The deflationary inflationary case for owning silver

In continuation of my last article where I outlined the bullish case for gold after the “panic sell” followed by massive stimulus measures from the Federal Reserve/Treasury department, it leaves me to believe that a repeat of what we saw in 2008 will occur in the precious metals market. The biggest debate that I am hearing on the street is whether this virus is going to provide us with a period of inflation or deflation. While both these arguments make sense, the open ended quantitative easing and unprecedented policy support from the Federal Reserve should continue to lend an underlying bid for assets that act as a store of value.

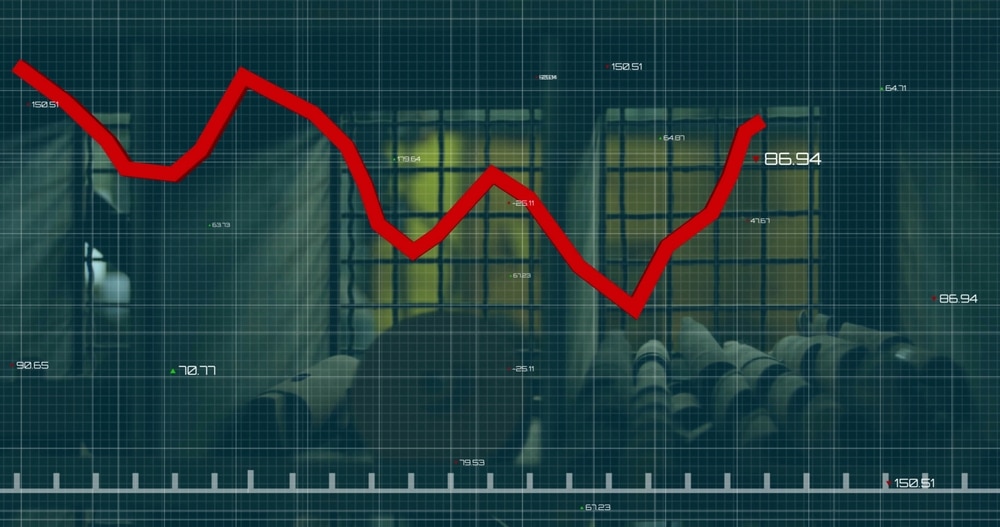

One of the charts that I always keep an eye on and often gives me some sense as to what the current psychology of the market is, the gold/silver ratio. Looking at the start of 2020 the gold/silver ratio was already at historic levels. Whatever your argument might be (i.e. short sellers, papered markets, manipulation) I believe that silver was mainly hit due to the massive loss in industrial demand because of the shut down in China. This caused investors to liquidate silver and pile into treasuries and gold. While I am not a fan of treasuries at such low yields, I can understand why someone would “sell silver” and “buy gold” causing the ratio to explode to unprecedented levels as seen in the chart below.

In the coming weeks, the spread of the virus should continue to take its toll on economic activity and be a key reason for the deflationary environment. Like an addict looking for another fix, the Federal Reserve will then further acknowledge that “more needs to be done” and this is where silver comes to life and starts its move like what we saw from October 2008 on up to April 2011. In the chart above, you can see that the gold/silver ratio had collapsed from the mid 80’s down to the mid 30’s and in the chart below, you can see that silver had rallied from $8.40/oz on up to $49.83/oz. This was when a perfect storm hit, just like what we are seeing now.

Looking at different approaches to trading these markets, we have expanded by adding a fully institutionalized research department with actionable trading recommendations. Our recommendations are comprised of limited risk options strategies, to receive more information please register here:

From a trading perspective we have been using multiple strategies to try and take advantage of the expected long term price appreciation in the precious metals markets. We also believe that silver will be a leader from this and the Gold/Silver ratio will begin the fall because of an outpacing increase in silver prices.

Remember there are many factors that could affect the direction of the metals markets so be sure to stay up to date on the developments by registering for a Free two-week trial of the Blue Line Futures Morning Express Research Reports by clicking on the link here: The Blue Line Express Two-Week Free Trial Sign up

Read Original Article at kitco.com