Warren Buffett's US Dollar Outlook Has Now Grown Bleak

Buffett’s 2015 Dollar Bull Run: Blind to the Storm Ahead

Back in 2015, Buffett couldn’t have been more confident in the U.S. dollar. He practically knighted it as the eternal reserve currency, claiming with smug certainty that it would reign supreme for 50 more years. This wasn’t just optimism—it was indoctrination. Buffett, like most elite financiers, couldn’t see beyond the illusion of American financial dominance.

But back then, BRICS was just a footnote. The de-dollarization movement was nothing more than conspiracy chatter among metal hoarders and geopolitical skeptics. That ignorance cost time—and maybe more.

BRICS Builds the Guillotine: A Global Shift in Real-Time

Fast-forward a decade, and the BRICS alliance has evolved from a whisper into a war drum. China’s Yuan is now flexing with $480 billion in new lending muscle. Russia’s ditching the dollar like it’s radioactive. Brazil, India, and South Africa are all quietly moving toward a post-dollar era—one that no longer depends on U.S. economic hegemony or its inflation-ridden play money.

This isn’t a pivot—it’s a coordinated takedown.

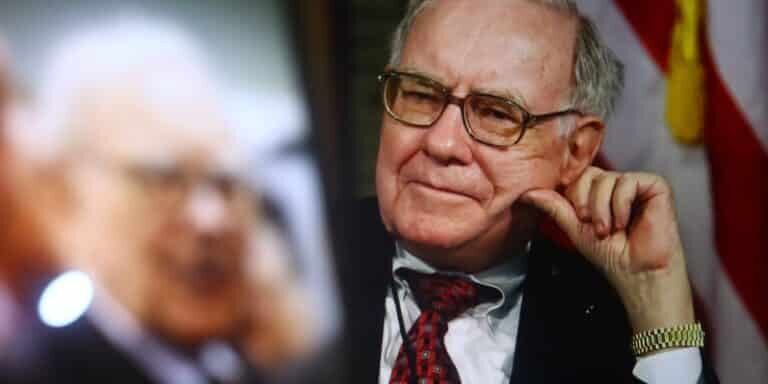

2025 Buffett: Finally Bearish, But Still Blind

Now, Buffett’s singing a different tune. He’s bearish on the dollar. He’s pointing fingers at the Federal Reserve, side-eyeing the White House, and even suggesting other currencies might be safer bets. “We wouldn’t invest in a currency that’s going to hell,” he says.

Nice line, Warren. But again, he’s still not offering a solution—just more hedging, more confusion, more fiat musical chairs. He refuses to embrace the one asset that’s stood tall through every economic collapse in history.

Why Buffett Hates Gold—and Why He’s Dead Wrong

Let’s talk about Buffett’s anti-gold stance. The man has openly mocked gold for decades because it “doesn’t do anything.” It just sits there, collecting dust. No dividends, no board meetings, no shareholder letters.

But that’s exactly what makes it powerful.

Gold doesn’t bend the knee to inflation. It doesn’t depend on trust in governments, trade deals, or fiat printers. It simply exists—and in times of uncertainty, that’s priceless. Buffett’s refusal to recognize this exposes a dangerous blind spot. As central banks around the world quietly stockpile gold while pushing digital surveillance coins like FedNow, the average citizen is being funneled into a monetary trap.

The Digital Dollar Trap: FedNow and the New Control Grid

Let’s not forget the elephant in the room: ISO 20022 and the FedNow system. These aren’t conveniences—they’re control mechanisms. With programmable money, they can freeze your account, restrict your spending, and track every transaction.

As this system tightens around us, gold becomes more than just a hedge—it becomes a weapon of resistance. If you can’t hold it, you don’t own it. And once your “money” is just code on a government server, you’re no longer a free participant in the economy—you’re a subject.

Buffett’s Half-Truths Are Dangerous

Yes, Buffett’s finally acknowledging that the dollar’s days are numbered. Yes, he sees the cracks in the foundation. But he still won’t point people to the exit door—because the exit is gold, and he’s bet his legacy against it.

That’s not just stubbornness. That’s a failure of imagination. And in this game, that failure could cost you everything.

Call to Action: Get Out Before the Collapse

If you’re waiting for mainstream approval to opt out of the dollar, you’re already too late. Buffett blinked—but he’s not your savior. Take control while you still can.

Download Seven Steps to Protect Yourself from Bank Failure by Bill Brocius. It’s a hard-hitting, no-BS guide that shows you how to move your money out of the blast zone before the next financial nuke goes off. Get it here.

Wake up. Load up. Opt out.

—Derek Wolfe