The Silver Squeeze Is Here: Why Silver’s Bull Market Is About to Shock the World

Let’s not sugarcoat it: we are living in a rigged system. The big banks, the unelected bureaucrats, the corporate media—they’ve all been working overtime to suppress the true price of silver. They’ve dumped mountains of “paper” contracts onto the market to keep you distracted, to keep you thinking fiat currency is “money.”

But the jig is up.

I’ve been studying silver for over four decades, and I haven’t seen a setup this bullish since the late ‘70s, when my old man scraped together every dime he had to buy silver rounds before the Hunt brothers sent prices to the moon. He understood the same basic truth I’m telling you now: when governments devalue paper money, real assets rise.

And that’s exactly what we’re witnessing.

Silver Finally Breaks Its Chains

For over a year, silver was pinned down under a massive wall of resistance between $32 and $35 an ounce. Every time it tried to break out, the bullion banks slammed it back down with aggressive short-selling—think of it like a beach ball they kept forcing underwater.

But you can only hold that beach ball under for so long.

Last month, silver blasted right through that resistance zone, closing in on $39 an ounce with a 4.4% surge in a single trading day. That was your first flashing neon sign that the bull market had officially begun.

Even more telling, silver priced in euros also ripped through its own resistance levels—proving this isn’t just about a weakening U.S. dollar. This is global.

I also track something called the Synthetic Silver Price Index (SSPI), which blends gold and copper to sniff out whether silver is lagging or about to leap. The SSPI just broke out of its trading range—confirming this rally has legs.

Copper and Gold Are Sending the Same Signal

Copper—a key industrial metal—just smashed through a $5.20 ceiling that held for years. Historically, when copper leads, silver follows.

Gold has been consolidating, like a boxer catching his breath between rounds. But the moment gold clears $3,500 an ounce, you’ll see a double-barreled boost for silver.

And if you think gold’s been strong, wait until you see what happens when silver finally starts closing the historic gap between the two. The gold-to-silver ratio is still sitting around 87. If it merely reverts to the 100-year average of 53, silver could shoot up past $60 an ounce—even if gold does nothing.

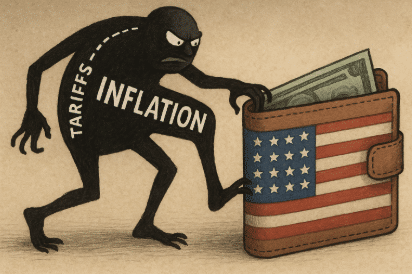

The Dollar Is Crumbling, and That’s Bullish for Real Assets

One of the most important drivers behind this breakout is the U.S. dollar quietly slipping beneath critical support levels. The Dollar Index falling below 100 is no small potatoes—it’s a major crack in the foundation.

Remember, the dollar is a currency that loses value every time Washington decides to bail someone out or fund another trillion-dollar boondoggle. It’s like driving a used car that leaks oil—you know it’s going to break down, it’s just a question of when.

When the dollar falls, real assets—especially precious metals—rise.

A Perfect Storm: Historic Demand Meets Shrinking Supply

If you’ve been following me for a while, you know I’m a big believer in Economics 101: supply and demand.

On the demand side, you’ve got industrial use exploding—especially for solar panels. Silver’s role in clean energy has never been bigger. Demand for photovoltaic applications alone has nearly tripled in four years.

On the supply side, mine production peaked years ago. The cheap silver is gone. What’s left costs more to extract, and there’s less of it to go around.

This deficit isn’t some blip on a chart—it’s been growing for five straight years. Last year alone, we saw a shortfall of 182 million ounces. This year, we’re on pace for another deficit, and above-ground inventories are evaporating.

The Banks’ Massive Naked Shorts Could Trigger a Short Squeeze

Now here’s where things get really interesting—and where the mainstream financial media refuses to look.

The bullion banks have been sitting on a monster net short position of over 260 million ounces of silver—much of it naked, meaning they don’t actually have the metal to deliver if someone calls their bluff.

Every dollar silver moves higher, they lose hundreds of millions of dollars. When they start to panic and buy back those shorts, that buying pressure compounds, sparking what’s called a short squeeze.

If that happens, we could see silver rip past $50… $70… maybe even higher.

And don’t forget: for every ounce of physical silver, there are hundreds of ounces of “paper” silver contracts floating around in futures and other derivatives. If even a fraction of those holders demand real metal, the scramble will be unlike anything we’ve seen in our lifetimes.

Why Silver Mining Stocks Could Go Parabolic

I know many of you prefer physical bullion—and I agree, it’s the bedrock of any sound wealth plan. But if you’ve got a higher risk tolerance, silver mining stocks are where you can see life-changing gains.

Many of the best-run silver producers have been quietly positioning themselves for this moment. As silver prices climb, these companies could see revenues—and share prices—explode.

Junior miners, in particular, are still lagging behind—but once they break out of their long-term patterns, it’s game on. The juniors are the rocket fuel in a silver bull market.

Final Thoughts—and a Word of Urgency

Look—if you’ve been waiting for a signal that it’s time to act, this is it.

Silver is no longer the ignored stepchild of the metals market. The manipulation is losing its grip. The fundamentals are undeniable. And the upside potential is massive.

Don’t wait for the headlines to tell you what’s happening after the fact. When silver is trading above $50 and the banks are scrambling, it’ll be too late to buy physical metal without paying an outrageous premium.

If you want to protect your purchasing power—and maybe even build real wealth—this is your window.

Download Bill Brocius’ free eBook “Seven Steps to Protect Yourself from Bank Failure” right now and learn how to build a fortress around your savings: Download the Free eBook

Subscribe to Dedollarize News and get my latest updates on precious metals and anti-establishment financial strategies straight to your inbox: Subscribe Here

Stay sharp out there—because the times we’re in demand it.