The Trillion Dollar Deficit is Growing...and Fast

Did you hear last month's report on the US deficit?

It jumped to $215 Billion.

To put this into context, this figure marks the most massive deficit measured in February since 2012.

If you're wondering why "February" is such a big deal, it's because February is typically not a good month for the US government's balance sheet.

It's tax season...and that tends to deplete government's coffers.

But this February is not only different in that government coffers were emptied more than usual, the numbers--and we'll show you what they are and what they mean--confirm an alarming trend.

In a nutshell, interest on the public debt last month jumped up to $28.43 Billion.

Not only is that 10.6% higher than February last year, but that's also the highest jump in any February on record.

In fact, interest on the public debt for the first five months of the current fiscal year is up 8.0% y/y to a figure of $203.23 Billion.

So why is our deficit surging now, and what's triggering it?

It's a combination of two things: Trump tax cuts + increased government spending.

As Zerohedge reports:

"According to the Congressional Budget Office, receipts declined by 9.4% from last year as tax refunds rose and the new withholding tables went into effect... Outlays meanwhile rose by 2% due to higher Social Security and [as] Medicare benefits rose and additional funds were released for disaster relief."

We're all for tax cuts. But tax cuts and higher spending doesn't make for a good combination unless we're trying to balloon our deficit.

In other words, if you're going to spend, don't use borrowed money, particularly when your debt load is already overburdened.

You might argue that we've had budget deficits before and that we made it through despite our debt.

True. In 1970, right before President Nixon did away with the gold standard for good, we had public debt--a total of $275 Billion.

In today's money, that figure would be $1.2 Trillion. Today's debt is $21 Trillion.

$1.2 Trillion vs. $21 Trillion. Huge difference.

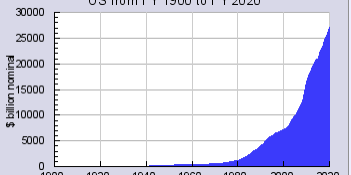

And that figure isn't static either. It's swelling and fast. (As an aside, can you see the point on the chart where the US debt began its parabolic ascent? That's right around the time when Nixon cut the dollar's ties to gold)

Source: usgovernmentspending.com

Doom & Gloom Report's Marc Faber has something interesting to say about this:

"Years of near-zero interest rates... allowed governments and households to borrow money for almost nothing. But that's changing… [and] this is where things get scary…

Since the Federal Reserve began raising interest rates in Q4 2015, interest payments on the United States national debt have soared 38%. Let that soak in… A 1.25% rise in short-term interest rates has corresponded with a 38% increase in the amount of interest paid for the United States national debt."

What's so disconcerting about that last point?

Let's think about it for a moment: A 1.25% short-term rise in interest rates means a 38% rise in interest on the national debt. 1.25% is not quite a "normalized" level.

Remember, we've got 3 or even 4 more interest rate hikes to go.

When that happens, what will it do to the interest on our debt?

Here's what will happen (and I borrow from analyst Daniel Amerman):

- A 1% rise in interest rate on the debt rises means that the federal deficit increases $200 Billion annually.

- A rise of 2% will add $400 Billion annually.

- A rise of 5% will add $1 Trillion to our annual federal deficit.

Currently, our federal budget has been around $4 Trillion per year.

If interest rates continue to go higher, can you see how our debt might claim up to 25% of our entire federal budget?

You may think that deficits haven't mattered much in the past, and perhaps because of that, our current deficit doesn't matter much now.

All we can say is that the numbers are the numbers and that numbers don't lie.

Sure, numbers can be used to confuse people and even obscure reality…

But the laws of economics cannot be fooled or delayed forever.

In time, the laws of economics will have its reckoning, as every action will have an equal and opposite reaction.

In our case, the reaction will come in the form of interest-rate normalization as balance once again must be achieved.

As to when this balance happens, nobody knows.

But when it happens, this balance will come at a significant cost.