The Fed May Hit Pause, But Gold’s Power Marches On

Why the Fed’s Pause Isn’t a Sign of Stability

If you're feeling like the world’s gone a little sideways lately, you’re not alone—and neither is gold.

This week, the yellow metal took a bit of a breather after a strong start, slipping from its highs above $2,400 (intraday spikes) to settle back slightly. Some folks saw that as a sign of weakness, but I’m here to tell you: don’t fall for that trap. This dip isn’t a collapse—it’s a buying opportunity.

Let’s cut through the noise.

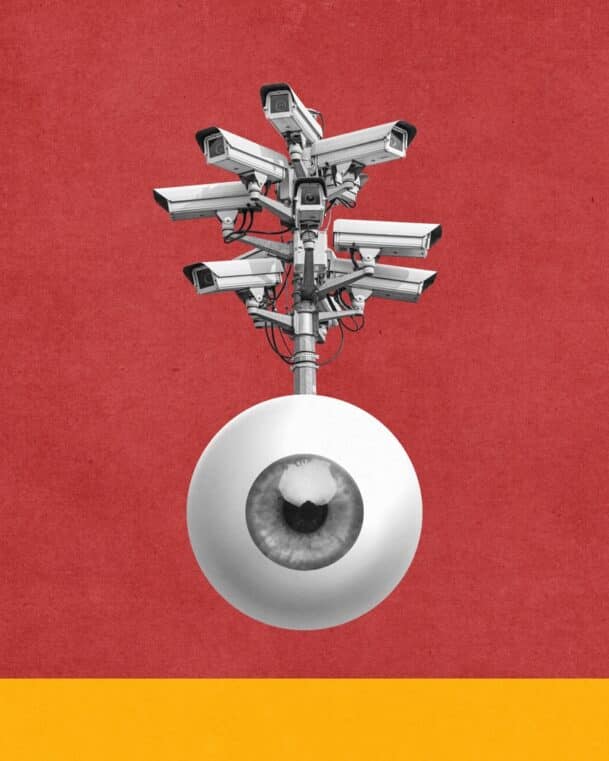

The mainstream media is parroting the same tired line: “The Fed might pause rate hikes, so gold is pulling back.” But this view ignores the deeper truth we’ve been hammering on for months—this entire system is held together with duct tape and wishful thinking. And when the Fed does nothing, that’s not stability—it’s paralysis.

The Fed’s “Pause” Is Not a Signal of Strength. It’s a Sign of Confusion.

The Federal Reserve is in a bind. After the government’s 43-day shutdown (the longest in U.S. history), a chunk of vital economic data—like October’s Consumer Price Index—is gone. Just gone. Poof. Can’t model what you can’t measure, right?

So what does the Fed do when it's flying blind? It stalls. Like an old truck running on fumes, it’s rolling to a stop and calling it “strategy.”

Investors saw the pause coming and some panicked. There was some technical selling, sure—algorithms doing what they do. But the core fundamentals haven’t changed one bit. The labor market is slipping. Inflation’s still here (just not rising fast enough to scare the Fed into action). And with election-year politics heating up—especially with Trump pressuring the Fed to start easing—you better believe rate cuts are on the horizon.

Even if they kick the can in December, they’ll be slashing by 2026. You can set your watch to it.

Gold Isn’t a Short-Term Trade. It’s a Long-Term Lifeline.

Too many folks still think of gold like a tech stock—up today, down tomorrow. But gold isn’t some Reddit-fueled momentum play. It’s real money. It doesn’t need a central bank to tell it what it's worth. It doesn’t get printed into oblivion. It’s been a store of value for thousands of years—for a reason.

This week’s 2% gain might not feel exciting when we’ve seen big spikes in the past, but when you zoom out, the trend is clear: higher lows, higher highs, and growing global demand as fiat currencies continue to bleed value.

Think about your dollar like a used car. Every year you hold onto it, it loses value—thanks to inflation, debt, and central bank mismanagement. Gold? That’s your inflation-proof garage. It holds value no matter what circus act comes out of Washington next.

Don’t Let the Headlines Shake You—The Real Storm Is Still Coming

The Fed can pause all it wants. It won’t stop the avalanche of debt, the collapsing middle class, or the erosion of trust in the dollar. And it definitely won’t derail gold or silver.

What we’re witnessing is a shift—not a cycle. The old system is dying, and those of us paying attention are getting ready for what’s next.

My advice? Don’t wait for Wall Street to tell you it’s time to move. They’ll be the last to warn you—right after they’ve already made their bets.

The Bottom Line:

The Fed might be pausing, but you shouldn’t. This is the time to act—before the next crisis hits.

👉 Download Bill Brocius’ FREE eBook: Seven Steps to Protect Yourself from Bank Failure

👉 Subscribe to Dedollarize Insider for real-time alerts, expert breakdowns, and strategies to protect your wealth. Click here to join

Stay sharp,

Frank Balm

Lead Analyst, Dedollarize News