URGENT WARNING FOR CREDIT UNION MEMBERS: MALWARE SURGE EXPOSES A NEW FRONTLINE OF FRAUD

If you still have money parked in a credit union, your financial security is now at serious risk.

A newly released, high-impact report from cybersecurity leader BioCatch has confirmed a 55% surge in Remote Access Trojan (RAT) infections at U.S. credit unions. These advanced malware tools—previously used in espionage and high-level cybercrime—are now being deployed directly against your checking and savings accounts.

RAT-enabled fraud now accounts for 15% of all credit union fraud in 2025. And it’s only gaining ground.

Let that sink in.

We’re not talking about phishing emails or password guesswork. This is next-generation digital crime, where hackers take over your device in real time, invisibly operate your online banking session, and drain your account while you watch helplessly.

📉 Credit Unions Are Becoming Prime Targets

The BioCatch report, based on data from over 200 financial institutions, reveals that fraudsters are intentionally targeting credit unions—and not by accident.

Why? Because these institutions, while trusted and community-oriented, lack the cyber defense budgets and infrastructure of major banks. That makes them low-resistance entry points for criminals deploying highly sophisticated malware tools.

Here’s what we’re seeing:

- Remote Access Trojan (RAT) fraud is up 55% since January.

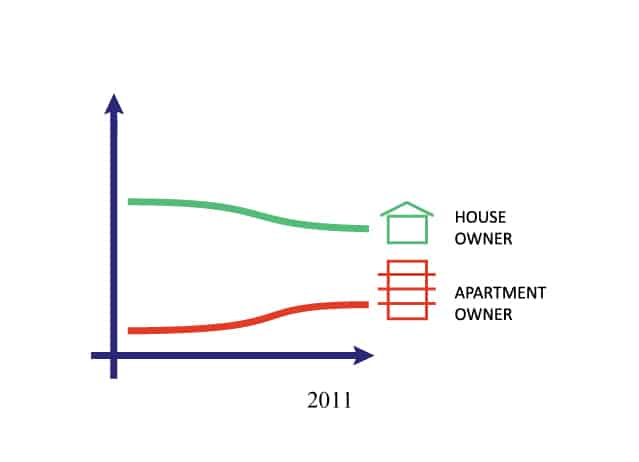

- RAT attacks now power 15% of all fraud at credit unions, up from 8% earlier this year.

- Account takeover attempts have surged by 50%.

- Fraud via stolen mobile devices and digital wallet manipulation is accelerating.

- Victims rarely recover stolen funds due to the complexity of these attacks.

As fraudsters shift to multi-channel approaches, they’re not just draining your account—they’re using your data to create virtual cards, link them to mobile wallets, and spend your money anywhere, anytime.

By the time you realize what’s happened, it’s already too late.

🧨 Digital Banking Is Becoming a Minefield

BioCatch’s warning couldn’t be more clear: traditional fraud detection systems are no longer adequate. Criminals have outpaced them.

With RAT-based takeovers, you won’t see suspicious logins from faraway IP addresses. These threats originate from your own device. They bypass two-factor authentication. They evade security flags. They operate invisibly.

This is not just a cyber problem. This is a systemic threat to your personal financial sovereignty.

And yet the mainstream financial press is barely whispering about it.

⚠ Why You Must Reconsider Where You Store Wealth

Most people believe credit unions are "safer" than big banks. That belief is now dangerously outdated.

When malware can bypass all protections and drain your account before breakfast, you need to take decisive action to relocate your wealth into assets immune to digital attack.

That’s where physical gold and silver, held in private, fully insured, non-bank depositories, come into play.

Unlike digital dollars:

- Gold can’t be hacked.

- Silver doesn’t rely on a password.

- Metals stored in a private vault are outside the banking system, shielded from account freezes, cyber attacks, and systemic collapses.

This isn’t about “investing.” It’s about surviving the coming fracture of digital finance.

🛡 Real Protection in an Era of Digital Chaos

This threat isn’t hypothetical. It’s here. It’s growing. And you’re exposed if your money remains in a credit union.

Your account may already be vulnerable. The next RAT infection could make you the next victim.

So, what can you do right now?

✅ Immediate Action Plan:

- Download my FREE eBook:

7 Steps to Protect Your Account from Bank Failure

👉 Click here to get your copy now - Exit vulnerable digital accounts: Begin reducing your exposure to digital-only banking environments, especially in smaller institutions with weak cyber infrastructure.

- Move a portion of your wealth into gold and silver: Store it in fully segregated, private vaults, not inside the banking system.

- Join my Inner Circle for $19.95/month:

Gain exclusive access to my ongoing analysis, asset relocation strategies, and alerts you won’t get from mainstream sources.

👉 Subscribe here

💬 Final Thoughts: The War on Your Wealth Has Gone Digital

We are rapidly approaching a moment where trust in traditional banking systems collapses, not just because of economic failure—but because of cyber exposure and digital theft.

Credit unions, once thought to be the “safe alternative,” are proving to be soft targets in an increasingly dangerous landscape.

Don’t wait until your account is drained to take action.

Don’t assume FDIC or NCUA insurance will save you—they won’t help you recover stolen funds from these kinds of cyber attacks.

If you want to protect your wealth, you must take it offline.

Get the free guide.

Relocate your assets.

Join the Inner Circle.

Stay ahead of the collapse.

—

Bill Brocius

Founder, DedollarizeNews.com

Author, End of Banking As You Know It

🔒 Stop trusting institutions that can’t protect you.

📩 Download your survival blueprint now

🔥 Join the Inner Circle and stay informed before the next cyber wave hits.