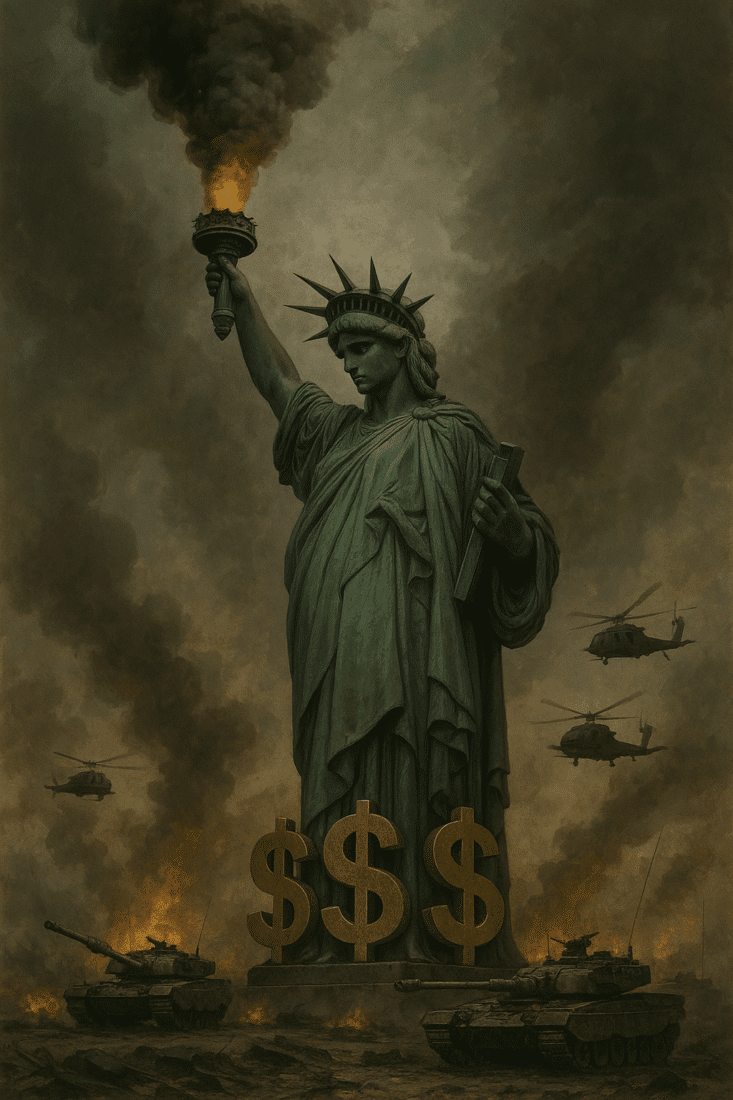

The Fed’s House of Lies: How the Bankers Are Rigging the Game to Save Their Own Hides

The Great Disconnect: Strong Data, Phony Panic

Let’s call this circus what it is. The numbers are clear:

- Unemployment scraping historic lows.

- Inflation still miles above the Fed’s mythical 2% target.

- Wages rising, consumers still spending (even while their credit cards catch fire).

- Stocks and risk assets juiced to the moon by cheap money expectations.

Yet futures markets are pricing in 150 basis points of rate cuts like we’re on the edge of a depression.

Does that smell right to you? Of course it doesn’t. Because it’s not about growth or inflation anymore. It’s about survival—the Fed’s survival, and by extension, the whole rotten edifice of the Washington-Wall Street cartel.

A New Master: The Debt Monster

For decades, the Federal Reserve claimed it was the adult in the room—raising rates to cool inflation, cutting them to save jobs. That fairy tale is dead.

The federal debt-to-GDP ratio is so bloated it makes a sumo wrestler look svelte. Every uptick in interest rates adds hundreds of billions in interest expense that the U.S. Treasury simply cannot afford. And let’s not sugarcoat this:

The U.S. government must refinance roughly $10 trillion over the next two years.

Higher rates mean higher borrowing costs. Higher borrowing costs mean more deficit spending. And more deficit spending means more money-printing. Which means your dollars buy less and less.

The Fed isn’t reacting to the economy anymore. It’s reacting to the Treasury’s desperation to keep the lights on without a default.

Political Games and Puppets in Suits

Think the Fed is independent? Spare me. Trump is already threatening to fire Jerome Powell like he’s a dog who forgot his trick. He’s floated installing a “shadow Fed chair,” someone willing to turn on the spigots and bury any pretense of discipline.

Why? Because when debt service is about to overtake defense spending, it’s a lot easier to cut rates than to tell Americans the truth—that the entire financial system is unsustainable.

So the market isn’t high on “hopium.” It’s simply front-running the collapse of central bank credibility. And if Powell or his successor caves—and they will—then inflation is coming back with a vengeance.

You’ll pay for it every time you fill your gas tank or buy groceries.

The End of the Illusion

Here’s the unvarnished reality:

- The Fed is boxed in.

- The debt is unpayable.

- The dollar’s purchasing power is circling the drain.

- The banking elite will never let the party end, no matter the cost to you.

When futures traders bet on cuts, they’re not stupid. They’re betting the Fed will choose fiscal bailouts over monetary integrity every time.

The old playbook—where policy followed economic data—is over. Now it follows the math of Treasury auctions and the desperation of a failing empire.

It’s time to prepare.

Don’t wait for the next wave of money-printing to wipe out what’s left of your savings.

👉 Download your free report: Seven Steps to Protect Yourself from Bank Failure.

👉 Join the Inner Circle to get uncensored analysis every week—before the next hammer drops.

👉 Order your copy of The End of Banking As You Know It and discover exactly how this game has been rigged from day one: Get your book here.

America First. Drain the Swamp. And never trust the Fed.