"The Gold Market Is Breaking Down": Gold Spreads Explode As LBMA Warns Of Liquidity Problems

The gold price is on the rise and so are the premiums on products. Looking for gold at spot price right now is like looking to use a coupon clipped from the Sunday Paper for toilet paper when the shelves are empty!

The London Bullion Metals Association has officially reported that there are liquidity problems and most vendors have no Yellow Metals to sell. Read More from Zero Hedge below:

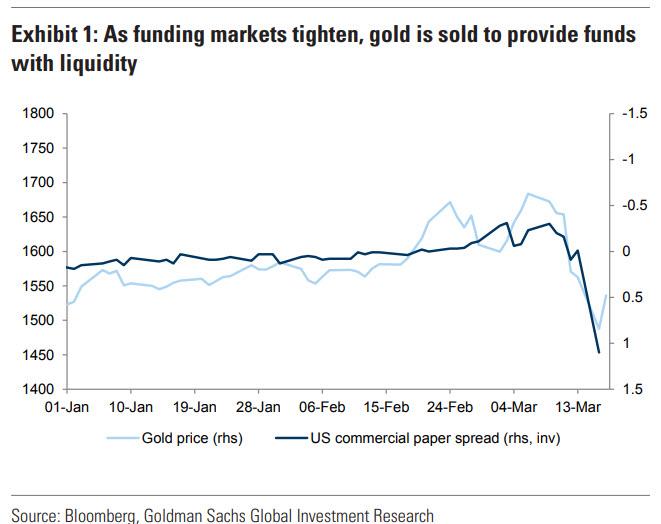

Last night, when observing the unprecedented "gold run" on precious metals dealers which has left all gold vendors with little to no physical gold, we said that "the price of physical gold has decoupled from paper gold" as a result of paper gold liquidations as leveraged funds scramble to cover margin calls using safe assets...

... resulting in an arbitrage that physical gold buyers, i.e., those who don't have faith in gold ETFs such as the GDX or simply prefer to have possession of the metal, find especially delightful as it allows them to buy physical gold at lower prices than they would ordinarily have access to.

However, we also noted that whereas in the past such conditions were self-correcting, this time it is not only a record surge in demand for physical gold but also a near shut down in supply as the most productive gold refiners, those located in the southern Swiss town of Ticina, namely Valcambi, Pamp and Argor-Heraeus, now appear to be offline indefinitely.

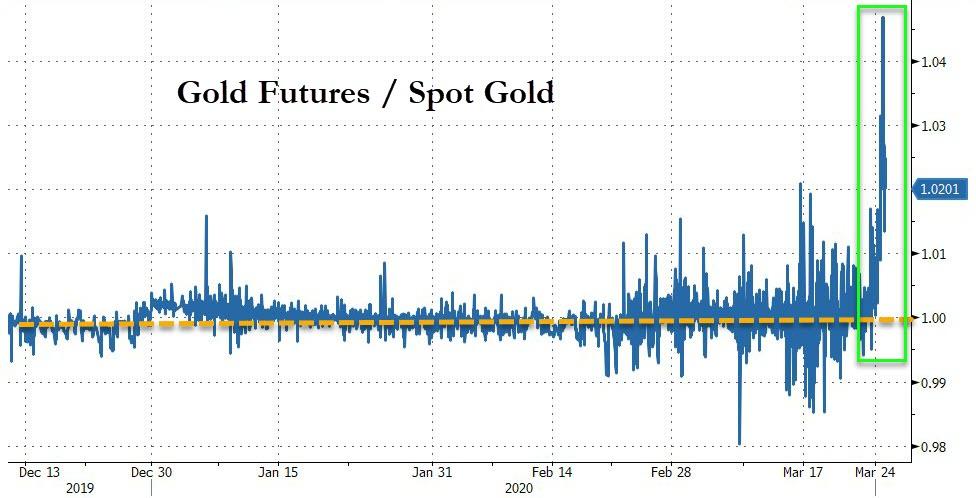

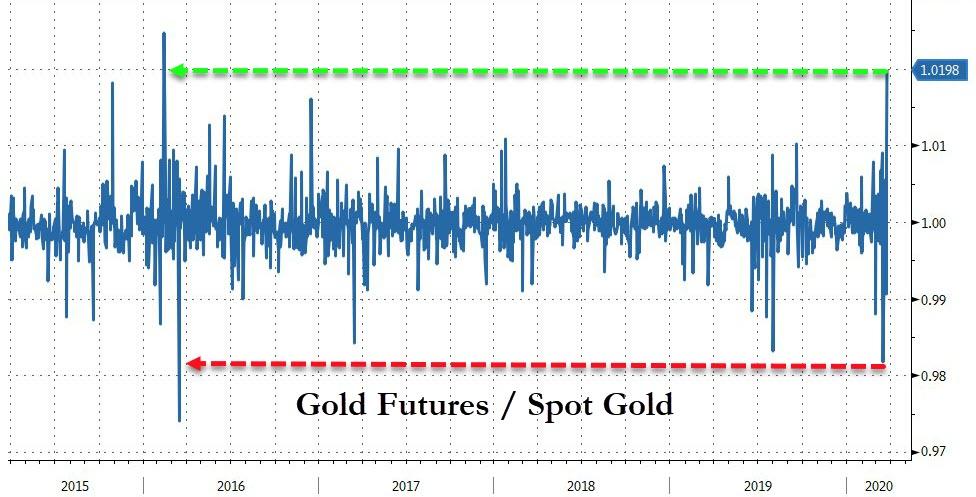

The result is that the spot/futures price divergence discussed last night and further described here, has exploded...

