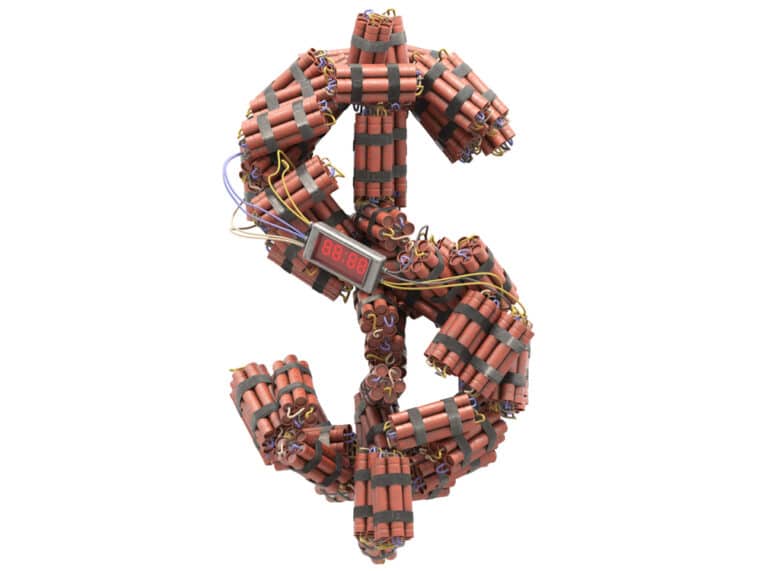

The Timeline is Set: BRICS to Abandon US Dollar by 2026

The BRICS economic alliance’s New Development Bank has announced its plans to fully abandon the US dollar in the next 3 years. The collective has further integrated the necessary methods to replace the greenback as a reserve currency soon.

At the bloc’s 2023 annual summit, it announced its first expansion effort that saw Iran, Egypt, Ethiopia, and the United Arab Emirates (UAE) join its ranks. This year is expected to see another expansion plan take place, with nations lining up to be a part of its de-dollarization plans.

BRICS to Completely Ditch Greenback by 2026

The BRICS economic alliance has not been shy about its hopes for a multipolar world. Moreover, they have not stopped building up their ranks to further equip that goal. A massive part of those efforts is the promotion of its own currencies, over those weaponized by the West.

The grouping is set to take a massive step forward in that regard. BRICS has announced its plans to fully ditch the US dollar in the next 3 years. The plan will see the integration of local currencies and should be furthered by the independent payment system project that could be unveiled this year.

Source: Bloomberg

Source: Bloomberg

China and Russia have orchestrated the move away from the dollar. Recent rumblings have suggested that Saudi Arabia could also abandon the greenback in oil trades. The move would have massive ramifications for the currency. Riiyahd is rumored to settle such trades in the yuan, with China buying over 20% of the country’s oil exports.

Saudi Arabia was among the list of five countries that accepted an invitation to join BRICS last year. It is also working alongside China to create an mBridge to facilitate cross-border payments in CBDCs. These developments could all emerge as threats to the dollar’s position atop global finance.

This article originally appeared on Watcher Guru.