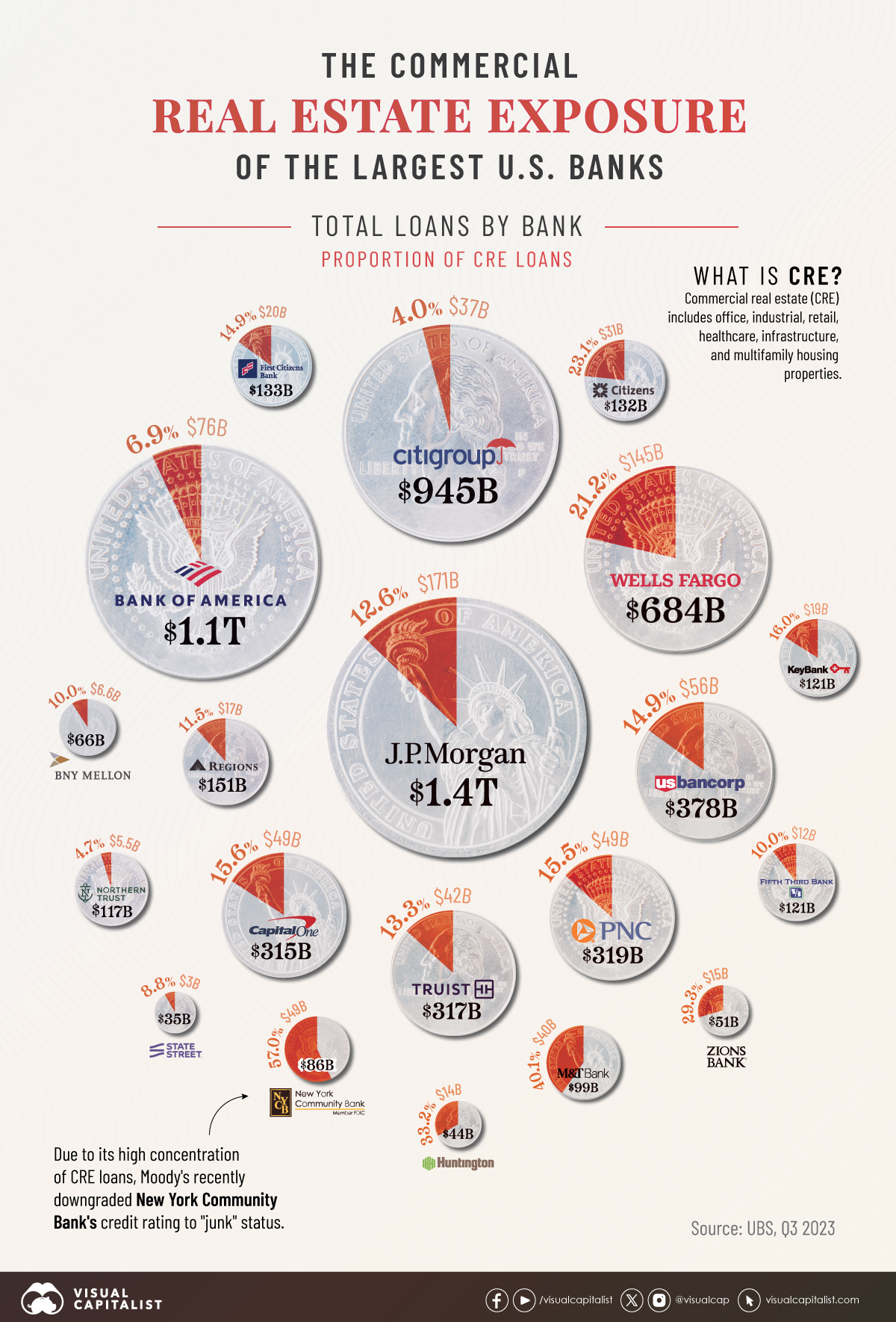

This Infographic Shows Why Regional Banks Are On the Brink of a Major Real Estate Crisis

U.S. Banks by Commercial Real Estate Exposure

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

The six largest U.S. banks saw delinquent commercial property loans nearly triple to $9.3 billion in 2023 amid high vacancy rates and increasing borrowing costs.

