The Silent Credit Rot: How Regional Banks’ Hidden Weaknesses Could Crush the Economy—and You

The Regional Banking Industry: On the Edge

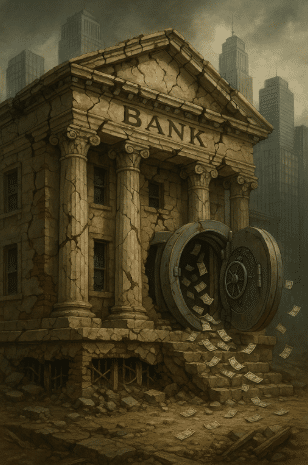

Cracks in the Foundation

The façade is starting to slip. What once looked like a relatively stable landscape of regional lenders has been pierced by a series of gut punches: sour loans, exposure to bankrupt companies, and even fraud. Banks like Zions are revealing tens of millions in losses tied to borrowers once assumed to be solid. That kind of exposure isn’t just a bad quarter—it’s a signal that their internal risk controls were either asleep at the wheel or hopelessly optimistic.

Collapsing Margins and Tightened Credit

Regionals already operate on thinner margins than their “too-big-to-fail” cousins. New losses tighten those margins even further, leaving them vulnerable to shocks, short-term funding stress, and regulatory fire. They’re now circling the wagons, and that means one thing: lending is about to dry up.

Lending Deserts and Vanishing Capital

Riskier borrowers—especially those in the small business sector or speculative industries—will be the first to feel the freeze. Banks that once competed aggressively to fund local projects and emerging businesses are shifting gears. With confidence low and auditors sharpening their knives, lending desks are slamming the brakes.

Regulatory Crackdown and Institutional Decay

Legal Reviews and Public Damage Control

These revelations have stirred regulators from their slumber. Internal reviews are underway. More stringent stress testing is almost inevitable. When institutions like Zions openly admit they’ll be encouraging outside legal counsel to comb through their books, you know things are going south. Regulatory pressure is coming, and for many smaller institutions, it could be the final nail in the coffin.

Mergers, Acquisitions, and Market Capture

Some of these banks won’t survive. They’ll be bought out by larger players, absorbed into mega-bank portfolios, or simply close their doors. What that means is fewer options for depositors, less local control over financial resources, and a power vacuum that Wall Street will gladly fill. The regional banking sector isn’t just in trouble—it’s facing potential extinction through attrition and acquisition.

The Rise of Zombie Banks

And if they don’t get bought out? Expect “zombie banking” to re-emerge: institutions that refuse to acknowledge losses, roll over toxic debt, and limp forward under a cloud of denial. That kind of slow-motion decay poisons the system, suppresses innovation, and hides systemic risks behind accounting games and regulatory forbearance.

The Broader Economic Fallout

A Squeezed Economy

The damage doesn’t stop at the bank lobby. A retrenchment in regional banking means a constriction of credit across the broader economy. When loans dry up, expansion halts. Businesses can’t grow. Consumers can’t borrow. Projects get canceled. That, in turn, slows GDP, puts pressure on jobs, and kicks the legs out from under economic recovery narratives.

A Web of Interconnected Fragility

The risk isn’t just about the banks themselves. These institutions are intertwined with hedge funds, non-bank lenders, and private credit markets that are notoriously opaque. That $4.5 trillion in exposure flagged by the IMF? It’s a ticking bomb. If the failures spread across that web, the dominoes don’t stop at the regional level—they ripple into global finance.

Central Bank Tightrope

The Federal Reserve, already walking a tightrope between inflation control and economic stability, may soon be forced into action. But that’s a trap too. Cutting rates or adding liquidity might stabilize some institutions—but it risks reigniting inflation or creating more speculative bubbles. Meanwhile, doing nothing could allow rot to spread until it reaches systemic scale.

Wealth Destruction in Real Time

Markets don’t like uncertainty. And when asset valuations come under pressure—whether through falling bank stocks, collapsing real estate prices, or investor withdrawals—the wealth destruction can be swift. Those with 401(k)s, mutual funds, or real estate portfolios aren’t insulated. They're directly exposed.

The Confidence Crisis: One Whisper Away

Trust Is the First to Die

Public confidence, always fragile, is now in the crosshairs. We’ve seen it before—when depositors fear that their money isn’t safe, they move it. And that kind of perception shift can kill a bank faster than a balance sheet ever could. A whisper campaign, a few headlines, a tweet—and the withdrawals begin. This is how bank runs start, even in the digital age.

How This Hits Everyday Americans

Credit Denied, Dreams Deferred

This storm isn’t confined to Bloomberg terminals or hedge fund offices. It’s coming to your front porch. As banks pull back, everyday people will be the first to suffer. Getting a small business loan will become a bureaucratic nightmare. Interest rates will rise. Approvals will slow. And if your credit isn’t perfect? Good luck.

Jobs on the Chopping Block

If you’re an entrepreneur, expect fewer funding options. If you’re trying to buy a car or expand your business, lenders may start moving the goalposts. Collateral demands, higher rates, tighter documentation—they’re all coming. And what happens when businesses can’t get capital? They freeze hiring. They cut staff. They delay raises. That pain rolls downhill into communities that rely on those jobs and those wages.

Housing Market Squeeze

Housing won't escape either. Regional banks have traditionally serviced local mortgage markets, especially in rural and suburban areas. As those banks falter or get absorbed, the mortgage options dwindle. That leaves borrowers at the mercy of big banks and the whims of macroeconomic winds.

Local Bank Closures and Community Decay

Some local branches will close. Entire counties may be left with no physical banking presence. That’s a death sentence for small-town economies that depend on regional banks for agricultural loans, equipment financing, and general commerce.

Your Retirement and Investments Are Next

And all the while, your investments are at risk. Retirement funds, real estate holdings, college savings—they're tied to this system. When confidence breaks and volatility rises, asset values drop. It might not be a crash, but it’ll feel like one if your nest egg takes a 20% haircut.

Final Word

This isn’t fearmongering. This is reality. The same one we saw in 2008, in 2020, and again now—where warning signs appear, get ignored, and then explode. Regional banks were once the backbone of local economies. Today, they’re looking more like liabilities waiting to ignite the next crisis.

Don’t wait for the headlines to confirm it. By then, it’s already too late. Understand where your money is. Diversify your risk. Keep your liquidity. And above all, prepare. The rescue teams will not be dispatched to your neighborhood. You’re on your own.

Download "Seven Steps to Protect Yourself from Bank Failure" by Bill Brocius to protect what’s yours before the system eats it alive. Get it here with this link.