US National Debt Hits a Record $25 trillion Showing No Signs of Slowing Down

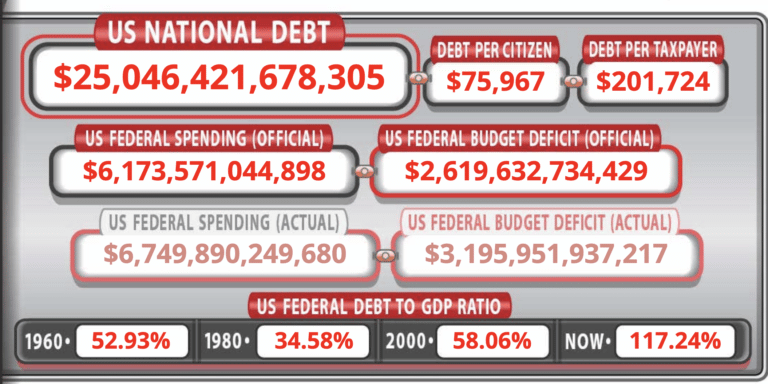

Anthony's Notes: The US national debt just crossed $25 trillion for the first time in history. The national debt is now just inches away from breaking the record for the highest debt to GDP ratio in US history. There are growing suggestions that the US should shirk its debt obligations to China and reports show that China is ready to dump US Treasuries in mass exodus, if the US were to default on its debt obligations!

To put the debt in contrast, for every ounce of gold mined, we are now printing $21,322.00, and for every ounce of silver mined we create $2,573.00!

The United States national debt has just crossed the $25 trillion threshold after adding $7 trillion in the last five years.

Since the start of the 2019/2020 fiscal year (beginning October 1, 2019), the US national debt has ballooned by more than 10% alone, climbing from $22.7 billion to its current value of $25 trillion, or $25,057,924,023,406.80 to be precise.

Jerome Powell, chairman of the Federal Reserve has called for more economic stimulus. Image: Federal Reserve.

According to data from the US Treasury, the US national debt continues to grow at a pace of ~$1.2 million per minute, adding more than $1.7 billion per day. These record numbers are the result of a huge uptick in government spending, in an attempt to suppress the ongoing coronavirus pandemic and keep the economy running during these uncertain times.

This has sent the debt to GDP ratio skyrocketing in recent years. The US debt to GDP ratio now stands at 117%—a number just shy of the 118.9% record set just a year after World War II ended. The debt ceiling—defined as the maximum amount of debt the US is allowed to carry—has also been increased four times in the last half a decade, and may need to be increased again soon.

Although the majority of US debt is owned by Americans, including institutional investors, banks and the federal reserve, almost 30% is owned by foreign entities—including China and Japan, which hold more than $1 trillion in US debt each. This intergovernmental debt is set to greatly increase in the second quarter of 2020, as the US treasury prepares to borrow a further $3 trillion to fund the government's continued response to the pandemic.

Jerome Powell, chairman of the Federal Reserve, recently argued there needs to be even more economic stimulus. “Economic activity will likely drop at an unprecedented rate in the second quarter,” Powell told a video press conference earlier this month, according to Bloomberg. “It may well be the case that the economy will need more support from all of us, if the recovery is to be a robust one.”

Despite the harrowing economic circumstances, US President Donald Trump recently announced that he would address the mounting national debt if he is re-elected in November. In his 2016 Republican party campaign, he also pledged to completely wipe the debt in eight years. Since he was elected, the debt has risen by $5 trillion.

If successful, he would be the second president in history to successfully clear all national debt—the first being Andrew Jackson, seventh president of the United States, who accomplished this in 1835. But he would need to find an extra $25 trillion—and counting.

Read Full Article Here at Decrypt.co

The financial market is crumbling and EVERYONE will be affected. Only those who know what's going on and PREPARE will survive... dare we say thrive. Our 7 Simple Action Items to Protect Your Bank Account will give you the tools you need to make informed decisions to protect yourself and the ones you love.