The FDIC Knows: Your Bank Account Is a Sitting Duck

The Silent Epidemic: Why Your Money Is Never Truly Safe in Digital Banks

Have You Ever Wondered If the System Actually Wants You to Lose?

Most people believe their money is safe because they see the FDIC’s familiar seal stamped on their accounts like a talisman against disaster. But let me show you the bigger picture: in 2024 alone, scammers posing as bank employees siphoned off an astonishing $12.5 billion from unsuspecting customers. And if you think the institutions you trust will make you whole, think again.

This is not a glitch. It’s a predictable feature of a banking system that thrives on opacity and plausible deniability.

The Anatomy of a Digital Heist

Here’s how it unfolds: You receive a text message that seems urgent—a suspicious login, a compromised account, a transaction you didn’t authorize. In that split second of panic, you do what the system has conditioned you to do: comply.

According to the FTC, these “bank impersonation” scams were the most reported text scam in America, growing twentyfold since 2019. The elderly, immigrants, and busy professionals are prime targets. But don’t kid yourself—this can happen to anyone.

One recent victim, a 73-year-old woman in North Carolina, was tricked by a fake Apple Care alert. Within days, she’d been coerced into converting $61,000 of her life savings into Bitcoin—money that vanished into the digital ether.

And the banks? They washed their hands of it. After all, she “authorized” the transfers under duress. Legally speaking, that was enough to absolve them.

Why the System Is Designed to Leave You Holding the Bag

The Electronic Funds Transfer Act is explicit: if you authorize a transfer—even under fraudulent pressure—your bank is typically off the hook. Consumer Reports’ investigation revealed that out of 11 major payment platforms, only one—Apple Cash—clearly explained that scams are treated as “authorized” payments.

The rest rely on ambiguity to protect themselves while you scramble to pick up the pieces. Zelle alone facilitated over $320 million in losses in just two years. Let that sink in: the same platforms marketed as “safe, instant, and convenient” are gateways for thieves—sanctioned by the indifference of the very institutions we fund with our trust.

Ask yourself: Who benefits from a system this brittle? Who profits from moving the world into cashless transactions and algorithmic approvals while disclaiming liability when things go wrong?

A Crisis No One in Power Wants to Solve

This epidemic is more than a crime wave—it’s a testament to the vulnerability baked into modern finance. When you digitize everything and centralize control, you also create a single point of failure ripe for exploitation.

Ironically, the FDIC’s recent advisory boils down to this: Be careful. Imagine if the airline industry told you, “Yes, 20 planes crashed last year, but just remember to buckle up.” Would you feel protected?

How to Reclaim Your Financial Sovereignty

If you’re serious about protecting your wealth, it’s time to stop assuming these institutions will ever have your back. Here are three steps you can take today:

Verify Independently: Never trust unsolicited calls, texts, or pop-ups. If you get a suspicious message, contact your bank using the phone number printed on your card—never the one in the alert.

Diversify Your Cash Holdings: Keep emergency funds outside digital-only platforms. Consider physical assets—gold, silver, even hard currency in a secure vault—to reduce single-point risk.

Educate Your Family: Make sure everyone in your household knows these scams are engineered to prey on fear. A five-minute conversation now can save decades of regret later.

Closing Thoughts

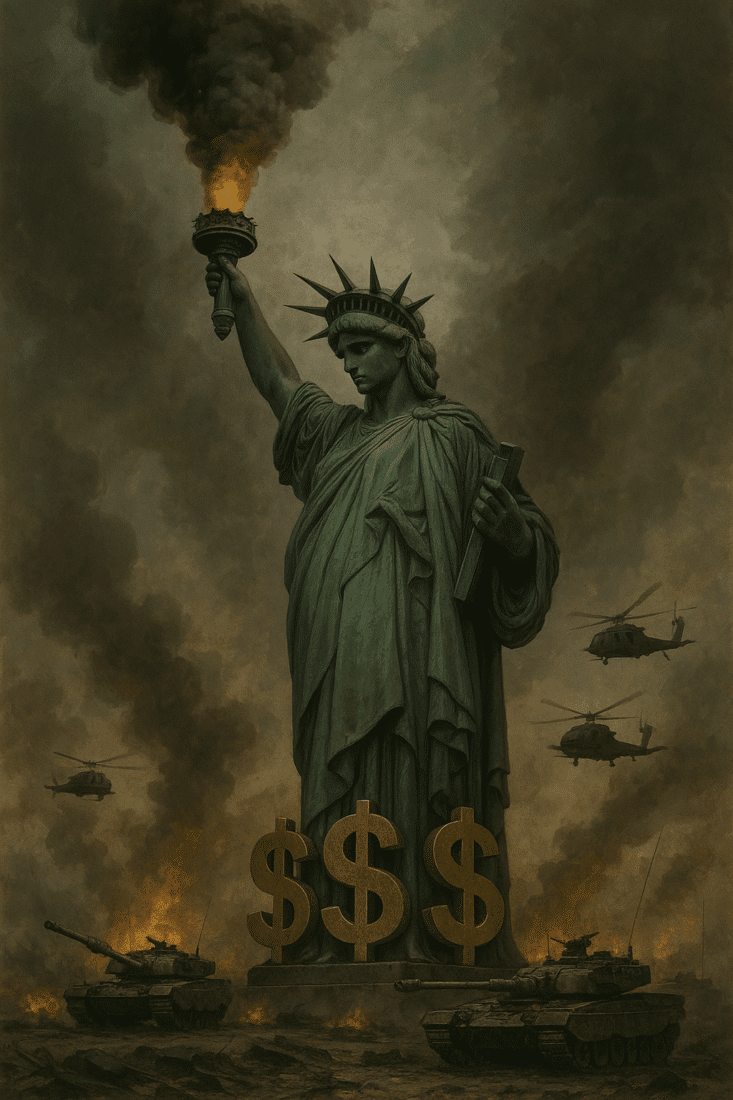

Here’s the truth: the digital banking era isn’t just about speed and convenience. It’s about control. And the faster we rush into this cashless utopia, the more power we surrender to institutions that view your losses as collateral damage.

If you don’t take steps to secure your financial independence today, you may wake up tomorrow to find your accounts empty—and no one willing to take responsibility.

Take Action Now

The financial landscape is shifting faster than most realize, and those who fail to prepare risk being left behind. If you’re ready to take control of your financial destiny, here are two resources to help you start today:

Download my free book, Seven Steps to Protect Your Bank Accounts:

Get Your Copy Here

Order the discounted hardcover, The End of Banking as You Know It by Bill Brocius for just $19.95 (retail $49.95):

Order Your Copy Here

Remember: in a world where control of the money means control of the people, taking action isn’t just wise—it’s essential.