THE MAR-A-LAGO ACCORD GOES LIVE MAY 16TH: AMERICA'S PLAN TO RESET THE GLOBAL FINANCIAL ORDER?

🔍 What Is the Mar-a-Lago Accord?

The Mar-a-Lago Accord is a theoretical economic strategy, not a signed agreement—yet. Coined in 2024 by financial strategist Zoltan Pozsar and further shaped by Trump-aligned economist Stephen Miran, this strategy takes inspiration from the 1985 Plaza Accord, where several nations cooperated to weaken the dollar.

But this time, there’s no cooperation—just strategic U.S. leverage. The Mar-a-Lago Accord proposes that the U.S. use its economic, trade, and military power to restructure the global financial system on terms favorable to American industry. The pivot becomes especially urgent given May 16th, the date now circulating as the possible kickoff for early implementation.

This involves:

- Weakening the U.S. dollar

- Lowering the interest payments made on U.S. debt (especially to foreign holders)

- Pushing allies to fund their own military protection

It’s a sharp turn from the post-WWII system, signaling that countries must now contribute more—or lose access to U.S. protection and trade benefits.

⚙️ Why This Strategy Is Emerging

The foundation of this shift is rooted in the belief that America’s economic strength has been hollowed out by a strong dollar and global overreach. Key points:

- A strong dollar makes American products too expensive to compete abroad while making cheap imports flood U.S. markets.

- The U.S. bears an outsized cost of global defense, footing the bill for NATO and military presence in Asia.

- Foreign nations benefit from the dollar’s reserve status, using trade surpluses to buy U.S. debt and earn interest—without contributing proportionally to global security.

The Mar-a-Lago Accord flips this structure. The aim is to:

- Boost U.S. manufacturing by reducing the dollar’s strength

- Use tariffs to support local industry

- Push foreign governments to fund their own military obligations

- Pressure Treasury bondholders into accepting lower returns, especially as the U.S. explores longer-dated debt like 100-year bonds

And again, with May 16th looming, these ideas may soon move from theory into action.

📉 What We’re Already Seeing

Even before May 16th, several developments align with this strategy:

- Tariffs are driving foreign firms to relocate manufacturing to the U.S.

- NATO cost-sharing is increasing, especially as U.S. threats to withdraw become more credible.

- Currency pressures reflect investor skepticism. Just the talk of this doctrine is already pushing money out of dollar assets.

- Debt restructuring concepts—as discussed by Miran—include lowering interest rates paid to foreign holders or extending the maturity of U.S. debt obligations to reduce short-term payment burdens.

These are not coincidences. They are clear indications that this policy framework is being tested—and could become formalized starting May 16th.

🧨 What Could Go Wrong?

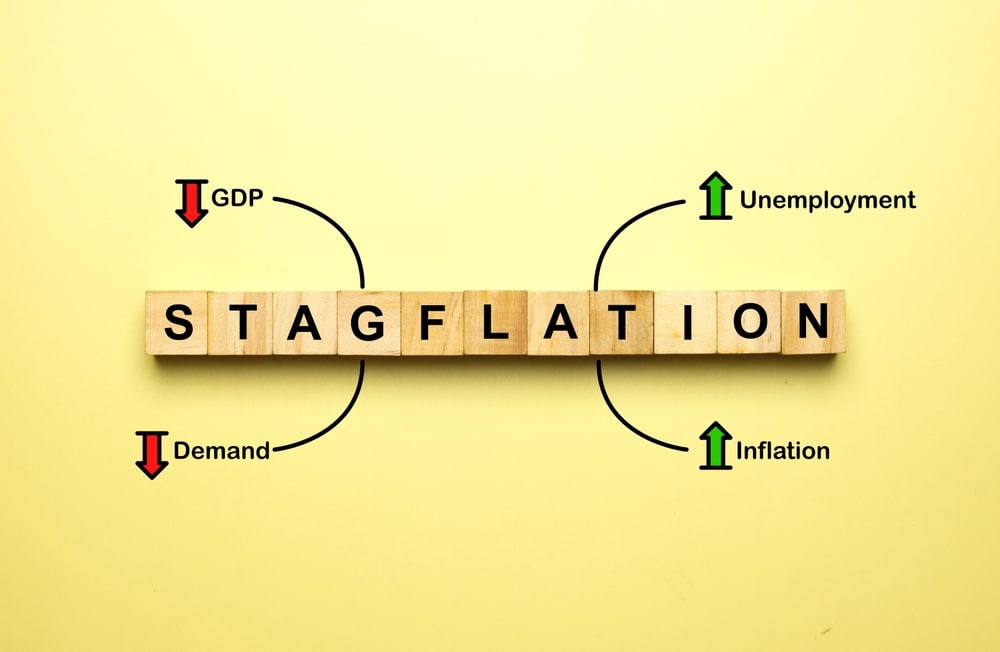

If this plan moves forward in full after May 16th, it could lead to major disruptions:

- Bond market turbulence if the U.S. adjusts repayment terms on its debt

- Foreign sell-offs of U.S. Treasuries due to declining confidence in repayment or returns

- Global capital realignment, as investors seek more stable and transparent environments outside the U.S.

- Accelerated de-dollarization, with countries diversifying into gold, the Chinese yuan, the euro, or digital currencies

These risks are real. If confidence in U.S. financial credibility is shaken, the effects could be immediate and global.

🪙 How to Prepare

If this new doctrine starts taking effect—especially with a May 16th launch date—the financial system could shift quickly. Here’s how to protect your savings and investments:

1. Invest in Tangible Assets

Gold and silver are historically reliable during times of currency devaluation or monetary instability.

- Physical gold and silver bullion for long-term protection

- Platinum and palladium for added upside due to industrial demand

2. Reduce Dollar Exposure—Shift to Real Money

If the dollar weakens or the U.S. restructures its financial commitments, holding dollar-based assets becomes a liability. The most effective way to protect your wealth is by converting a portion of your savings into real, tangible assets that governments can’t print.

- Gold and Silver are time-tested stores of value, trusted for thousands of years during currency collapses and financial resets.

- These metals don’t rely on a central bank’s promise or political stability—they hold value on their own.

This isn’t just a hedge—it’s a way to reclaim financial independence from a system built on debt and devaluation.

3. Limit Long-Term U.S. Treasury Holdings

If the U.S. attempts to restructure its debt, long-term bondholders could suffer first.

- Short-duration U.S. Treasuries or TIPS

- Global bond strategies to diversify interest-rate risk

4. Watch for Shifts in Global Power

As the dollar weakens, nations like China and groups like BRICS may gain more economic influence.

- Keep track of global trade alliances and central bank moves

- Understand that geopolitical decisions could have a larger impact on markets than traditional metrics

🚨 Final Thoughts

The Mar-a-Lago Accord, whether officially announced or gradually implemented, represents a dramatic shift in U.S. strategy. With May 16th now cited as a potential launch date, there’s little time left to prepare.

If these changes take hold, the dollar’s global role may decline, and those holding dollar-based assets could find themselves exposed. That’s why it’s critical to shift toward real assets, diverse international exposure, and financial independence.

📥 Take Action Now

👉 Download Bill Brocius' FREE eBook: "Seven Steps to Protect Yourself from Bank Failure"

👉 Subscribe to Dedollarize Alerts & Reports: Stay Informed

Don’t wait for the headlines on May 16th. The shift may already be underway.