash Happens After Rate Cuts

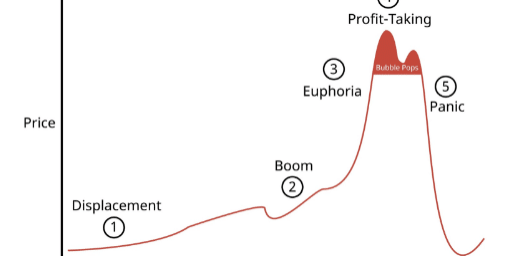

Many believe an inverted yield curve is the bellwether of economic doom. But as Gammon highlights, the true crash begins when the Federal Reserve reacts to market pain by slashing interest rates. A steepening yield curve may seem like relief—but it’s the precursor to what he calls “the stuff hitting the fan.”

The U.S. economy, built precariously on asset bubbles, cannot sustain its house of cards forever. These bubbles—whether in housing, equities, or corporate debt—continue to expand until a pin finally pricks them. The real question isn’t if but when.

The Danger of Unlimited Government Spending

Contrary to fears of a debt apocalypse, the issue is deeper: reckless government spending enabled by an insatiable global demand for U.S. Treasuries. Foreign banks seeking arbitrage opportunities are effectively handing Washington an “unlimited credit card.”

And what does this unchecked spending buy us? Bloated bureaucracies, distorted markets, and an economy increasingly detached from real productivity. Imagine an entrepreneur shackled by red tape while government largesse rewards inefficiency—this is the America we face unless we dismantle these destructive systems.

Protecting Your Wealth in the Chaos to Come

For the savvy investor, risk management is paramount. Gammon advocates for assets with favorable asymmetry—those with significant upside potential and limited downside risk. Gold, silver, and uranium stand out as hedges in this uncertain environment.

But beware of timing the market. Gammon suggests focusing on long-term trends, like the unfolding commodity supercycle. Whether prices wobble in the short term or not, the trajectory for tangible, hard assets remains upward as fiat confidence erodes.

Closing Thoughts

The economic warning signs are flashing red. Disinflation is the quiet thief, lulling us into complacency before the chaos of rate cuts awakens a full-scale crisis. The time to act is now.

Protect your wealth and prepare for the coming storm:

- Get your free digital copy of "Seven Steps to Protect Your Bank Accounts" and learn how to safeguard your finances in volatile times. Click here.

- Order the discounted hardcover of "The End of Banking as You Know It" and discover the future of decentralized finance. Get it here.

When the system cracks, will you be ready—or left behind? The choice is yours.