What Are They Hiding? New Senate Bill Pushes to Audit U.S. Gold Reserves After Decades of Secrecy

Why a U.S. Gold Reserves Audit Matters Now

Frank’s Take: What’s My Opinion?

First off — finally! It’s about time someone lit a fire under the folks guarding Fort Knox.

I absolutely agree with the spirit of this bill. If you’re going to tell the American people we’ve got over 261 million ounces of gold sitting in vaults, then prove it. For decades now, we've been asked to just trust the government and the Federal Reserve — the same folks who inflate our currency, rack up trillions in debt, and can’t even pass a basic audit themselves. If your boss at work said, “I’ve got the company’s emergency funds right here in the safe, but you can’t look,” how long would you believe that?

This bill — led by Senator Mike Lee and backed by liberty-minded voices like Ron Paul — is really about restoring trust in the most fundamental building block of monetary value: gold. But trust me, this isn't just about nostalgia or pride. This is about national security, financial survival, and honest accounting.

What’s Likely to Happen?

Now here's where I throw a little cold water on the fire — not to put it out, but to keep us clear-eyed.

Will this bill pass? Highly doubtful — at least not in its current form.

Why? Because if you dig into what this audit could uncover, you start to see why the establishment would fight it tooth and nail. We're not just talking about whether the bars are sitting there in Fort Knox. We're talking:

- Whether the gold has been swapped, loaned out, or rehypothecated.

- How much of it even meets modern purity and “good delivery” standards.

- Whether the reserves could be instantly liquidated in a true global monetary crisis.

It’s no secret that some of that gold dates back to 1933 — melted coin bars, 90% purity, not compliant with modern standards. So even if the gold is physically there, it might be financially irrelevant in the modern global market. That’s a huge red flag.

Let me be clear: If the public ever saw the full, unfiltered truth of what’s really backing our dollar — or not backing it — the fallout would be massive. Confidence in the dollar could plunge overnight. That’s why I believe the powers that be will stall, amend, or bury this bill before it ever gets to the floor.

But it’s still a big deal. Because just introducing this legislation shows growing mistrust — and cracks in the system they’ve worked so hard to keep opaque.

Why This Matters Right Now

This audit push isn’t happening in a vacuum.

Here’s the reality you won’t hear on CNN:

- Foreign central banks are buying gold hand over fist. China, Russia, even Saudi Arabia are dumping U.S. Treasuries and loading up on physical gold.

- The BRICS nations are laying the groundwork for a gold-backed alternative to the dollar.

- ISO 20022 is quietly being rolled out behind the scenes, setting up the infrastructure for future digital financial control — including CBDCs, even if they’re currently banned.

Don’t let that ban fool you. The digital rails are being laid, and ISO 20022 is the blueprint. It standardizes financial messaging across borders, connects banks and payment systems globally, and opens the door to full traceability, programmability, and eventual restriction of your funds — all under the guise of “efficiency.”

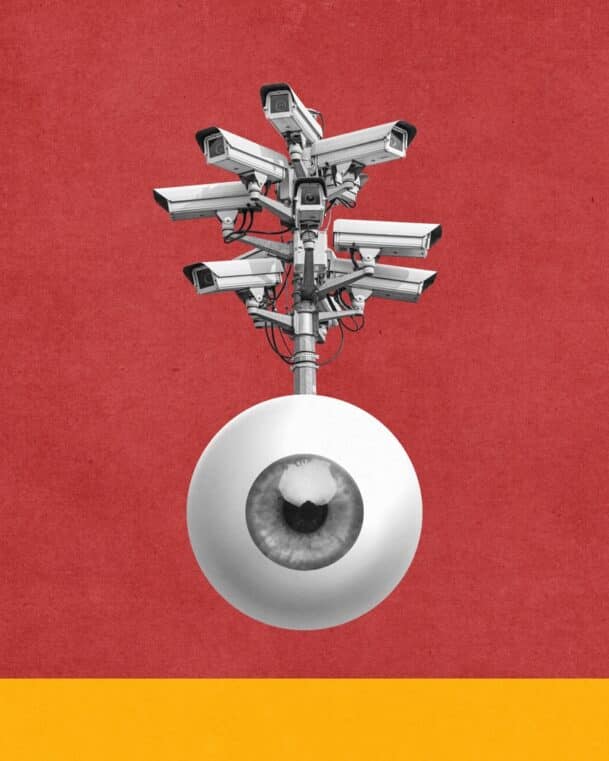

So while politicians talk tough, the global system is still moving toward total surveillance finance — with or without official CBDCs. If the audit reveals our gold is impure or encumbered, the U.S. loses its last shred of monetary credibility just as this infrastructure clicks into place.

What Should You Do?

Friend, if there was ever a moment to protect yourself, this is it. An audit might happen, or it might not. But the very fact that we even need this bill should be setting off alarm bells in your head.

And if we find out the emperor has no clothes?

That’s when physical gold and silver go from being “old-fashioned” to being the lifeboat of your financial future.

Next Steps (Don’t Wait for Congress)

📥 Download Bill Brocius’ FREE eBook: Seven Steps to Protect Yourself from Bank Failure

🔒 Secure your savings with real assets: Explore Dedollarize’s Gold & Silver Solutions

We don’t need to wait for an audit to tell us the system is broken. We just need to pay attention.

Stay safe, stay sovereign.

— Frank Balm

Dedollarize News | Gold & Silver Watchdog for the Working Class