The Banking Cartel’s Attack on Bitcoin: A Threat to Economic Liberty

Marc Andreessen said it best when he told Joe Rogan:

“We can't live in a world where somebody starts a company that's a completely legal thing, and then they literally get sanctioned and embargoed by the United States government through a completely unaccountable process. No due process. None of this is written down. There's no rules, no court, no decision process, no appeal.”

Welcome to America, 2024. A Wyoming company just learned this lesson the hard way when its bank, Mercury, abruptly terminated its account. The company’s crime? Accepting a good chunk of its payments in Bitcoin. That’s right. Pay rent, utilities, contractors, and vendors in dollars—but settle a few transactions with Bitcoin, and you’re suddenly too “risky” to bank. Mercury, which operates through Evolve Bank, blamed “internal factors,” a cowardly euphemism for “we’re scared of our regulators.”

This isn’t incompetence; it’s a coordinated attack. Chokepoint 2.0 is the financial regime’s latest playbook for crushing innovation. They target Bitcoin businesses—not by outlawing them outright (too messy, too obvious)—but by strangling them through their banks. No bank, no business.

From Chokepoint 1.0 to 2.0: History Repeats Itself

Sound familiar? It should. Operation Chokepoint 1.0 used the same tactics to go after gun dealers, payday lenders, and other “undesirables.” It ended in disgrace when the FDIC had to settle lawsuits and admit the obvious: weaponizing the financial system against lawful businesses is unconstitutional.

Yet here we are again. Only now, they’re more subtle. Instead of obvious villains, the targets are Bitcoin miners and crypto businesses. The method? Whisper campaigns from unelected bureaucrats leaning on banks to “de-risk” anyone who steps out of line. No laws. No oversight. Just backroom deals and winks from the regulators pulling the strings.

Why This Fight Matters

Losing access to banking isn’t an inconvenience; it’s a death sentence. Businesses can’t function without reliable financial services. By debanking Bitcoin companies, regulators send a clear message: Stay out of this industry—or else.

This isn’t just about Bitcoin. It’s about the principle of fairness in a financial system that operates on public trust. Banks don’t get to play ideological kingmaker. If they can unilaterally shut down a lawful Bitcoin business today, what’s stopping them from targeting independent journalists, dissident voices, or politically inconvenient non-profits tomorrow?

This is about more than Bitcoin. It’s about freedom. And it’s about whether the financial system serves the people—or the state.

How We Fight Back

- Expose the Regulators

Congress needs to investigate who’s behind this assault on Bitcoin. Names, titles, emails—drag it all into the sunlight. Regulatory agencies aren’t shadow governments. They answer to us. - End the Shadow Rules

If a bank cuts you off, they should be required to tell you why—and you should be able to appeal. This cloak-and-dagger nonsense has no place in a republic. - Pass Financial Neutrality Laws

We need laws that stop banks from discriminating against lawful businesses based on politics or ideology. Your money isn’t theirs to control. - Champion Bitcoin

Decentralization is the ultimate antidote to this madness. Bitcoin was built for moments like this—to sidestep corrupt, centralized gatekeepers and put power back in the hands of individuals. - Support Banking Alternatives

Institutions like Wyoming’s Custodia Bank are blazing the trail by standing up to federal overreach. But the government is fighting back, denying Custodia access to the Federal Reserve. That’s how scared they are of a bank that refuses to play ball.

What You Can Do

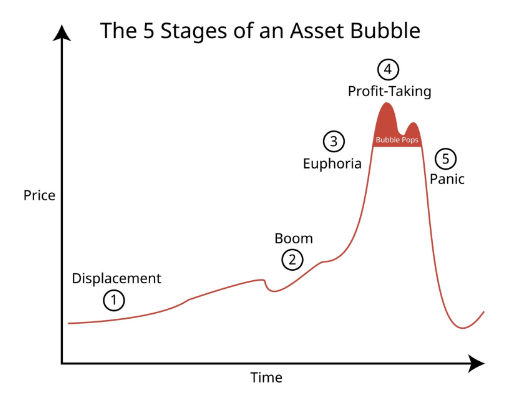

The establishment fears one thing above all: exposure. Spread the word. Demand accountability. And most importantly, hedge against the inevitable collapse of their rigged financial system.

Bitcoin isn’t just a hedge—it’s a weapon in the fight for freedom. Download my free guide, Seven Steps to Protect Yourself from Bank Failure, by Bill Brocius, and take the first step toward true financial independence. Click here to get your copy.

The financial noose is tightening. The time to act is now.

The financial market is crumbling and EVERYONE will be affected. Only those who know what's going on and PREPARE will survive... dare we say thrive. Our 7 Simple Action Items to Protect Your Bank Account will give you the tools you need to make informed decisions to protect yourself and the ones you love.