The Fed’s Expanding Balance Sheet Signals Instability in Bonds and Cash, Safety in Gold

With the entire nation hunkering down amid COVID-19, you can’t expect much in terms of American workforce productivity.

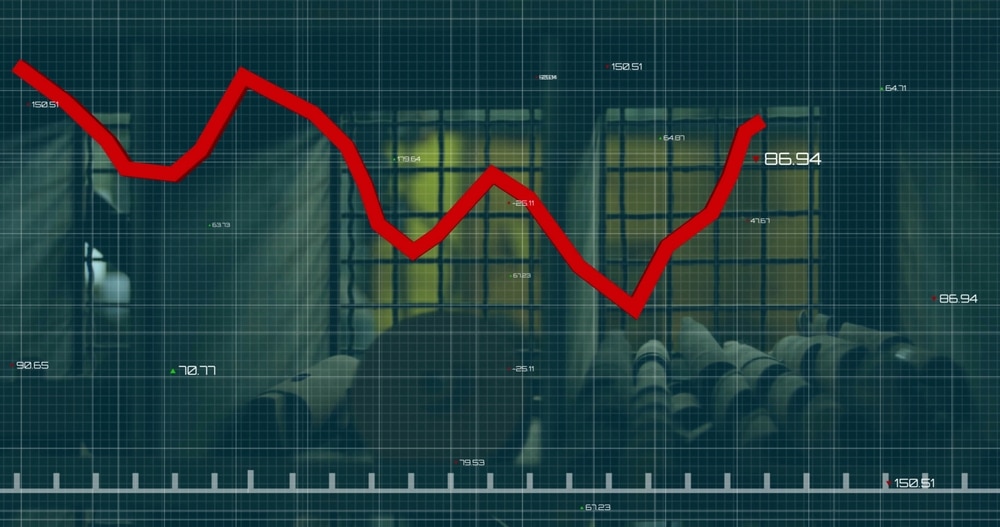

Businesses have been shuttered, millions of jobs lost, and incoming economic reports have generally been pointing downward. Yesterday morning, retail sales have plummeted far below expectations, as shown in the image below (source: CNBC):

This morning, another 5.2 Million people in the US have filed for unemployment benefits. To date, 22 million Americans are currently unemployed.

As the US eases up on restrictions, allowing for a gradual “re-opening” of the American economy, we can’t expect to just pick up where we left off prior to the lockdown.

Considering the damage already done, we can’t be so naive as to think that the engines of the economy can get revved up as quickly and easily as a flick of the switch.

Things aren’t going to be the same, quite possibly for a very long time. And alongside all of the dismal economic data pouring in, the Federal Reserve’s monetary actions may hurt the economy in the long run as effectively as it might boost the economy (or confidence in the economy) in the short term.

On March 23, the US economy underwent a major yet imperceptible shift. That’s when the Fed announced its $30 Billion deployment of capital from the Treasury’s Exchange Stabilization Fund.

This is a massive and highly-leveraged initiative--up to tenfold in buying power--aimed at propping up businesses through loans and bond purchases.

Add to this the Fed’s pledge of virtually “infinite QE,” and you might guess we’re in for an impact.

Except this impact is more like a weighted chain--it wraps around you first, until finally, the weight’s sharp blow.

Might we expect the Fed’s balance sheet to run as high as $9 Trillion or $10 Trillion by year’s end? To give you some context, the Fed’s balance sheet at the beginning of 2020 was $4.2 Trillion.

Here’s where we’re at now:

But there’s more. What about the $2 Trillion fiscal package that was approved on March 27?

With the Federal Reserve’s ability to print money out of thin air, there’s seemingly no limit as to how high this new bubble can run-up.

Bonds May Soon Lose Their “Safe Haven” Status

The COVID-19 shut down triggered a flight to safety in Treasury bonds. Notice the fall in yield for both the 10- and 30-year bonds since the 1980s:

A closer look at the current yield scenario:

The question of negative rates comes to mind, and opinions differ as to whether the Fed might (or might not) consider going that far.

