The Corporate Bitcoin Rush: Big Bets, Bold Moves, and a Bigger Agenda

The Corporate Case for Bitcoin: A Mirage or a Movement?

Canada-based Jiva Technologies, an e-commerce outfit focused on wellness and plant-based products, announced it’s throwing up to $1 million into Bitcoin. CEO Lorne Rapkin spun it as a hedge against inflation, calling Bitcoin a “resilient and innovative investment.” Sure, Lorne, but let’s not kid ourselves—this isn’t just about “innovation.” It’s about the sinking ship of fiat currency, the Federal Reserve’s endless money printer, and the institutional scramble to shore up real value as the dollar crumbles.

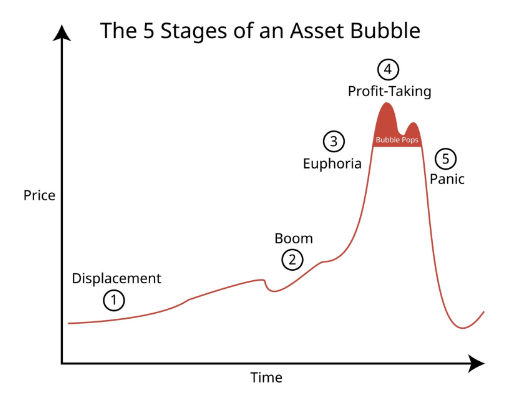

And they’re not alone. MicroStrategy, the corporate Bitcoin poster child, recently dropped $5.4 billion to buy another 55,000 BTC. That puts their holdings at a jaw-dropping 386,700 BTC. The message? If the fiat house of cards collapses, these corporations want the kind of hard assets central banks can’t touch.

Jiva’s Bitcoin play isn’t their first foray into crypto. They’ve also partnered with Kale Coin, a niche Ethereum-based cryptocurrency targeting the wellness industry. A plant-based crypto for a plant-based company—how fitting. Meanwhile, their stock price shot up 36% after the Bitcoin announcement, proving that Wall Street still rewards the illusion of forward-thinking while the whole system teeters on the edge.

Rumble’s $20 Million Crypto Gambit

Rumble, the free-speech alternative to YouTube, has approved a massive $20 million Bitcoin buyout. CEO Chris Pavlovski is playing it cool, emphasizing Bitcoin as a strategic asset in a world warming up to crypto under a “friendly” administration. Don’t miss the irony here: a platform known for opposing Big Tech censorship is now betting big on a currency that governments and central banks would love to control through regulation.

Pavlovski framed Bitcoin as immune to the endless money-printing of fiat currencies, calling it a reliable inflation hedge. But let’s not sugarcoat it—this move is about survival in an era where trust in fiat systems, and the governments backing them, is circling the drain.

The Bigger Picture

Jiva and Rumble aren’t the only players in this game. Biopharma company Hoth Therapeutics and AI firm Genius Group have also jumped in. Hoth allocated $1 million to Bitcoin, citing its “inflation-resistant characteristics.” Genius Group, on the other hand, went all-in with a $120 million Bitcoin-first strategy, committing 90% of its reserves to BTC.

These aren’t isolated events—they’re part of a growing trend of institutions fleeing the sinking fiat ship. The re-election of a “crypto-friendly” U.S. president and the rise of Bitcoin ETFs have fueled this fire, but make no mistake: governments aren’t standing idly by. The same institutions touting Bitcoin as an inflation hedge are, knowingly or not, marching toward a future where central banks will try to reel them in with digital currencies like FedNow and CBDCs (Central Bank Digital Currencies).

What It All Means

These corporate moves highlight a deeper truth: Bitcoin is no longer just a niche investment for tech bros and libertarians. It’s becoming the go-to escape hatch for institutions looking to opt out of a rigged financial system. But don’t get too comfortable. As Bitcoin adoption grows, so does the threat of government intervention. They’ll let Bitcoin rise just enough to look progressive—until they’ve built the infrastructure to replace it with something they can control.

Call to Action

Want to protect yourself from the looming financial storm? Don’t wait for corporations to set the tone. Take control of your financial future. Download "Seven Steps to Protect Yourself from Bank Failure" by Bill Brocius today. Learn how to safeguard your wealth before the system collapses.

Click here to download

Stay vigilant, stay skeptical, and keep questioning the narrative. The future belongs to those who prepare.

The financial market is crumbling and EVERYONE will be affected. Only those who know what's going on and PREPARE will survive... dare we say thrive. Our 7 Simple Action Items to Protect Your Bank Account will give you the tools you need to make informed decisions to protect yourself and the ones you love.