The Next Crash Is Already Wired In: How Trump's Mortgage Shift and Tax Boom Set the Stage for Financial Surveillance

A Fragile Mortgage Market Is Being Weaponized—Again

Let’s start with the 35-group coalition warning the Federal Housing Finance Agency (FHFA) about looming disaster. They’ve raised alarms that Trump’s plan to let lenders choose between different credit score models could ignite a 2008-style collapse—and they’re right to be worried. This Weaponized Mortgage Market Collapse is exactly how financial instability gets normalized before it detonates across the entire economy.

When you decouple credit from standardized risk metrics, you don’t create opportunity—you create uncertainty. And uncertainty in a market propped up by Fannie Mae and Freddie Mac means taxpayer bailouts are back on the table.

This isn’t “innovation.” This is regulatory roulette. It’s déjà vu for anyone who remembers how government-sponsored experiments with subprime mortgages detonated the economy in 2008. Now they’re teeing up round two—with more complexity, less transparency, and all the systemic risk you can’t see until it’s too late.

Transparency Denied: Who Benefits From Hidden Data?

The coalition also demanded that the FHFA release the validation data behind these new credit models—and surprise, they haven’t. Why would they? The last thing any of these bureaucrats want is the public asking real questions.

Secrecy is currency in this new financial architecture. When data is buried, risk is mispriced. And when risk is mispriced, catastrophe is inevitable. But this isn’t just incompetence—it’s strategic. Keep the public in the dark while quietly laying the groundwork for programmable money and total financial traceability.

A Boom Built on Gimmicks: Tax Refunds as Bait

While the mortgage market is being rewired behind closed doors, Treasury Secretary Scott Bessent is out here selling the dream. He’s touting the Trump administration’s “One Big Beautiful Bill Act” as the reason Americans will see “substantial refunds” and bigger paychecks in 2026.

Sounds great, right? Until you remember that massive refunds = more government control over your income. The administration is effectively saying: “Don’t worry, we’ll give you back some of the money we took.” That’s not reform—that’s bait.

Worse, they’re pairing it with a push to create “Trump accounts”—government-managed investment vehicles for kids born between 2025 and 2028. You read that right. The same government that couldn’t balance a checkbook wants to manage your child’s financial future.

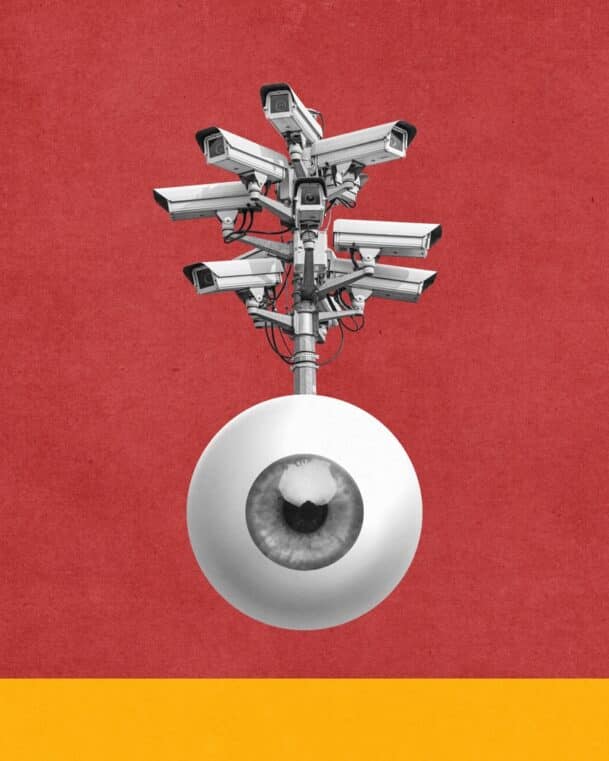

The Real Game: Surveillance Disguised as Stimulus

Let’s connect the dots:

- The mortgage market is being quietly deregulated in a way that increases systemic fragility.

- Tax refunds are being amplified to create the illusion of prosperity—but they’re funded by debt and inflation.

- The federal government is expanding its financial footprint with “Trump accounts” and likely programmable benefits tied to behavior.

This isn’t a boom. This is the on-ramp to CBDCs—Central Bank Digital Currencies that will replace cash, monitor transactions, and enforce compliance through programmable controls.

They sell it as “financial innovation.” In reality, it’s digital feudalism—a system where the government is landlord, employer, and banker all in one. And once cash is gone and the grid is digital, opting out won’t be an option.

What You’re Not Being Told: This Is the New Financial Order

Both of these stories—the mortgage shakeup and the refund bonanza—are part of a larger strategy to transition America into a cashless, surveillance-driven economy.

And here’s the kicker: it doesn’t matter who’s in office. Whether the controls are rolled out in red, blue, or bipartisan packaging, the destination is the same—financial dependency enforced by digital code.

They’ll say it’s to prevent fraud. To help the poor. To increase fairness. But what it really does is eliminate anonymity, decentralization, and freedom. And once programmable money is the norm, your spending will be a reflection of your obedience.

The Call to Action: Opt Out Before You’re Locked In

You can’t stop this with a vote. You can’t wait it out. You have to arm yourself with knowledge and take proactive steps to preserve your financial autonomy while you still can.

That’s why you need to read the Digital Dollar Reset Guide by Bill Brocius. This isn’t a suggestion. It’s required intelligence for anyone who refuses to be caught flat-footed when the next crisis hits—and it will. Whether it’s sparked by mortgage defaults or “Trump accounts” turning into CBDCs, the writing is on the wall.

Download the guide now and learn how to secure your assets, exit the surveillance grid, and reclaim control over your money before it’s too late.