The Inverted Yield Curve Yields the Trade of the Century

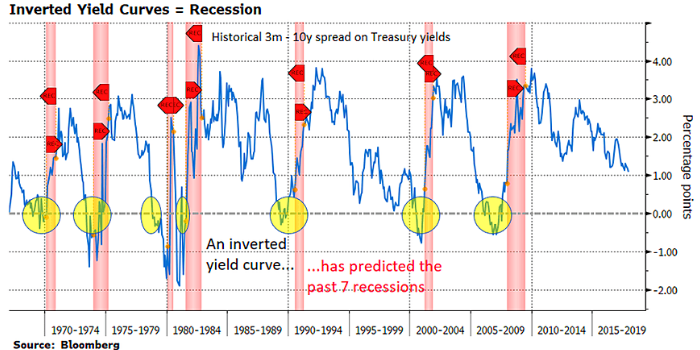

An inverted yield curve is a near-perfect warning signal that a recession is on the horizon.

It tells us that the “natural order of things” in which the future holds more uncertainty than the present has been reversed.

To bondholders, greater uncertainty typically translates into higher yield as a form of compensation for risk.

But when a yield curve inverts, short-term bondholders are compensated more than long-term bondholders, as near-term uncertainty far outweighs the longer-term outlook.

And that’s what happened in the bond market last week: yield for the 10-year Treasury slipped below the 3-month yield for the first time since 2007.

For the Federal Reserve, the inversion of the 3-month and 10-year spread is a preferred measure, for it has exhibited the highest levels of historical correlation to a following recession.

For most investors, it’s an omen for economic winter’s first signs of deep frost.

The conventional economy may look grim, but for those who don’t rely solely on returns from conventional assets (i.e. stocks and bonds), the coming blizzard yields great investment opportunities for those who are prudent enough to pay attention.

In a recent Bloomberg article, Crescat Capital LLC, a top performing hedge fund with a history of outperforming the S&P 500, warned that corporate “insiders” are beginning to sell stocks hand over fist in anticipation of the coming global freeze.

The “trade of the century” is to buy gold while selling (or selling short) stocks and other risk assets, they conclude.

When corporates begin selling heavily into the peak of public exuberance, it sets the gears in motion for a massive stock bubble burst.

It happened in 2017 and again toward the end of 2018. As Crescat states in a letter to clients over the weekend, “the third time should be the charm for the stubborn U.S. market.”

As the US and global economic data continue to deteriorate, with inversions remaining across the Treasury yield curve, the current “buy the dip” mindset that has driven much of the 13% rebound in global stocks in 2019 will eventually lose steam.

Exuberance turned greed will turn into fear. Fear will beget selling. Selling will beget even more selling. And selling will trigger panic across the markets.

This is how bubbles burst. It’s how stock markets collapse. It’s the boat that investors always seem to miss...on the way down, and on the way up.

And as you know, bear markets have almost always preceded economic recessions. But the timing of a recession after a bear is also never consistent.

So, does an inverted yield curve signal immediate danger? No, it doesn’t.

Historically, you have around 18 months before the onset of a full-blown recession.

But the markets, global economy, and geopolitics--all moving parts in this dance of semi-predictable outcomes and indeterminate consequences--may bring the current episode to a close much sooner than we think.

The exact timing of the recession or the bear preceding it cannot be predicted, just anticipated.

Humans may not have the gift of prognostication, but all humans are endowed with the capacity for wisdom and prudence.

Rather than submitting to fear (particularly if you hold large equities exposure) or greed (if you’re planning on shorting the market), a smarter and more tempered approach may yield better results.

Since the 1930’s bear markets have averaged around 16 months. That’s not very long. Bull markets have averaged around 57 months.

The point is not only to hedge against stock market declines and recessions but to seek growth during both phases of the market cycle.

Many investors turn to bonds and fixed-income. But neither of those assets can protect you from the erosive effects of inflation.

Gold and silver, on the other hand, can do all three--hedge against economic downturns, provide growth when all other equity-driven assets fall, and preserve your purchasing power when inflation rises.

At the same time, you will want to position yourself for the next bull market.

Perhaps the most conservative play is to continue holding on to most of your assets and dollar cost averaging your portfolio, but this time allocating a healthy portion of your money to gold and silver.

The most aggressive way to exploit this “trade of the century” is to convert your stocks to gold and silver and to go short equities...essentially, what many institutional investors are now doing. But going short entails a great degree of risk and active trade management.

There is a third approach: buying silver and gold according to the cyclical shift in the gold/silver ratio. We covered this in a previous article and suggest that you read it to fully take advantage of a much more advanced approach to precious metals investing.

In any case, the current economic environment presents you with several opportunities to hedge, seek growth, and preserve capital.

How you choose to exploit this “trade of the century” will determine just how wealthy you will become once the storm breaks.