US Farmers Face Bankruptcy as Wall Street Banks Bail Out

When the housing and financial markets collapsed in 2008, JPMorgan and other large Wall Street banks began looking for ways to continue expanding their loan business.

With the mortgage sector in pieces, banks had to find new opportunities to maintain and increase their loan-based revenues. They found it, in the rural Midwest.

As grain prices surged while farmland values continued to increase, plenty of US farmers had sufficient capital for collateral necessary for loans in support of their farming operations.

By providing loans to farmers, JPMorgan’s farm loan portfolio expanded by 76%, a total of $1.1 Billion from 2008 to 2015. Other banks followed suit, flooding into the lucrative sector.

Currently, farm debt levels are projected to rise to around $427 Billion in this year alone. According to the US Department of Agriculture, these debt levels haven’t been seen since the 1980s farm crisis.

But currently, farmers’ prospects have been negatively impacted by the ongoing trade war between the US and China. Farm income has been falling, and the risk of farm loans have been increasing.

Hence, JPMorgan and 30 of the nation’s largest banks have begun slowly bowing out of the sector. In fact, agricultural loans have decreased by 17.5% over the last four years. That’s $3.9 Billion worth of loans taken out of the sector.

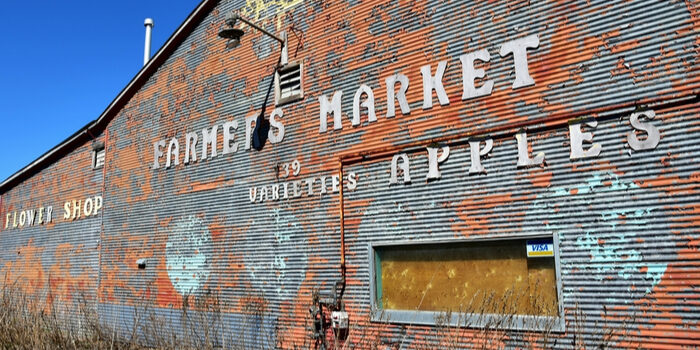

The massive decline in agricultural loans has had a severe impact on US farmers. Faced with shrinking cash flow, many farmers face one of two prospects: retire or file for bankruptcy.

Not only has agriculture been suffering from years of low commodity prices and oversupply, tariffs imposed by China and Mexico in 2018 resulted in a significant decline in sales of US farm products, particularly soybeans, the nation’s top ag export.

In 2018, 498 mostly small farmers filed Chapter 12 bankruptcy protection. In the meantime, grain and soybean farmers who were able to survive are among the farmers driving up demand for farm credit.

Many farmers are unable to continue paying for seeds, pesticides, and equipment--all standard operational expenses--without loans.

When banks reduce their agricultural debt portfolio, the survivability of small farming operations becomes a critical issue. Given the difficulties faced by most farmers even before the trade war, many farmers had already seen their income halved (going as far back to 2013).

Since 2015, JPMorgan had steadily reduced its farm holdings by 22%--a figure of $245 Million. Capital One had reduced their holdings by 33% between 2015 and 2019; U.S. Bancorp, by 25%; BB&T Corp, by 29% (from a peak of $1.2 Billion in 2016); PNC Financial Services Group, by 12%.

The common factor underlying these reductions is the perception of increasing risk.

Although some relief has been forthcoming, namely lending from the wider banking industry plus the Federal government’s Farm Credit System, agricultural lending has slowed considerably since the larger banks had begun paring their agricultural debt portfolios.

Even the Farm Credit System debt holdings have slowed--a sign that many banking experts interpret as increasing caution and concern in the sector.

As far as the wider banking industry is concerned, smaller banks--many of which are more dependent on their local farm lending operations than national banks--have run up against the challenge of decreasing populations in farming towns.

As one might expect, many of these smaller banks are now looking to the federal government for protection as many of these smaller farmers have now become high-risk prospects.

Despite increased loan demand, past-due loan payments have also been increasing. This year alone, FDIC-insured banks reported that 1.53% of their loans were over 90 days past due. These rates were even higher for loans provided by bigger Wall Street banks.

Although JPMorgan and other large banks are aware that a large number of small farms are suffering, the issue remains--particularly for banks whose agricultural lending portfolios don’t constitute a core component of their operations--that they do not want to be the last bank left holding the bag of bad loans.