The SEC's Abuse of Power Under Biden's Watch

Score one for 'the law'...

In mid-March, a federal judge in Utah took the extremely unusual step of sanctioning the SEC, saying that the regulator abused its authority in a case against crypto platform Digital Licensing Inc., known as DEBT Box.

The SEC’s conduct “constitutes a gross abuse of the power entrusted to it by Congress and substantially undermined the integrity of these proceedings and the judicial process,” Robert Shelby, a federal district court judge in Salt Lake City, said in an 80-page legal filing on Monday.

He also ordered the agency to pay DEBT Box’s attorney’s fees and other costs related to the restraining order that the regulator had sought against the crypto platform.

The SEC sued DEBT Box in July 2023, accusing the crypto platform of defrauding investors of at least $49 million. The same month, Shelby froze the company’s assets and put the company into receivership at the SEC’s request.

However, the freeze was later reversed after the court found that the SEC may have made “materially false and misleading representations” in the process.

A month later, and Bloomberg reports, according to people familiar with the matter, that two SEC lawyers - Michael Welsh and Joseph Watkins - stepped down this month after an SEC official told them that they would be terminated if they stayed.

The pair were lead attorneys on a case against DEBT Box.

The judge had faulted arguments from Welsh, the SEC’s lead trial attorney on the matter, and evidence provided by Watkins and his team.

Watkins was the agency’s lead investigative attorney on the case.

In one instance, Welsh told the judge that Draper, Utah-based DEBT Box was closing bank accounts and transferring assets overseas.

The court found that this wasn’t happening.

An SEC investigator later said that a miscommunication led to the error, and Welsh apologized to the court.

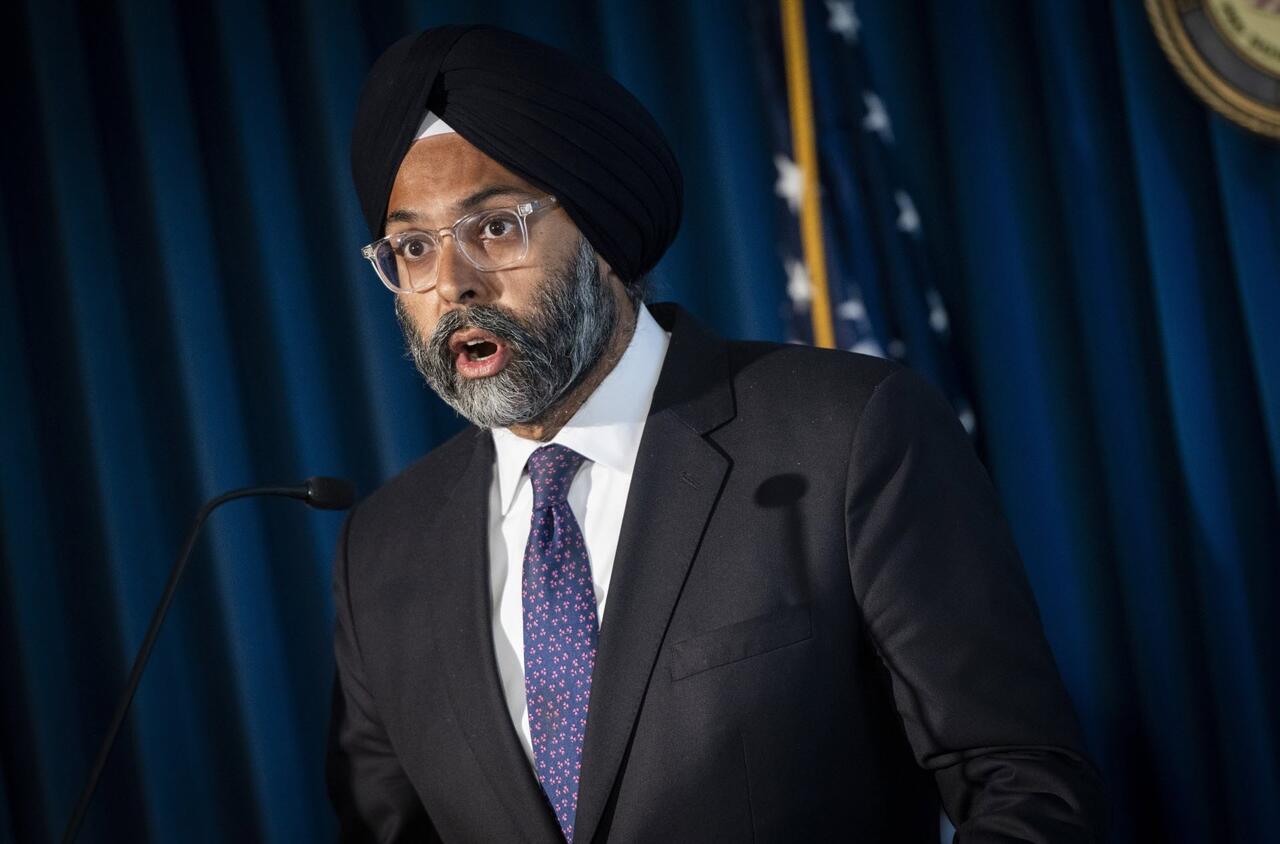

SEC enforcement chief Gurbir Grewal apologized to the court for his department’s conduct.

Gurbir Grewal

He said that he had appointed new attorneys to the case and mandated training for the agency’s enforcement staff.

Last week, attorneys for DEBT Box and other parties filed motions requesting that the SEC pay more than $1.5 million in fees and other costs incurred in the case.

This article originally appeared on Zero Hedge