Either way, it probably doesn’t matter. With yields at record-low levels, the long-term benefits of Treasuries seem to be disintegrating rather quickly.

Here’s something investors should seriously be thinking about: the multi-decade bond bull market that started in the 1980s might finally be nearing an end.

Dependency on the Fed As a New Normal

When the Fed loosens monetary policy, the idea of cheap money always brings to the fore the risk of “moral hazard,” among businesses and banks.

Cheap money often results in mal-investment toward projects better left unpursued. This is normally what happens when the Fed slashes rates.

But what are the chances that the US economy has become dependent on the Fed’s quantitative easing? Should that be the case, we’ve got serious problems.

Econ 101, money printing devalues the dollar. Since 2007, right before the Great Recession and the Fed’s “great” QE experiment, the dollar had lost -19.7% of its purchasing power.

$100 sitting idly under your mattress would now be worth only $80.33. As the Fed embarks on another round of easing, we should expect that sinking trend to accelerate once again.

As a side note, the price of gold (adjusted for inflation) from 2007 to present-day has appreciated $113%.

What This Means for Investors

If you’re invested in the stock market, the fate of your portfolio will be determined by the Fed’s ability to reverse the current deflationary trend.

With 22 Million Americans unemployed, and as dismal economic data continues to pour in, it’s going to take some time for the Fed to make the right adjustments to get the economy going again. Once that happens, we’ll have to deal with the inflationary effects of the Fed’s easing.

As equity values fall, we typically see a flight to safety in bonds. But with yields spiraling downward, the long-term incentive to hold Treasuries may no longer be sufficient to attract large investment.

At that point, we may see a flight from bonds to cash. That’s when, as we mentioned above, the bond market rally may come to an end.

With the purchasing power of cash eroding at an accelerated rate, investors may finally seek safety in the “bedrock” of all things financial. That’s when gold, once again, becomes a matter of mainstream concern.

By that time, physical gold may be hard to get; it’s prices having significantly risen; it’s supply insufficient to satisfy demand.

As we mentioned in another piece this week, that flight to bedrock safety is already underway among central banks worldwide.

Gold investors, like yourself, may have already begun accumulating the yellow metal.

As you can see in the image above, gold has been outpacing 30-Year bonds (blue), 10-year bonds (orange), the S&P 500 (black), and the dollar index (green).

Should the deflationary trend continue, and there’s every fundamental reason to think that it might, gold may still have quite a ways to go.

In other words, deflation first. Then much higher inflation. From that letter:

In a deflationary financial crisis – the kind I think we’re seeing now or will see shortly – the assets at the bottom of the pyramid are “safer” than the assets at the top.

In a typical financial crisis, liquidity begins to disappear in the assets at the top of the pyramid. It moves “down” the pyramid toward safety.

In liquidity terms, money moves not only where it’s treated best but where it’s treated safest.

(Paid-up Bonner-Denning Letter subscribers can read the August 2019 issue in full here.)

The pyramid I’m referring to in that passage is John Exter’s liquidity pyramid. You can see it below.

The important point for this discussion is that bonds, cash, and gold are at the bottom of the pyramid. Stocks are right above them, as you can see in the graphic above.

If the deflationary bust continues, liquidity will keep flowing down the pyramid. Stocks and bonds will be traded for cash, then gold.

Gold is at the very bottom of the pyramid for a reason. It’s the apex – or bedrock – of asset quality in the financial system.

The bad news is you may have a hard time getting your hands on physical gold in the market right now. It may get a little easier if central banks and other large players sell gold to raise cash.

In the meantime, we’re biding our time. The selling has longer to go. The money-printing and deficit spending will continue at a breakneck pace.

If Bill, colleague Tom Dyson, and I are correct, this will eventually result in runaway inflation.

At that point, gold mining stocks – the companies that have physical gold in the ground – will become the best performers in the market.

Until next time,

Anthony Allen Anderson