The Digital Dollar: A Tool for American Totalitarianism

Central Bank Digital Currencies (CBDCs) threaten to replace the cash we use with programmable, trackable, and censorable tokens controlled by governments. Your financial choices could be suppressed, and privacy eliminated. Based on what I’ve learned and experienced directly, this could happen before the 2024 election. The best way to stop it is through direct action, not through politics.

In my 30 years as a serial entrepreneur and liberty activist, I have never encountered a more significant or urgent threat to human freedom and liberty than CBDCs. My direct experience with cryptocurrency, insights from researching my book about the threat of CBDCs called The Final Countdown, and an understanding of the political realities regarding CBDCs from my experience running in the 2024 Republican Presidential primary, have propelled me to dedicate 100% of my time and attention to sounding the alarm on this issue. We are at DEFCON 1.

How CBDCs Could Lead to Total Control: Your Spending, Your Identity, Your Life

CBDCs are a form of digital cash that can be programmed, monitored, and censored by the government. They can serve as a gateway to complete tyranny by enabling social credit scores, digital IDs, vaccine passports, and more. To see what life might be like under this type of digital tyranny, you can read the first chapter of my book at Brownstone Institute.

As I have traveled to 20 states and given presentations on my book, I realize that I need to do more to empower people to take the first step towards taking control of their own money. I am more concerned with empowering people than selling books. To ensure people understand the threats and available solutions, I am taking a hands-on approach by traveling across the country and hosting 4-hour workshops based on the content of the book. At the conclusion, every participant will possess self-custody crypto, gold, and silver, along with a detailed understanding of the threat.

My goal is to reach millions of people, and ultimately make an online version of this course available. However, I have learned that nothing beats face-to-face interaction. To minimize the costs of the in-person workshops, I am planning them as far in advance as possible. If you are interested in either hosting, participating in, or sponsoring a workshop, please visit my workshop page.

This article outlines my case for why CBDCs are an imminent threat that requires everyone’s immediate focus and attention and provides an overview of what will be covered in the workshop.

The Political Landscape for CBDCs in the United States

This is why I believe a CBDC might be rolled out in the United States before the 2024 Presidential election.

1/ President Biden has Authorized the Exploration of a CBDC, and There Isn’t any Real Resistance in Congress.

On March 9, 2022, President Biden signed Executive Order 14067. This EO places “the highest urgency on research and development efforts into the potential design and deployment options of a United States CBDC.” It also calls for a whole-of-government approach to regulating digital assets. As you will see in a further section below, the technology for a US CBDC has already been developed.

The crackdown on digital assets has been ongoing and aggressive, directly impacting people I know personally and respect for their activism in the furtherance of liberty. Ian Freeman, a longtime liberty activist, radio host, and early mover as part of the Free State Project was sentenced to federal prison for 8 years for simply selling Bitcoin (my wife and I attended the sentencing hearings). He operated a number of ATMs and would help people exchange their dollars for cryptocurrency. The Federal government wanted to make an example of Ian and have a chilling effect on person-to-person methods for people to get into crypto. Other services, like LocalBitcoins, have also been forced to close due to added government pressure.

Another liberty activist I know personally and who is also part of the Free State Project, Jeremy Kaufmann, created a company called LBRY (also known as Odyssey). Jeremy’s offering provided a decentralized and censorship resistant version of YouTube using blockchain technology (the underlying technology used in Bitcoin and many other cryptocurrencies). He was sued and harassed by the SEC. Despite many other cases that were clearly in violation of the SEC guidelines, Jeremy was targeted because his offering was a successful use of technology that also was in direct conflict with the federal government’s extensive efforts to censor America’s social media interactions. His business was forced to shut down in October 2023.

In total, the SEC has targeted 127 companies for crypto enforcement action, and a whopping 24 of those came in 2023 alone. In addition to individual companies, they have aggressively targeted crypto exchanges like Binance, Bittrex, Coinbase, Kraken, and FTX, making it difficult for people to buy and sell cryptocurrency.

During my presidential campaign, I had the opportunity to speak with many current members of Congress who are actively working to stop CBDCs. US Senator Ted Cruz (R-TX) has been leading the battle against CBDCs in the United States Senate. In 2023, he introduced a bill to prohibit the Federal Reserve from issuing a CBDC. Alarmingly, Cruz informed me that the bill is dead in the water and that the votes aren’t there in the US Senate to block a CBDC. He also expressed concern that the Federal Reserve might attempt to act unilaterally and bypass Congress by introducing a CBDC.