Today, the sector is facing greater scrutiny from regulators amid growing risks to bank stability. In fact, for almost half of all U.S. banks, commercial real estate debt is the largest loan category overall. While commercial loans are more heavily concentrated in small U.S. banks, several major financial institutions have amassed significant commercial loan portfolios.

The above graphic shows the commercial real estate exposure of the top U.S. banks, based on data from UBS as of Q3 2023.

Top 20 U.S. Banks by Assets: Commercial Property Exposure

Here are the commercial property loans across the largest U.S. banks by assets as of the third quarter of 2023:

| Bank | Total Assets | Total Loans and Leases |

Total Commercial Real Estate Loans |

Share of Total Loans |

|---|---|---|---|---|

| JPMorgan Chase & Co. | $3.9T | $1.4T | $171B | 12.6% |

| Bank of America Corp | $3.2T | $1.1T | $76B | 6.9% |

| Citigroup Inc. | $2.2T | $945B | $37B | 4.0% |

| Wells Fargo & Company | $1.9T | $684B | $145B | 21.2% |

| U.S. Bancorp | $668B | $378B | $56B | 14.9% |

| PNC Financial Services Group, Inc. | $557B | $319B | $49B | 15.5% |

| Truist Financial Corporation | $543B | $317B | $42B | 13.3% |

| Capital One Financial Corp | $471B | $316B | $49B | 15.6% |

| Bank of New York Mellon Corp | $405B | $66B | $7B | 10.0% |

| State Street Corporation | $284B | $35B | $3B | 8.8% |

| Citizens Financial Group, Inc. | $226B | $132B | $31B | 23.1% |

| First Citizens BancShares, Inc. | $214B | $133B | $20B | 14.9% |

| Fifth Third Bancorp | $213B | $121B | $12B | 10.0% |

| M&T Bank Corporation | $209B | $99B | $40B | 40.1% |

| Keycorp | $188B | $121B | $19B | 16.0% |

| Huntington Bancshares Incorporated | $187B | $44B | $14B | 33.2% |

| Regions Financial Corporation | $154B | $151B | $17B | 11.5% |

| Northern Trust Corporation | $146B | $117B | $6B | 4.7% |

| New York Community Bancorp Inc | $111B | $86B | $49B | 57.0% |

| Zions Bancorporation, N.A. | $87B | $51B | $15B | 29.3% |

As the above table shows, JPMorgan Chase, America’s largest bank, has 12.6% of its loan portfolio in commercial real estate.

Despite commercial property troubles, the company witnessed record stock prices in 2023, with its share price increasing 27% over the year. The bank acquired First Republic at the height of the U.S. regional banking turmoil in 2023, which helped boost performance.

Still, big banks remain cautious. Several major banks, such as Wells Fargo, are building bigger cash reserves for commercial property credit losses as a buffer for potential defaults.

Perhaps the most concerning big bank is New York Community Bancorp, which has 57% of its total loans exposed to commercial property debt. The bank reported a $2.7 billion loss in the fourth quarter of 2023, and Moody’s recently downgraded its credit rating to “junk” status. The bank brought in a $1 billion infusion of capital as a lifeline after growing concerns about the state of its commercial real estate loan portfolio.

Overall, while pockets of trouble are surfacing, major banks are more insulated from commercial property shocks compared to other banks. On average, about 11% of big banks loan portfolios are concentrated in commercial real estate compared to small banks, where average exposure falls around 21.6% of loans.

sign up for the newsletter

By signing up, you agree to our Privacy Policy and Terms of Use, and agree to receive content that may sometimes include advertisements. You may opt out at any time.