The "Mother of All Bubbles" Is About to Burst

America’s Debt-Driven Delusion

The United States isn’t thriving—it’s overdosing. According to Ruchir Sharma, chair of Rockefeller International, the so-called “mother of all bubbles” is about to pop, and it’s not a matter of if, but when. This bubble of “American exceptionalism” has been pumped full of hot air by unsustainable levels of government debt. Sharma warns that the growing addiction to deficit spending will kneecap economic growth and corporate profits, leading to a reckoning that could shatter the fragile illusion of U.S. dominance.

Sharma laid it all out in a Financial Times column, peeling back the façade of Wall Street's bullish narrative. Tech giants and bloated government spending may give the appearance of stability, but strip away the artificial props, and what remains is a financial house of cards. The U.S. is borrowing $2 for every $1 of GDP growth, up 50% in just five years. That’s not an economy—it’s a ticking time bomb.

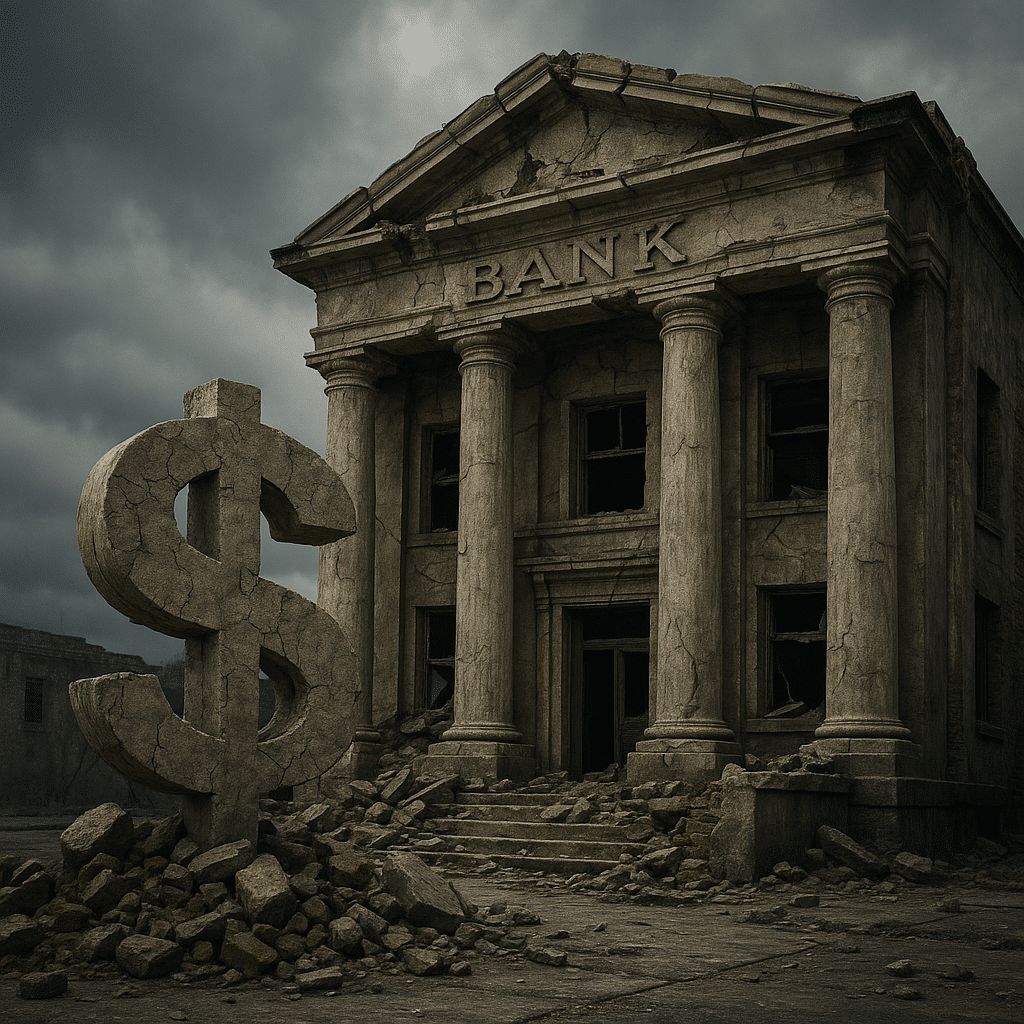

Debt Levels Unseen Since WWII—Without the Excuse of a Global Crisis

Here’s the kicker: U.S. debt levels are now around 100% of GDP and climbing. The last time we saw this kind of debt-to-GDP ratio was after World War II. But back then, America had just finished saving the world. Today? There’s no global catastrophe, no post-war rebuilding effort—just runaway spending and corporate greed.

To service this debt, the government is now paying $1 trillion annually in interest—more than it spends on defense. Let that sink in. We’re bleeding money just to stay afloat, and the more we borrow, the more this vicious cycle accelerates.

Meanwhile, Wall Street cheerleaders point to robust GDP growth, revised up to 3.1% in the third quarter. But don’t be fooled. Sharma exposes how this growth is artificially inflated by deficit spending, masking the underlying rot.

The Inevitable Collapse

Every empire has its Achilles’ heel, and America’s is its unsustainable addiction to debt. While U.S. households and companies might look fine for now, the cracks are already forming. Sharma predicts that next year, markets will demand higher interest rates on U.S. debt, forcing Washington to curb its spending addiction. That’s when the house of cards collapses. Growth slows, profits tank, and the average American is left holding the bag.

Bond giant Pimco is already bailing, reducing its exposure to long-term U.S. bonds over concerns about soaring debt. Foreign economies like China or Europe could also mount a comeback, further eroding America’s precarious position.

And if history is any guide, the late stages of a bubble are the most dangerous. Over the past six months, U.S. stock prices have skyrocketed, outpacing global markets by a margin unseen in 25 years. But when you’re flying that high, it only takes a small gust to stall the engines.

The Final Warning

Sharma calls it: the end is near for America’s bubble of “exceptionalism.” This isn’t just another market correction; it’s a systemic implosion fueled by decades of arrogance, greed, and short-term thinking.

Don’t wait for the mainstream media to tell you it’s time to panic—they’ll be too busy reassuring you while the ship sinks. Take action now to protect your assets, question the narratives, and prepare for the inevitable fallout.

Call to Action

Download Seven Steps to Protect Yourself from Bank Failure by Bill Brocius today. Arm yourself with the knowledge to survive the coming storm: Click Here.

Stay vigilant. Stay free.