UBS: 8 Warning Signs of an Impending Market Meltdown

-

UBS strategists say six out of eight signs of a stock market bubble are already flashing.

-

Generative AI hype has driven stock prices to record highs, raising bubble fears.

-

Current conditions mirror 1997, not 1999, suggesting a bubble could soon form.

There's been a lot of talk about the stock market being in a bubble over the past year as hype for generative artificial intelligence drives stock prices to record highs.

In a recent note from UBS, strategist Andrew Garthwaite outlined the eight warning signs of a stock market bubble — and according to Garthwaite, six of them are already flashing.

That means the stock market isn't in a bubble yet, but could be soon.

"The upside risk is that we end up in a bubble. If we are in such a situation, then we believe it is similar to 1997 not 1999," Garthwaite said.

That's important because stock market bubbles often lead to a painful 80% decline once it pops, but Garthwaite says we're not there just yet.

"We only invest for the bubble thesis if we are in 1997 not 1999 (which we think we are)," Garthwaite said.

These are the eight stock market bubble warning signs, according to Garthwaite.

1. The end of a structural bull market - Flashed

"Bubbles tend to occur when historical equity returns have been very high relative to bond returns and thus investors extrapolate historical returns to be predictors of future returns - when in fact future returns, as shown by the ERP, are significantly below their norms," Garthwaite said.

2. When profits are under pressure - Flashed

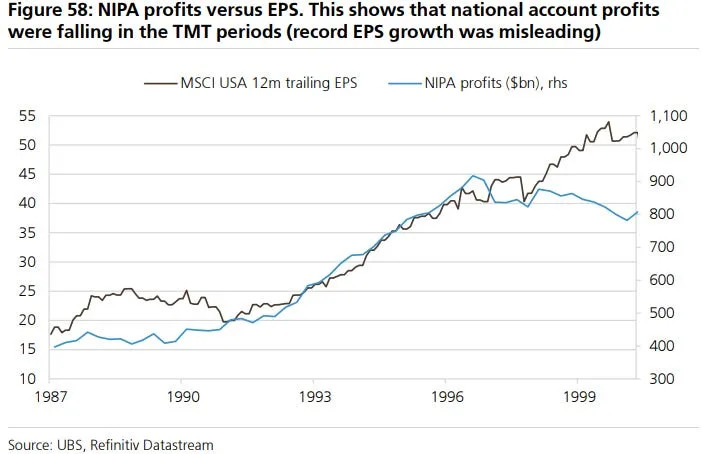

While S&P 500 profits have been booming over the past year, there is another measure of corporate profits that should be monitored by investors.

NIPA profits measure the profitability of all corporations, including private companies, and when those diverge with the profits of publicly traded companies, investors should take notice.

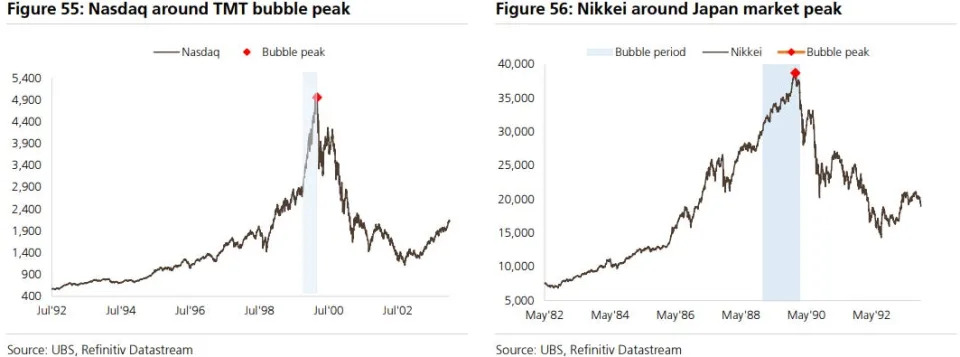

"We can see this if we look at the TMT period when the NIPA profits fell while stock market profits rose. The same was true in Japan in the late 1980s," Garthwaite said.

