The Hidden Costs of a $20 Minimum Wage: Who Really Pays?

California’s $20 Minimum Wage: A Case Study in Economic Myopia

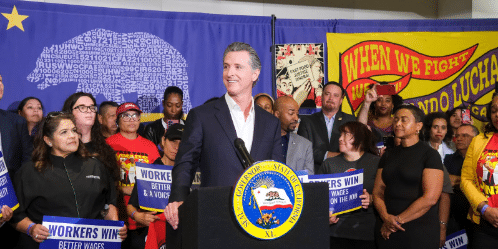

On April 1, 2024, California implemented AB 1228, raising the minimum wage for fast-food workers to $20 an hour. Proponents hailed it as a triumph for workers, while critics warned of higher prices, job cuts, and a decline in service quality. Now, a study from UC Berkeley’s Institute for Research on Labor and Employment suggests those fears were misplaced, claiming minimal price increases and no significant job losses. The media latched onto these findings, celebrating them as proof that higher wages come without economic trade-offs.

But a closer look at the study reveals significant flaws—ones that undermine its sweeping conclusions and ignore basic economic principles. Can wage mandates really sidestep the laws of supply and demand? Let’s dissect the evidence.

The Study’s Sleight of Hand

The research, led by economist Michael Reich, relied on a statistical method called difference-in-difference (dif-in-dif) to compare California’s outcomes with other states. The aim was to isolate the effects of the wage hike from broader economic trends. Superficially, the results seemed promising: food prices in California rose only slightly more than in other states (3.7%), and employment remained stable. Governor Gavin Newsom even declared it a “Win, Win, Win.”

Yet, beneath the surface, the study’s methodology raises serious doubts. For starters, the price data were collected over just four weeks—two weeks before and two weeks after the policy took effect. Such a short timeframe makes it impossible to capture long-term price adjustments or gradual shifts in business behavior. Employers often stagger price increases or adjust other aspects of their operations, like promotions or staffing levels, to cushion the blow of higher labor costs. Measuring only immediate changes paints an incomplete picture.

Price Stability or Delayed Pain?

The reported 3.7% price increase might seem small, but context is key. Broad price increases of this magnitude, especially in an already inflationary environment, ripple through the economy. And remember, this snapshot ignores potential future adjustments. Businesses often resist raising prices all at once, opting instead to phase in changes over months or even years. By narrowing their focus to a four-week period, the researchers effectively ignored these delayed effects.

This approach also glosses over the concept of “price stickiness,” a well-established economic principle. Prices don’t adjust instantaneously to new conditions; they require time to stabilize. To draw conclusions about the wage hike’s impact after just one month is like judging a marathon based on the first mile.

The Employment Mirage

Employment effects are the most contentious aspect of minimum wage debates, and the study’s findings here are equally suspect. While the authors claim no significant job losses—and even hint at gains—this conclusion rests on shaky ground. Their analysis abandons the rigorous dif-in-dif methodology when it’s needed most, instead relying on vague trend observations.

Curiously, the study shows that job growth in California lagged behind the rest of the country in early 2024, even before the wage hike took effect. After the policy’s implementation, this divergence widened. While California’s employment numbers technically rose, they did so at a slower pace than in comparable states. In other words, the real cost may not be outright job cuts but foregone opportunities—positions that would have been created in a less burdensome regulatory environment.

Economic Realities Can’t Be Ignored

The study’s shortcomings aren’t just academic; they reflect a broader trend of using data to fit preordained narratives. By cherry-picking timeframes and selectively interpreting results, the authors obscure the trade-offs inherent in minimum wage policies. The idea that businesses can absorb significant cost increases without raising prices, cutting jobs, or compromising service quality defies economic reality.

History offers countless examples of these trade-offs. When Seattle raised its minimum wage to $15, a study by the University of Washington found that while hourly pay increased, total earnings for low-wage workers fell due to reduced hours. Similarly, after New York’s fast-food wage hike, franchise owners reported scaling back hiring and shifting to automation. California is not immune to these dynamics; it’s simply too soon to see the full effects.

The Real Winners and Losers

While workers earning $20 an hour might celebrate, the broader economic consequences paint a different picture. Consumers face higher prices, businesses contend with tighter margins, and job seekers encounter fewer opportunities. The promise of a “win-win” policy often turns into a zero-sum game—or worse, a net loss.

Policymakers and media outlets eager to tout the benefits of minimum wage increases must grapple with these realities. Instead of focusing on feel-good narratives, we need honest conversations about the trade-offs involved. Economics, after all, is the study of scarcity and choice—not wishful thinking.

Take Action: Protect Yourself from Economic Overreach

As governments continue to push policies that ignore economic fundamentals, it’s crucial to safeguard your financial future. Download Bill Brocius’ free ebook, 7 Steps to Protect Yourself from Bank Failure, to learn how to secure your wealth in uncertain times. For deeper insights, join Bill’s exclusive Inner Circle newsletter for just $19.95 per month and gain access to actionable strategies and market analysis.

Get started today: Download the ebook here. Don’t wait for the next policy blunder to impact your wallet.