He further suggested that if a CBDC is not introduced this term, it is very possible that Senator Elizabeth Warren (D-MA) could become the Chair of the Senate Finance Committee, which would oversee the push for a CBDC. Warren has recently expressed her enthusiastic support for and advocacy for CBDCs.

“We need a digital version of the dollar that can be exchanged quickly and cheaply by anyone, anywhere in the world. A CBDC would make it easier for people to access their money and participate in the economy.” She has also taken the national security angle, stating, “A CBDC could help reduce the risks associated with cryptocurrencies, which are often used for illicit activities and are subject to changing technology and market conditions.”

I have also spoken with Senator Cynthia Lummis (R-Wyoming), Senator Ron Wyden (D-OR), former Senator Cory Gardner (R-CO), and Congressman Warren Davidson (R-OH) and can report that while there is some opposition to CBDC, it isn’t anywhere near what is necessary to stop CBDCs before the election.

On the presidential candidate front, I had the opportunity to speak with and/or get my book in front of numerous candidates. In June of 2023, I had my first conversation with Vivek Ramaswamy. I gave him a copy of my book and was very pleasantly surprised that he actually read it.

I had three subsequent conversations with him about it and aggressively pushed him on the CBDC issue, explaining that it was my sole reason for running for President and that there is a risk of it being implemented before the election.

The first thing Vivek did after exiting the race after the Iowa Caucus was to convince Donald Trump that he should oppose CBDCs. On January 17, 2024, in my home state of New Hampshire immediately before the Presidential primary, Trump made the following statement: “I want to thank my friend Vivek for bringing this important issue to my attention. He’s been a great help in understanding the dangers of CBDCs, and I’m grateful for his guidance. Together, we’ll make sure that these digital dollars never see the light of day in America.”

I have also given copies of my book to RFK, Jr. and have received pledges from Libertarian Presidential Candidates Mike Ter Maat and Dr. Michael Rectenwald, confirming their full opposition to CBDCs.

With that said, President Biden is pushing full steam ahead. With Cruz’s concern about unilateral action by the Federal Reserve, I wouldn’t want to rely solely on the commitment of candidates who may or may not win the race. In my decades of experience with politicians, I have found few who actually followed through on their promises, so I take their stated positions with a grain of salt.

The main theme you will hear from me over and over again is that the only way we can guarantee CBDCs are stopped is by the direct action of individuals boycotting the dollar and moving into self-custody crypto, gold, and silver, and using those alternatives as cash in a parallel economy BEFORE everyone’s fiat is mandatorily converted to CBDC, and we have no other choice.

2/ The Technology for a US CBDC has Already Been Developed and Could be Deployed Quickly.