3. Large loss of breadth - Flashed

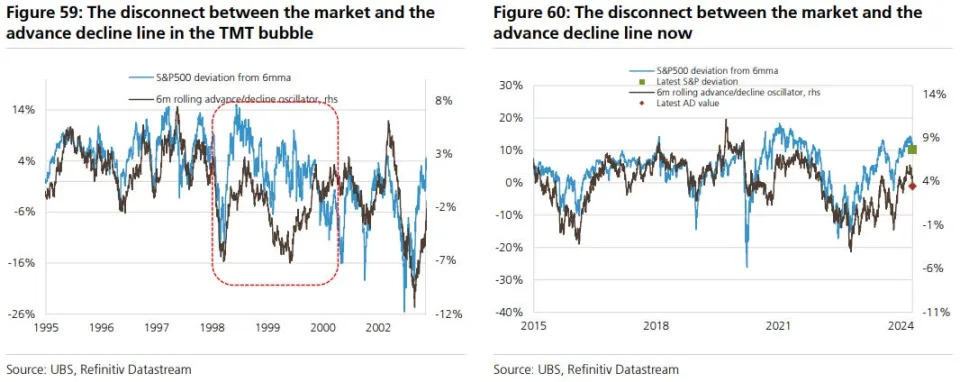

When the stock market is extremely concentrated in a handful of companies that are driving the bulk of the gains, that's a sign that breadth is weak.

With record concentration in the mega-cap tech stocks, that is exactly what has been happening as the median stock fails to deliver strong returns.

"We can see this in particular if we look at the advance to decline line versus the S&P 500 during the TMT period," Garthwaite said.

4. Needs a 25-year gap from the prior bubble - Flashed

"This enables a whole set of investors to believe 'it is different this time around' and develop theories that equities should be on a structurally lower ERP," Garthwaite said.

5. Has a 25-year gap from prior bubble - Flashed

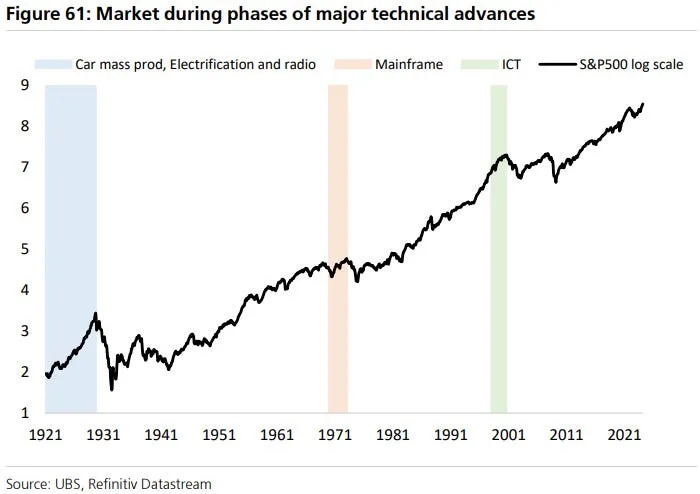

"This narrative either revolves around dominance or more typically technology. In the 19th century there was a bubble associated with railways and in the 20th century there was a bubble in the run-up to 1929 which was associated with the mass production of cars, electrification of cities and the radio," Garthwaite said.

6. Retail starts to participate aggressively - Flashed

When retail investors aggressively buy into the stock market, it allows the equity risk premium to fall to very low levels, leading to sky-high valuations.

"There is some evidence of this such as the bull/bear ratio of individual investors being very high relative to its norm," Garthwaite said.

7. Monetary policy being too loose - Hasn't flashed

Previous bubbles occurred when real interest rates were allowed to fall in a big way. That hasn't happened yet, as the Federal Reserve has yet to cut interest rates.

"Current monetary conditions look abnormally tight versus the output gap," Garthwaite said.

8. Extended period of limited declines - Hasn't flashed

Previous stock market bubbles saw a multi-year period of limited sell-offs of less than 20%.

With the S&P 500 experiencing a painful bear market in 2022 and selling off more than 25% at its low, there could be a long way to go before this condition is met.

This article originally appeared on Yahoo Finance