... and on Tuesday morning the divergence that was barely noticeable late Monday has blown out to unprecedented level, with gold futures decoupling and trading far above spot prices.

The near record spread is the widest seen in four years.

As Kitco notes, just before noon EDT, one price vendor was showing spot metal was trading at $1,612.10 an ounce while at the same time showing the Comex April futures were at $1,654.10 an ounce – a spread of $42 an ounce. It was much wider earlier in the day, when as Kitco adds, "nearby futures were more expensive than deferred, a sign of strong demand in any commodity market."

"I’ve never seen that before," said one gold trader who has been in the market for 30-plus years. Some contacts reached by Kitco suggested the discrepancy is an evolving story that is still unfolding, with traders trying to figure out what’s happening.

Earlier in the day, the London Bullion Market Association, the world's most important authority for physical gold and its transfers, issued this stunning statement to Kitco:

"The London gold market continues to be open for business. There has, however, been some impact on liquidity arising from price volatility in Comex 100-oz [ounce] futures contracts. LBMA has offered its support to CME Group to facilitate physical delivery in New York and is working closely with Comex and other key stakeholders to ensure the efficient running of the global gold market."

In short, the unprecedented scramble for physical metal coupled with continued liquidations among levered players, while refiners remains offline, appears to be fracturing the gold market from within.

Saxo Bank's head of commodity strategy, Ole Hansen, observed that a lockdown is occurring in two biggest gold hubs in the world, New York and London, so many traders are working from home. "This has caused a breakdown in the marketplace", he said.

“There is no price discovery in the market right now,” he said Tuesday morning. “If you need to borrow gold in the OTC [over-the-counter] markets right now, you are going to pay a king’s ransom.”

Picking up on what we said last night, Hansen described the problem as a logistics issue as the coronavirus has decimated supply chains across the world, adding that the gold market has dried up because nobody has access to physical metal.

“We don’t have enough hands to handle all the demand,” he said. “There is plenty of gold in the market, but it’s not in the right places. Nobody can deliver the gold because we are forced to stay home.”

Or, as we put it yesterday, "If You Haven't Bought Physical Gold Yet, It's Probably Too Late."

Speaking to Kitco, Rhona O’Connell, head of market analysis for EMEA and Asia regions at INTL FCStone, said that dislocation in the gold market is the result of nervous trading in an increasingly thin marketplace. Not only is physical demand picking in London up, but three major Swiss refiners are shutting down operations, which is putting a further squeeze on supply.

"I think the price action we have seen is as simple as people guarding their risks," she said.

O’Connell added that the price difference between North American markets and London markets is also the result of the U.K. market being more of a physical gold market.

“The balance between physical and futures is more geared towards the [over-the-counter] markets in London,” she said.

Speaking to several other traders, Kitco cites Afshin Nabavi, head of trading with MKS, who pointed out that traders from many banks are working from home due to the coronavirus pandemic. Meanwhile, these participants may be trying to limit risk, contributing to the spreads.

Phil Flynn, senior market analyst with at Price Futures Group, suggested some of the reasons for higher futures prices may be because the market is anticipating future demand as a result of all of the quantitative-easing measures and expectations for fiscal stimulus.

“Futures prices may be a leading indicator of what may be a rush into gold,” Flynn said.

Separately, traders also pointed out that gold futures were in backwardation this morning, with April futures more expensive than the June and December contracts this morning, although that has since reversed with the back months higher again. When nearby are more expensive, the condition is known as backwardation and is the opposite of normal conditions in any commodity market.

During regular times, later months are more expensive due to extra costs such as storage. But when the nearby months are more expensive, this is seen as a sign that traders are paying a premium to get the commodity as soon as possible.

Which anyone who has been to APMEX or any other gold seller in the past few days, has discovered:

"Backwardation shows “there is a lot of demand” with market participants worried about the economy and focusing on the response by governments and central bankers, Flynn said. “People are buying gold like it’s going out of style,” he added.

Or, as we first put it, "It's Selling Like Toilet Paper", which is ironic because thanks to the Fed, Americans are fleeing the toilet paper money known as the dollar, and rushing into real money... as well as actual toilet paper.

The financial market is crumbling and EVERYONE will be affected. Only those who know what's going on and PREPARE will survive... dare we say thrive. Our 7 Simple Action Items to Protect Your Bank Account will give you the tools you need to make informed decisions to protect yourself and the ones you love.