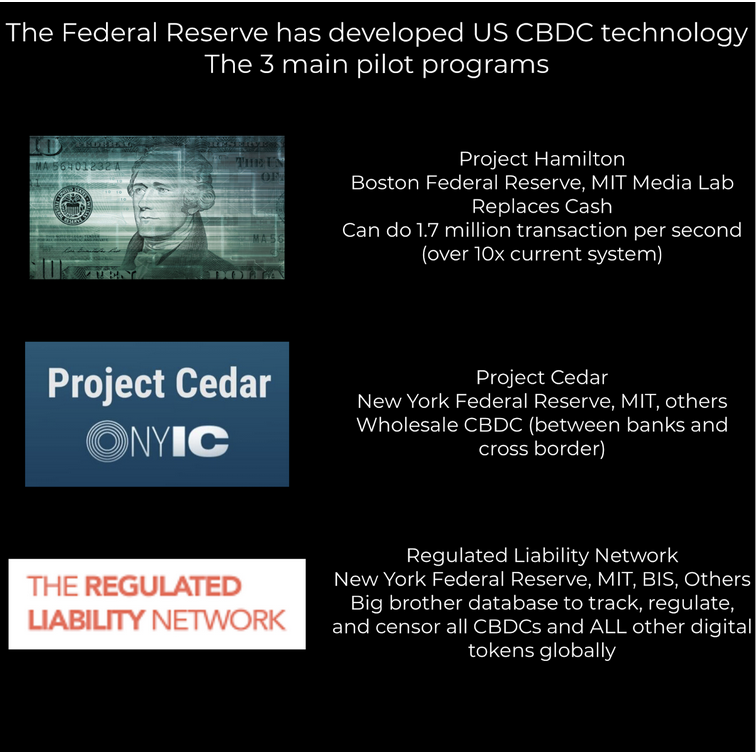

The Federal Reserve has already completed three successful pilots. The technology works and is only pending the creative “legal and marketing” spin before it is rolled out. I describe the pilot programs in detail, along with the involvement of the MIT Media Lab and their ties to Jeffrey Epstein, in this article.

The exploration of Central Bank Digital Currencies (CBDCs) through projects like Project Hamilton, Project Cedar, and the Regulated Liability Network (RLN) raises significant concerns over privacy, autonomy, and the consolidation of power within the hands of a few centralized entities. These pilots, while technically impressive, venture into dangerous territory, potentially undermining individual freedoms and enabling unprecedented levels of surveillance and control by governments and globalist organizations.

Project Hamilton, a collaboration between the Federal Reserve Bank of Boston and MIT, demonstrates a leap in transaction-processing capabilities with its digital dollar concept. However, the capability to process 1.7 million transactions per second not only underscores the technical feasibility of replacing traditional cash but also suggests a future where every transaction can be monitored and controlled. The involvement of the MIT Media Lab, with its murky financial connections to controversial figures, further taints the project, suggesting underlying agendas that may prioritize control and surveillance over public benefit.

Project Cedar focuses on the wholesale market, exploring the use of a digital dollar among financial institutions. While it claims to aim for efficiency and security in high-value transactions, the reality is that it could lead to a financial system where the public has even less visibility and say in the monetary operations that underpin their economy. The engagement of major banks and the MIT Media Lab in this project does little to dispel fears about the increasing influence of powerful financial and technological elites in dictating the terms of our economic future.

The Regulated Liability Network (RLN), meanwhile, represents a further step towards a dystopian future where every asset, from your house to your car, could be tokenized and tracked on a government-controlled ledger. This proof-of-concept project not only threatens the fundamental idea of ownership as we know it, but also opens the door to chilling possibilities like remotely disabling access to your own possessions based on your behavior or social credit. The involvement of globalist organizations and the potential for such technologies to be abused for political or social control cannot be overstated.

In essence, these CBDC pilots, while cloaked in the language of innovation and efficiency, may well be Trojan horses for a world in which individual freedom and privacy are relics of the past. The advancements they propose come at too high a cost when the price is our autonomy and the right to live without every transaction and movement being scrutinized and controlled by a centralized power.

3/ Most Americans are Unaware of What CBDCs are and Could be Easily Manipulated in an Emergency.

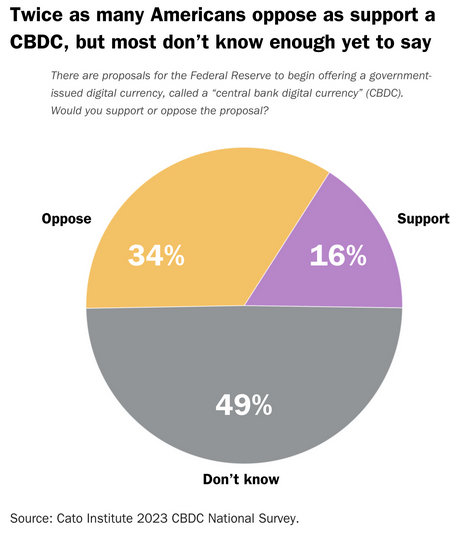

An article in Forbes on March 8, 2023, Federal Reserve Chair Jerome Powell stated “Given the very modest and biased mainstream media coverage on this topic, most Americans are fairly complacent about the issue.” The Cato Institute recently conducted a survey on the issue, and while it shows that 34% oppose a “central bank digital currency,” most don’t know enough yet to have an opinion.

The Patriot Act passed with public support after 9/11. I suspect if the issue had been polled prior to 9/11, the majority would have been against it. Now, more than two decades later, a majority of Americans are opposed to it.

The CBDC issue is flying under the radar intentionally, and will likely not receive mainstream attention until after an emergency so that people will make a fight-or-flight decision out of fear.

