The Honeymoon Is Over: Stablecoins, ISO 20022, and ‘Salt Typhoon’—Your Phone Is the New Bank Branch

1) The law that lit the fuse: GENIUS Act

In July, Congress passed—and the President signed—the GENIUS Act, America’s first comprehensive federal framework for payment stablecoins. It greenlights permitted issuers (bank and non-bank) to mint dollar-pegged tokens fully backed by cash/T-bills, with monthly reserve disclosures and AML obligations. Translation: Washington just put a formal stamp on “digital cash”—but not your cash. It is programmable, surveillable, and lives where it’s most vulnerable: on your phone. See the bill on Congress.gov: S.1582 – GENIUS Act (now Public Law 119-27). (Congress.gov)

Policy wonks are already dissecting loopholes—like “rewards” on stablecoin balances that look and feel like bank interest without bank rules—creating incentives to siphon deposits out of community banks and into crypto platforms. Read WIRED’s breakdown of the “trillion-dollar fight”: The Loophole Turning Stablecoins Into a Trillion-Dollar Fight. (WIRED)

2) The balloon is already airborne

With the legal fog lifting, stablecoins are scaling fast. USDT (Tether) sits around the $150B+ mark and dominates volumes; analysts track a 2025 boom across USDT, USDC and upstart issuers as corporates and fintechs plug tokens into checkout, payroll, and cross-border flows. See Motley Fool’s size rankings: Largest Stablecoins in 2025. Also see Protoson this year’s jump in aggregate market cap: Stablecoins boom in 2025. (The Motley Fool, Protos)

This is not hypothetical plumbing. The banking and card networks are aligning their back offices to interoperate with token rails. The policy trajectory is clear: less paper cash in your hand, more phone-based money in custodial apps. The Fed’s own consumer diary shows cash’s share slipping to ~14% of payments in 2024—down again in 2025—while mobile and card rails expand. See the Atlanta Fed/FedCash reports: 2024 S&D CPC (PDF). (Federal Reserve Bank of Atlanta)

