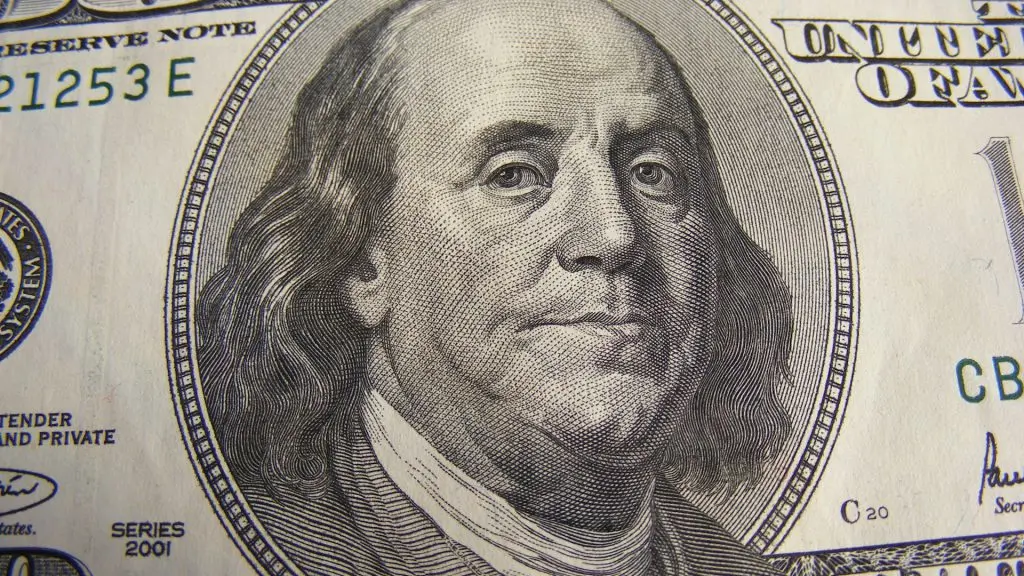

The Dollar’s Slow Death: Only 3% of Its Original Power Remains

The decline of the US dollar’s value is accelerating with depleting purchasing power in 2024. A dip in the USD’s buying power could lead to hyperinflation in the homeland affecting the broader stock and commodity markets. The US dollar’s purchasing power is dwindling at a time when the BRICS alliance is looking to topple it from the world’s reserve currency status.

Lynette Zang, CEO of Zang Enterprises, emphasized that the US dollar’s purchasing power is eroding. The Federal Reserve documented that only 3% of the US dollar’s original purchasing power remains in 2024. “This is what the official government data will tell us,” said Zang. This gives BRICS more mileage to take on the US dollar as its purchasing power is dwindling.

Additionally, Zang explained that the purchasing power at 3% in 2024 could turn to zero next year in 2025. This could lead to hyperinflation causing job losses and disruption in the US markets. “It’ll become very obvious in 2025,” she said.

In addition to the US dollar woes, the BRICS de-dollarization agenda will also be on the table to take on. “I believe with all my heart and everything that I know that we’ve already begun the transition to hyperinflation,” Zang told Kitco News. “We’re going to see more borrowing, more money printing, more inflation because they have not killed that beast that they created and continue to create,” she said.

BRICS: The US Dollar Faces Threats From Digital Currencies (CBDC)

Apart from BRICS, the US dollar is also facing threats from central bank-issued digital currencies (CBDC). Around 134 countries are working towards building CBDC and 66 of them are in advanced testing mode. The others are yet to cross the pilot phase and could take two to three years to make digital currencies fully functional, reported the Atlantic Council.

This article originally appeared on Watcher Guru.