4/ In Recent History, Emergencies Have Driven Major Legislation That Strips Us of Our Rights.

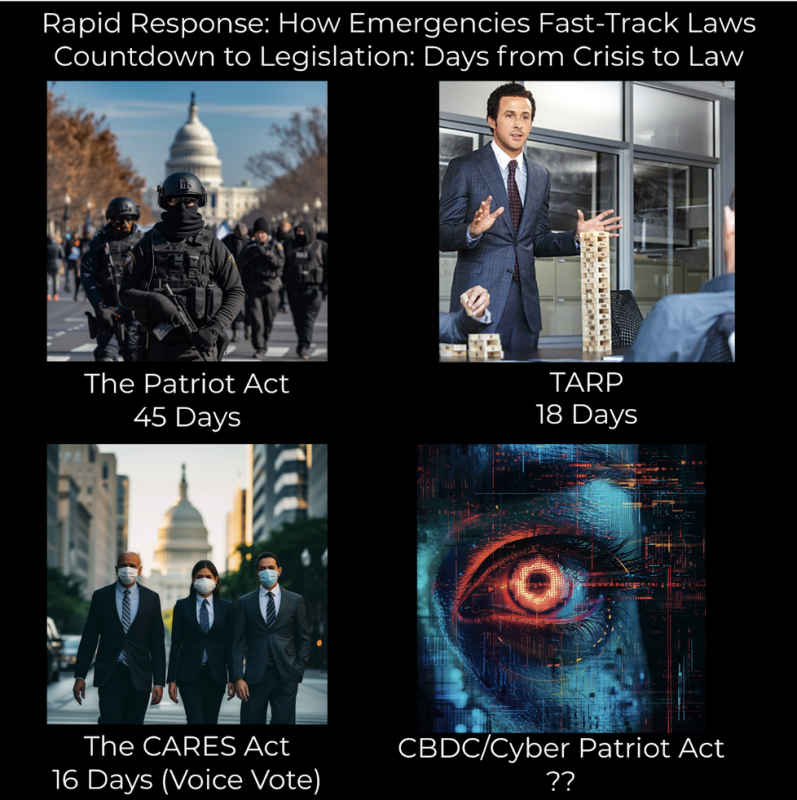

There has been a recent trend of passing larger and larger emergency legislation in shorter and shorter timeframes with less scrutiny over time. Winston Churchill stated, “Never let a good crisis go to waste” and the US Congress and Senate have not missed this opportunity to use an emergency to strip US citizens of their freedoms.

In fact, there are some in Congress today, such as Mitch McConnell, Chuck Schumer, and Nancy Pelosi, whose eagerness to pass monumental bills under the guise of urgency spans across various administrations and crises. All three, along with many others, voted for the Patriot Act, TARP, and the CARES Act.

This is why I am deeply concerned that we could see the introduction of CBDC and a Cyber Patriot Act in the blink of an eye.

The Patriot Act, rushed into law just 45 days post-9/11, expanded the surveillance state to Orwellian proportions, making a mockery of privacy and due process.

TARP, a knee-jerk reaction to the financial meltdown of 2008, saw billions of taxpayer dollars funneled into the coffers of the very institutions whose greed-fueled incompetence necessitated the bailout, all within 18 days.

And then the CARES Act, enacted in a 16-day frenzy as Covid-19 gripped the nation, not only crushed small businesses to the benefit of large, multinational corporations but also opened floodgates for potential misuse of funds and expanded the surveillance state, all under the convenient veil of emergency.

Following this trend, we could see a CBDC passed in under two weeks.

Understanding that legislation like this is often passed during an emergency, the strategy is to onboard early adopters now (to self-custody crypto, gold, and silver) and prepare an online workshop that can scale to millions so that when the emergency is declared, Americans can be presented with an option.

They are likely to roll out a CBDC using the problem-reaction-solution approach. Problem-reaction-solution is a concept often used to describe a pattern of manipulation and control that can occur in various aspects of society. It suggests that those in positions of power or influence can deliberately create or exacerbate a problem or crisis (the “problem” stage) to provoke a strong emotional reaction or fear among the public (the “reaction” stage). Once this reaction is triggered, it becomes easier to implement a predetermined solution (the “solution” stage) that may not have been accepted under normal circumstances. This process has been observed in politics, the media, and even marketing. Sadly, it works every time.