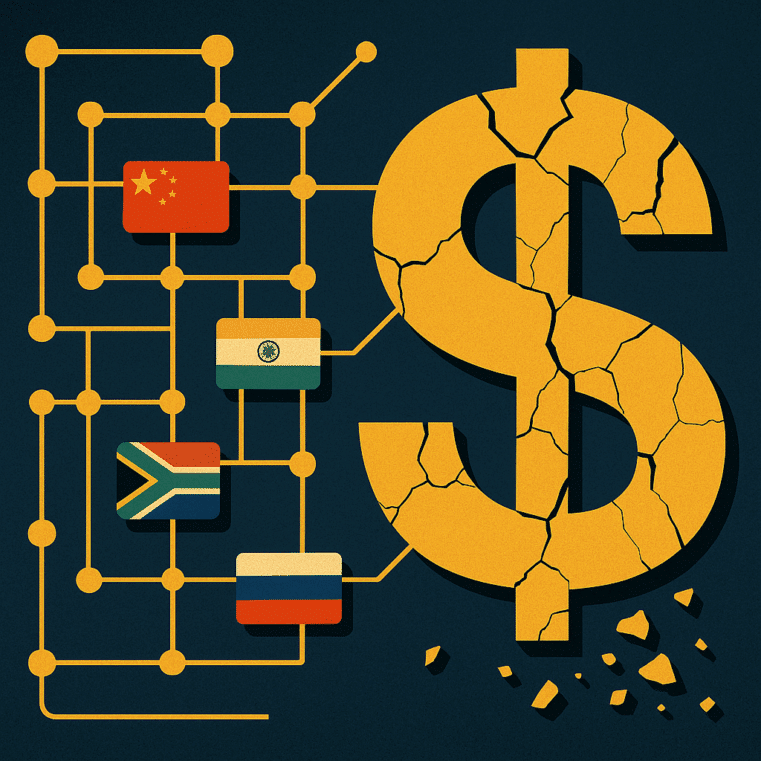

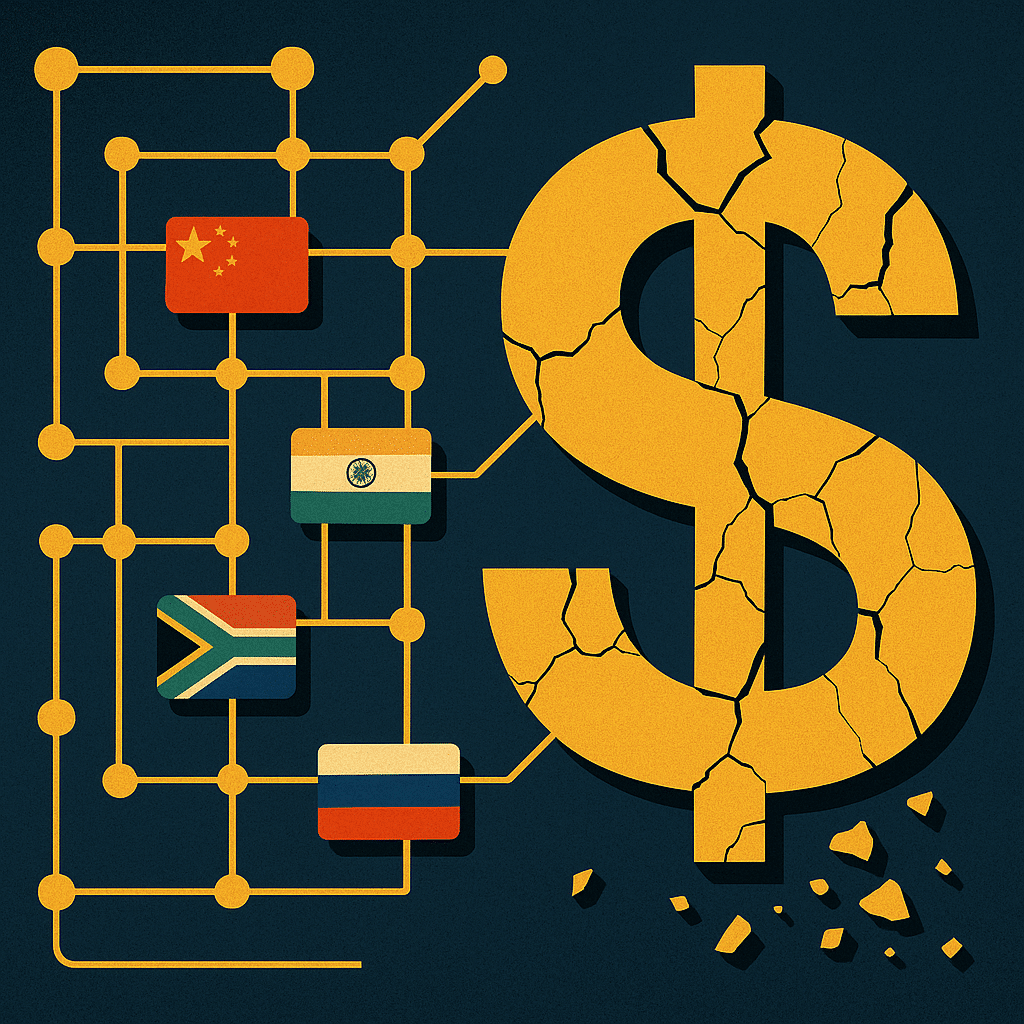

3) ISO 20022: the new rails, locked in by date

ISO 20022 isn’t a buzzword—it’s the standardized language for global payments that aligns messaging across banks and tokenized systems. SWIFT reconfirmed 22 November 2025 as the end of the MT/ISO coexistence for cross-border FI-to-FI instructions, forcing stragglers onto the new rails. Read the SWIFT FAQ: Implementation timeline (Nov 22, 2025). (Swift)

Why it matters: once the rails are uniform, policy switches (transaction screening, automated holds, wallet blacklisting) get easier to implement at scale. Stablecoins plus ISO 20022 equals a frictionless, programmable layer—great for efficiency, terrible for sovereignty.

4) ‘Salt Typhoon’ proved the network is the weak link

Now the gut punch. U.S. and allied agencies say China-linked “Salt Typhoon” spent years burrowing into at least eight U.S. telecoms, siphoning call metadata and in some cases contents, across 80+ countries. Reports indicate even Donald Trump’s calls were swept up. See WSJ: Chinese Spies Hit More Than 80 Countries; Trump’s Calls Swept Up. See Defense One for the 80-country scope: Salt Typhoon targeted 80+ nations. (The Wall Street Journal, Defense One)

Carriers have not told most victims, and officials admitted they haven’t fully evicted the intruders. See Ars Technica: AT&T/Verizon not notifying most victims. See The Verge on officials urging encrypted apps post-breach: Use encrypted messaging after Salt Typhoon. (Ars Technica, The Verge)

This isn’t rumor: CISA/NSA/FBI published joint advisories on the sister campaign Volt Typhoon, detailing how PRC actors camp in U.S. critical infrastructure. Read CISA: PRC-sponsored Volt Typhoon activity alert. And UK NCSC’s document tying recent ops to Salt Typhoon tradecraft: NCSC multinational advisory (PDF). (CISA, NCSC)

Connect the dots: If state actors live inside telecom backbones, what does that imply for phone-tethered wallets and SMS-based verification that protect access to them? If a president’s calls can be hoovered, your digital wallet traffic isn’t sacred.

5) What this means for you (and what to do now)

- Assume the rails are hostile. Treat the phone as a convenience layer, not a sovereignty layer. Minimize reliance on SMS for authentication; prefer hardware keys or app-based, offline-seed wallets for any serious capital. (Officials literally advised encrypted apps after Salt Typhoon; see link above.) (The Verge)

- Diversify out of custodial stablecoins. The GENIUS framework invites mass adoption—along with switchesregulators (or bad actors) can flip. If you must use stablecoins, keep balances transient, not strategic. Parking savings in custodial tokens on a phone is counterparty risk + telecom risk.

- Keep a non-digital core. The more they push a phone-centric money model, the more physical hedges matter—allocations to gold/silver outside the app layer. You want assets that don’t depend on the same networks Salt Typhoonjust showed they can compromise.

- Prepare for ISO-aligned enforcement. Once ISO 20022 flips fully in Nov 2025, back-office harmonization makes it easier to throttle flows in the name of “security” or “sanctions.” Plan your liquidity and access before the switch. See SWIFT timing: Nov 22, 2025. (Swift)

The bottom line

They told you stablecoins would “modernize” money. The GENIUS Act did more than that—it institutionalized digital cash and put it on rails that are efficient for clearing…and convenient for control. Meanwhile, Salt Typhoon proved the communications layer that your wallet depends on is permeable. When your bank branch is your phone, and your phone rides networks adversaries inhabit, your wealth is only as safe as the least-secure hop. That’s the battlefield—right now.

Take Action Today

- Free guide — Seven Steps to Protect Your Bank Accounts

- Special hardcover — The End of Banking as You Know It by Bill Brocius ($19.95)

Remember: control the money, control the people. Free the money, and you free yourself.