U.S. Travelers Hit the Brakes: A Softening Demand Signals Financial Strain

The travel industry is warning that U.S. consumers are pulling back on their excursions.

"The desire to travel is ingrained in humans, but financially there are signs that the consumer might not be able to endure the amount of travel they would like," Morningstar equity analyst Dan Wasiolek told FOX Business.

Earlier this month, Hilton CEO Chris Nassetta told analysts during an earnings call that the money consumers saved up during the COVID-19 pandemic had been depleted.

"They've spent all that money. They're now borrowing more. And so, they have less available, less disposable income and capacity to do anything, including travel," Nassetta said. However, this isn't a problem with the "upper echelons" of its customer base, he noted.

Similarly, Priceline CEO Brett Keller warned that there has been a softness in leisure travel. Priceline was just one of a growing list of travel companies, including Airbnb, Expedia and Marriott, that used the term "softness" more than they have in the past.

"I wouldn't call it a slowdown but certainly a little bit of softness here and there," Keller told FOX Business' Liz Claman. "I think the consumer is really reaching a point now where they are making some very conscious decisions about how they want to spend their money."

Airbnb also told analysts earlier this month that it anticipates "sequential moderation" of growth in bookings year over year during the third quarter.

In its shareholder letter, Airbnb said it's "seeing shorter booking lead times globally and some signs of slowing demand from U.S. guests."

Demand for Airbnb, though, is still well above 2019’s levels and near all-time highs, according to Wasiolek.

Overall, U.S. leisure travel and domestic travel in China are the two areas where Wasiolek is noticing the softest demand.

Wasiolek pointed to how U.S. consumer savings as a percent of disposal income was 3.4% in June, down from 4.4% in July 2023 and from the average of 5.2% between 2010 and 2019.

"Lower-price hotel operators, like Wyndham and Choice, are seeing the weakest growth, as they tend to service more leisure than business and group travel," Wasiolek said, citing how Wyndham’s revenue per available room fell 2% in the second quarter.

S&P Global reported that lower-end consumers have "become more price sensitive due to a decline in savings, high hotel rates, and a cooling labor market."

It said in its recent report that "further softening of the economy could lead higher-income travelers to tighten their travel budgets or search for deals, which could pressure room rates."

This article originally appeared on Fox Business.

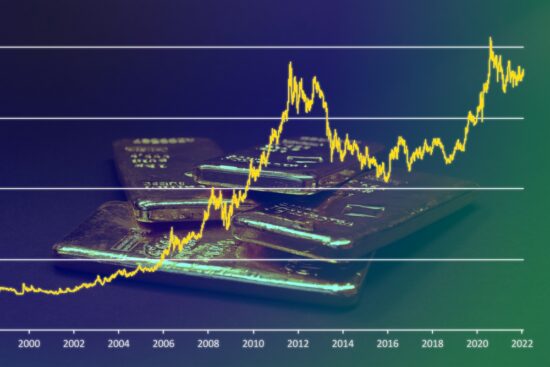

The financial market is crumbling and EVERYONE will be affected. Only those who know what's going on and PREPARE will survive... dare we say thrive. Our 7 Simple Action Items to Protect Your Bank Account will give you the tools you need to make informed decisions to protect yourself and the ones you love.