Given the precarious state of the global geopolitical situation, I can very easily see a terrorist attack or a cyberattack used as the “problem” mentioned above. The reaction would be fear. The solution would be a CBDC which would be marketed as a way to keep us safe from terrorism and money laundering. The goal, then, is to have an alternative solution that can scale at the time of an emergency. “Don’t let the arsonist become the firefighter. Let’s exit fiat before they turn it into CBDC.”

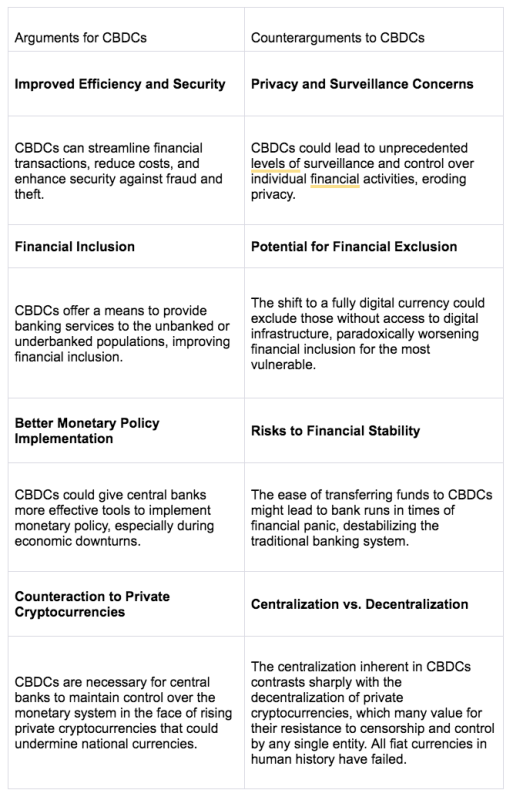

Don’t Believe the Hype

You should be aware that the people pushing CBDCs (central banks, the United Nations, the World Economic Forum, Bank of International Settlements, and others) have refined their messaging and will be presenting a full propaganda campaign extolling the virtues of CBDCs. I have provided a quick table so that you can understand their argument and the counterargument.

These talking points address the official narrative, yet it’s clear that the primary aim of CBDCs is control, a fact that is scarcely concealed. Below are direct quotes from advocates of CBDCs:

Agustín Carstens, General Manager of the Bank for International Settlements, stated, “We don’t know who’s using a $100 bill today, and we don’t know who’s using a 1,000-peso bill today. The key difference with the CBDC is the central bank will have absolute control over the rules and regulations that will determine the use of that expression of central bank liability, and also we will have the technology to enforce that.”

Christine Lagarde, President of the European Central Bank, remarked, “Without CBDC, we risk losing the role of anchor.”

Neel Kashkari, President of the Federal Reserve Bank of Minneapolis, observed, “CBDC doesn’t solve any actual problems, other than enabling central bankers to monitor all transactions and deduct taxes directly from people’s accounts.”

The Plan to Defeat CBDCs

I wrote my book, The Final Countdown, to provide a comprehensive overview of the magnitude and urgency of the CBDC threat, as well as to offer step-by-step guidance on actions we can all take to halt CBDCs before they are implemented.

While the book is intended to stand alone as a resource, I have discovered that people significantly benefit from an in-person workshop. At the end of these workshops, each participant will walk away with their own self-custody crypto, gold, and silver. I do not receive any compensation for selling any crypto, gold, or silver. I am offering unbiased advice based on my own experience.

To maximize our outreach and maintain affordability, I am currently assessing interest in attending the workshop and exploring the community’s capacity to support or sponsor various aspects of the event. If you’re interested in participating in or contributing to the workshop’s success, please sign up and share your interest. My goal is to create a significant impact and reach millions, which is why I plan to develop an online version of the workshop. Despite this, I firmly believe in the unmatched value of in-person interactions. Thus, even after launching the online course, I will continue to offer live workshops to preserve the powerful experience of direct engagement and learning.

The financial market is crumbling and EVERYONE will be affected. Only those who know what's going on and PREPARE will survive... dare we say thrive. Our 7 Simple Action Items to Protect Your Bank Account will give you the tools you need to make informed decisions to protect yourself and the ones you love.