US Strategy Will Cause Crude Prices To Be Higher In The Long Run

EDITOR'S NOTE: Last week, the White House announced it is releasing 50 million barrels from its reserves in coordination with the U.S., China, Japan, India, the U.K., and South Korea, per Bloomberg. While this steadied crude prices in the short-term, Bloomberg says the amount “underwhelms” the overall market. Amrita Sen, an analyst at Energy Aspects, wrote in a note to clients, “This will do little to alleviate the ongoing tightness in sweet crudes. The U.S.-led effort to reduce crude prices in the short run will - with all else equal - lead to higher prices next year.” Talks with Iran and Russia to help out with this crisis by releasing more reserves are ongoing but not promising. The result of all of this means higher prices at the pump and to heat your home are on their way.

Oil fluctuated following the announcement of a coordinated release of strategic petroleum reserves, with the additional supply unlikely to tame price gains in some pockets of the market.

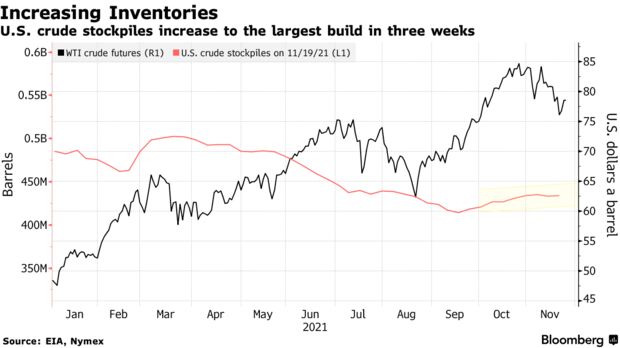

Futures in New York fell 0.3% after a government report showed U.S. stockpiles increased 1.02 million barrels last week. The White House announced on Tuesday a release of 50 million barrels from its reserves in coordination with the U.S., China, Japan, India, the U.K., and South Korea.

After a flurry of headlines on the release of reserves, “this EIA report has hit energy traders with tryptophan,” said Ed Moya, senior market analyst at Oanda Corp. “A tiny headline build, an expected production rebound, and as the U.S. returns to being an oil importer, was not enough to do anything for crude prices.”

The release of reserves was already priced into the oil markets for weeks, with oil having fallen $10 from its multiyear highs in October. The focus now turns to OPEC+ and how the group will respond to the move by some of its biggest customers. Prior to the announcement, the alliance said a release is unjustified by current market conditions and it may have to reconsider plans to add more supply at a monthly meeting next week.

The U.S. also confirmed Tuesday that its barrels -- which make up the bulk of the release -- will be mostly sour, or high in sulfur. That does little to solve an underlying problem of a shortage of sweet crudes, which are low in sulfur content. As a result, a key time spread that measures the health of those markets has surged markedly.

“This will do little to alleviate the ongoing tightness in sweet crudes,” Energy Aspects analysts, including Amrita Sen, wrote in a note to clients. “The U.S.-led effort to reduce crude prices in the short run will - with all else equal - lead to higher prices next year.”

Talks on the Iran nuclear deal are set to get underway next week and, if successful, they still have the potential to add extra supply to the market. A Russian diplomat hinted Wednesday at the difficulty of resurrecting the deal, however, tweeting that “heated debates seem to be unavoidable.”

| PRICES |

|---|

|

Of the 50 million barrels released by the U.S., 32 million will be issued from the Strategic Petroleum Reserve as an exchange over the next several months, and the remaining 18 million will come from an accelerated release of previously authorized sales, the White House said in a statement Tuesday. A senior administration official said barrels could start moving as soon as mid-December.

“By releasing reserves from the SPR, fundamentally you are just diminishing that cushion that you have in the event of a real crisis,” Neil Beveridge, senior analyst at Sanford C. Bernstein, said in a Bloomberg Television interview. “It doesn’t really make a big difference physically in the market today but will probably just make things worse, rather than better, down the road.”

The report from the U.S. Energy Information Administration also showed inventories at the nation’s biggest storage hub at Cushing, Oklahoma, rose rose 787,000 barrels. The increase is the most since October and volumes are now sitting at a four-week high.

Originally posted on Bloomberg.

The financial market is crumbling and EVERYONE will be affected. Only those who know what's going on and PREPARE will survive... dare we say thrive. Our 7 Simple Action Items to Protect Your Bank Account will give you the tools you need to make informed decisions to protect yourself and the ones you love.